Budget 2021 sets path for recovery – Sector Reaction

In a #Budget which ‘meets the moment’, the Chancellor @RishiSunak has today (3 March) set out a £65 billion three-point plan to provide support for jobs and businesses as we emerge from the pandemic and forge a path to recovery.

- Billions to support businesses and families through the pandemic

- Investment-led recovery as UK emerges from lockdown

- Future changes to strengthen public finances

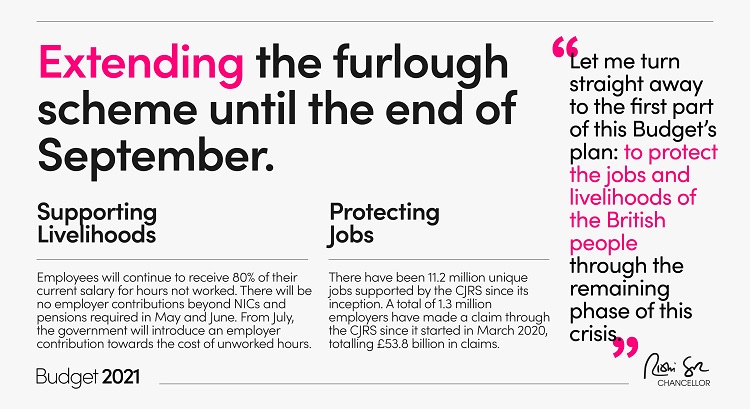

Chancellor of the Exchequer Rishi Sunak said his immediate priority continues to be supporting those hardest hit, with extensions to furlough, self-employed support, business grants, loans and VAT cuts – bringing total fiscal support to over £407 billion.

He also set out plans to drive jobs, growth and investment to help the economy rebound – and spoke honestly about the tough choices required to put the public finances on a more sustainable path.

Delivering the budget in Parliament Chancellor of the Exchequer Rishi Sunak said:

“This Budget meets the moment with a three-part plan to protect the jobs and livelihoods of the British people.

- First, we will continue doing whatever it takes to support the British people and businesses through this moment of crisis.

- Second, once we are on the way to recovery, we will need to begin fixing the public finances – and I want to be honest today about our plans to do that, and

- Third, in today’s Budget we begin the work of building our future economy”.

New measures and funding for education and skills, including for apprenticeships and traineeships

As part of the UK Government’s Plan for Jobs to support, protect and create jobs, the Chancellor is increasing support with £126 million of new money to enable 40,000 more traineeships, and doubling the cash incentive to firms who take on an apprentice to a £3,000 payment per hire.

The National Living Wage will be increased to £8.91 from April and there will also be a six-month extension of the £20 per week Universal Credit uplift, with eligible Working Tax Credit claimants receiving a one-off payment of £500.

In July 2020, the Government announced incentive payments of £2,000 for hiring an apprentice aged 16 to 24 and £1,500 for hiring a new apprentice aged 25 and over. These grants were in addition to the existing £1,000 payment the Government was already providing to employers for taking on new 16 to 18 year-old apprentices.

The number of people of all ages on an apprenticeship programme was 511,000 in August-October 2020. New programme starts in that period were 91,000 – a drop of 27.6% compared with the year before. As of the beginning of February 2021, only 25,420 apprentices had been recorded on the Apprenticeship Service where incentive claims have been submitted by employers.

Today, the Government confirmed a further £1,000 payment for each new apprentice aged 16 to 24 hired until September 2021 and an additional £1,500 for each older apprentice. Taking account of the existing grant payments, this means that employers will now stand to receive £4,000 for taking on an apprentice aged under 19 and £3,000 for older apprentices.

Sector Reaction

Apprenticeship training providers welcome increased apprenticeship incentives and say furlough extension will keep apprentices in jobs

Association of Employment and Learning Providers chief executive Jane Hickie said:

Association of Employment and Learning Providers chief executive Jane Hickie said:

“The boost for traineeships so soon after last July’s investment is exactly the type of support that young people need to secure a job opportunity as we emerge from lockdown.

“With the continued shelter offered by the furlough scheme, employers and training providers can work closely together to take full advantage of the incentives. Furlough also keeps thousands of existing apprentices in jobs who otherwise might have been at risk of redundancy.

“The extension of the apprenticeship financial incentives until the end of September could be a game-changer and the increase in the incentives should prove to be particularly attractive to smaller businesses who have traditionally offered apprenticeship opportunities to young people. The incentives now subsidise over half the cost of employing an apprentice at entry level which is what AELP has been calling for since the start of the first lockdown.

“However, there is a case for channelling increased apprenticeship support towards 16 to 24 year olds only, because that is where the support is really needed and where the stimulus is required.”

The extra £126m for traineeships follows the £111m announced for the programme in last July’s Plan for Jobs. AELP welcomed this at the time but the roll-out for it was very slow after a much delayed procurement for provision for 19 to 24 year olds. The government also wanted to expand the number of providers supplying traineeships for 16 to 18 year olds but we haven’t heard any more about this. In the meantime current 16-18 traineeship providers can apply for more funding.

Jane Hickie added,

“Independent training providers are keen to jump out of the blocks in finding more employers willing to offer apprenticeship and traineeship opportunities. Matters aren’t helped however by the government not offering covid testing kits to young people eager to grab them. Unless they can go to a community testing centre (and most 16-18 year olds can’t drive), young apprentices and trainees may to have to wait until April.”

Association of Colleges responds to Chancellor Rishi Sunak’s budget statement

Responding the Chancellor’s second budget in Parliament, Chief Executive of Association of Colleges, David Hughes said:

Responding the Chancellor’s second budget in Parliament, Chief Executive of Association of Colleges, David Hughes said:

“Today’s budget was always going to be a tightrope, getting the balance right between restoring the public finances and supporting people and businesses through tough and uncertain times and between the short term priorities and the longer term. The extension of financial measures announced today support the cautious approach to easing the lockdown announced last month.

I’m pleased to see further investment in the apprenticeship and traineeship incentives, underpinning the Chancellor’s commitment to investing in skills and education for the long term. It is crucial that unemployed young people and adults can gain new skills which will help them secure and retain good work. Young people leaving education this year will have missed out on their education during the last year and they will face tough times in the labour market. I look forward to seeing further investment in education recovery in the coming weeks. That will be essential to build back fairer as well as better.

The recent Skills for Jobs White Paper could be a game-changer for post-18 education and skills and a catalyst for so many of the ambitions this government has to get people into secure jobs that meet the needs of a much-changed labour market. To achieve this, it is crucial that measures like Kickstart, bootcamps, traineeships and college programmes are aligned and funding simplified. The programmes currently do not work well together, are confusing to employers and will not work effectively for many unemployed people. The key thing now is to join up jobs and skills initiatives to allow as many people as possible to benefit from them quickly.”

Responding to the announcements from the Chancellor in the Spring Budget, Stephen Evans, chief executive of Learning and Work Institute, an employment and skills think-tank said:

Responding to the announcements from the Chancellor in the Spring Budget, Stephen Evans, chief executive of Learning and Work Institute, an employment and skills think-tank said:

‘The lower forecast for unemployment shows the success of the furlough scheme, but still means almost a million more people out of work than a year ago. We need to focus on encouraging employers to take people on, and helping people find work and build skills. Young people have been particularly hard hit, which is why we need a Youth Guarantee and an extension to Kickstart, currently due to end in December 2021.

‘Today’s announcements, like more traineeships, and the wider Plan for Jobs are welcome. The extension to furlough will protect jobs and employment support will help people find work. But to build the economy of the future, we’ll need more ambitious investment in skills and retraining with one million fewer adults in learning than ten years ago. And after years of freezes, the £20 uplift to Universal Credit should be made permanent.’

Budget does not go far enough to provide a comprehensive long-term strategy that connects all the dots of employment, welfare, skills and education, to connect people to jobs, for longer term growth and productivity.

Kirstie Donnelly MBE, CEO at City & Guilds Group, commented:

Kirstie Donnelly MBE, CEO at City & Guilds Group, commented:

“In the Chancellor’s own words, this Budget was unlike any other, a defining moment for the UK’s exit strategy from the crippling impact of Covid-19 and a golden opportunity to set us on a path to recovery. However, the announcement we have seen today appears to be far too short-sighted in its focus. Whilst we welcome a rise in the national living wage, more incentives and some increased flexibility for businesses to take on apprentices and traineeships – what we’re not seeing, and what is needed now more than ever, is a comprehensive long-term strategy, that connects all the dots of employment, welfare, skills and education, to connect people to jobs, for longer term growth and productivity.

“The stakes are high if we don’t get this right as the lives of millions will be affected for decades to come. Covid-19 is casting a long shadow over the futures of young people in particular – with many unable to secure apprenticeships or find jobs and still more are spending tens of thousands on degrees with uncertain prospects. We would like to see more support for ‘would be apprentices’ and hard-hit businesses by extending greater flexibility in the use of the levy to pay wages and allowing employers an extra year to spend their levy funds. This should begin to stimulate growth in apprenticeship numbers after the slump in starts we saw last year.

“And we must remember that the pandemic has also delivered a devastating blow to many people who are mid to late career, they seem to have been largely forgotten by this budget. Whilst furlough may have been extended again, we need funding to be made available right now to help unemployed and furloughed people retrain and reskill so they can transition from one job to another and quickly get back into meaningful work. Otherwise, once furlough ends we may be leaving millions with no route back to the labour market.”

City & Guilds Group urges Government to also prioritise the creation of long-term solutions to curtail long-term unemployment, as well as direct some immediate funding to older workers to help them re-skill and transition.

Cindy Rampersaud, Senior Vice President for BTEC and Apprenticeships, Pearson, said:

Cindy Rampersaud, Senior Vice President for BTEC and Apprenticeships, Pearson, said:

“Today’s measures to increase on-the-job training and apprenticeships is welcomed and important in supporting the government’s plans to kick start the economy as we come out of lockdown. We must act now to support individuals back into employment and also help businesses recover. Reskilling and upskilling talent will go some way to ensuring we are able to recover in an effective and sustainable way from the economic and social impact of the virus.

“There will be a continued need to maintain flexibility and a broad range of options to support access to learning and reskilling – enabling progression and helping individuals to fulfil their potential helps to address inequality, supports our economic recovery and enables UK PLC return to growth.”

David Gallagher, Chief Executive of NCFE said:

David Gallagher, Chief Executive of NCFE said:

“We are pleased with the Chancellor’s statement and the ongoing commitment to support the current and future workforce as we start the journey to recovery from the pandemic. Upskilling those out of work to fill essential jobs in healthcare, social care and digital is particularly vital to our country’s return to prosperity.

“The incentives for businesses to support Apprenticeships in all sectors is very welcome, especially in the creative industries, where there is a significant need. Traineeships, the Lifetime Skills Guarantee and the Government’s continuation of the KickStart scheme will be essential components in creating opportunities for people of all ages to re-skill and find meaningful work. Looking ahead to the autumn statement, we would also like to see greater provision in place for the many individuals looking to retrain, reskill and start again in a new sector, due to the profound impact of the pandemic in certain industry areas.

“The Government must now work hard to ensure these attention-grabbing headlines translate into tangible opportunities across the UK. While we applaud the Chancellor’s commitment to empowering businesses, increasing training opportunities and spreading prosperity across the country, there must be a concerted effort to ensure this reaches the individuals and areas which need it most.”

Alice Barnard, Chief Executive, Edge Foundation said:

Alice Barnard, Chief Executive, Edge Foundation said:

“The pandemic has had a lasting impact on the lives and educational experiences of learners up and down the country. Support for education and skills must be front and centre of the government’s recovery plan and Treasury’s investment strategy. This is not about piling on more pressure by talking about ‘catch up’ and ‘lost learning’ but about providing intensive support to all learners, including those in FE and apprenticeships, to help them develop the transferable and technical skills they will need as the economy gradually recovers. Government rhetoric needs to be met with greater pace and urgency if we are to rise to that challenge. ”

Fiona Burford, Operations Director at the Association of Apprentices said:

“The newly formed Association of Apprentices welcomes the Chancellor’s budget announcement to offer more financial support to employers who hire apprentices. Apprentices are the lifeblood of the Nation’s economic recovery and support all our futures. As we rebuild after Covid, providing opportunities for everyone to get back on their feet is vital.

“Apprentices have been especially hard hit during the pandemic; more often than not being the first to bear the brunt of job losses and being furloughed. Incentivising employers to hire more apprentices is exactly what’s needed to get these predominantly young people back into work.

“Apprenticeships are a brilliant way to provide the skills that employers need – and would-be apprentices right across the country and from all backgrounds are crying out for opportunities.

Inaugural Chair of the Association of Apprentices, Sir Peter Estlin said:

“Today’s additional support for employers makes great business sense – for the economy and for the next generation of UK talent – it’s a win, win!”

David Robinson, Director of Post-16 and Skills at the Education Policy Institute (EPI) said:

David Robinson, Director of Post-16 and Skills at the Education Policy Institute (EPI) said:

“The additional funding committed by the Chancellor for traineeships is welcome, given this skills development programme has been effective in helping young people to progress into employment and further learning. It is important that the government does much more to make young people aware of this programme and the opportunities that it can bring.

“The new ‘flexi-job’ apprenticeship may prove positive for young people, allowing them to accrue important skills and experiences in a number of roles within one sector. It will be important to closely scrutinise the details of this new scheme, including how it will be implemented.

“Proposals to increase employer subsidies for both adult and younger apprentices will no doubt open up opportunities for many people, but given we know that it is apprenticeships and employment opportunities for younger people that have been disappearing the fastest, they should be receiving a far greater share of these subsidies.

“While it is encouraging to see an emphasis on further education in today’s Budget, there are still a number of critical issues that need addressing. Funding for further education remains historically low and educational inequalities in the 16-19 phase are substantial. We need to see a more enduring financial settlement for the further education sector, together with a Student Premium that provides more targeted support to the most disadvantaged.”

Ann Francke, Chief Executive of the Chartered Management Institute said:

Ann Francke, Chief Executive of the Chartered Management Institute said:

“Businesses will welcome the clarity provided in today’s Budget on the financial support that will be made available to see out the Prime Minister’s roadmap. Being able to plan is integral to success and extending the furlough scheme allows businesses to do so more effectively, helping to also ensure their survival.

“We’re delighted to see the Government investing in management and leadership training, which we know increases firm-level productivity. SME leaders will play a vital role in the UK’s economic recovery, both as growth drivers and job creators and the Government is right to invest in developing their capabilities and growing their confidence.

“The Help to Grow scheme, alongside apprenticeship incentives and the expansion of Traineeships provide much needed opportunities to upskill workers with the core skills – including management, innovation and digital adoption – that the economy requires. Great management and leadership is key to the success of these schemes and to delivering a return on the Government’s investment.

“We particularly welcome that the Government is covering 90% of the cost – this will help ensure the pandemic doesn’t hold back future prosperity. Good managers and leaders are also essential to the successful delivery of the Government’s Levelling Up agenda, so the more the Chancellor can do to bed-in these skills across all socio-demographics of the UK workforce, the better for the nation’s prosperity.”

Welcome support for employers hiring new apprentices

Carole Willis, chief executive of the National Foundation for Educational Research (NFER), said:

“We welcome the further support announced today for employers hiring new apprentices. However, in these uncertain times, we know existing incentives in this area have generated limited take-up. It is therefore likely employers, particularly small and medium-sized organisations, will require more support.

“We also welcome the recently announced school recovery funding package during a hugely challenging time for teachers, parents and pupils. This is a good start, but we believe more support will be needed to help all pupils, particularly those from disadvantaged backgrounds, to recover.

“The government’s priority to level up school funding has meant the most disadvantaged schools are receiving the smallest increases in their budgets at a time when they face a disproportionate challenge in supporting pupils with their learning. We believe this policy should be re-evaluated in light of the pandemic’s impact.

“Covid-19 has placed significant financial pressures on schools, and led to substantial losses in income. Not all schools will be able to meet these pressures through existing reserves or recent funding increases. There is a risk some schools will need to divert resources, which could be used for teaching and recovery, or place additional pressures on their workforces to meet these needs.”

Chancellor has doubled the amount of money incentivising businesses to hire apprentices.

Ben Hansford, Managing Director, Apprenticeships at Firebrand Training, said:

Ben Hansford, Managing Director, Apprenticeships at Firebrand Training, said:

“The news that apprenticeships have received additional funding is a welcome update from the Chancellor in today’s budget.

“The UK’s digital skills gap, which was already growing rapidly pre-pandemic, has only widened during the past year and this desperately needs to be addressed if the economy is to get back on its feet. Upskilling and reskilling people of all ages must be a key focus in order to create opportunities for jobseekers and stability for businesses in this time of economic uncertainty. The Levy, which came into play in 2017 is working fantastically, despite having only been running for a few years, and now is not the time to change it unless we are streamlining the system as a whole, for example aligning competing initiatives so they complement each other.

“We need to be wary around the ongoing introduction of newer, competing, unproven schemes such as traineeships and the Kickstarter campaign when apprenticeships have both stood the test of time and shown great adaptability and resilience throughout the pandemic. Measures to encourage greater adoption of apprenticeships should be promoted instead, it’s great to see the enhancement of employer incentives which are working wonderfully to encourage more businesses to hire, and see the value in apprentices.”

Heather Frankham, co-founder, Bud Systems, the training management platform, said:

“We’re pleased that the Government has committed to help amplify apprenticeship and skills opportunities for young people and that it’s outlined greater support for new apprenticeship hires of any age.

“ONS data shows that young people have been hardest hit by unemployment, with rates increasing by 13% since the pandemic struck. We see today’s budget as a vital step in avoiding a scenario where generation Z adversely pays the consequences of starting their journey into employment following the global pandemic.

“Rishi Sunak has provided some serious support to protect the economy and kickstart a recovery to get businesses and people’s livelihoods back on track. It provides a great foundation to Build Back Better but to deliver on this requires business leaders to work in partnership with government to Build Back Together. The post pandemic recovery won’t be easy but announcements on apprenticeships, the Lifetime Skills Guarantee, traineeships, and support for training and digital projects in small businesses provides a great tool for businesses to use to drive growth.”

News of ‘flexi-job’ apprenticeships and celebrates investment in wider training options is welcome

Joe Turner of Acacia Training, said:

“As a leading provider of workplace training across apprenticeships, traineeships and the Kickstart programme, we must welcome today’s news that an additional 40,000 traineeships will be created, and businesses will be further incentivised to take on apprentices. At a time when we must focus efforts on allowing the economy to recover, providing both the means for businesses to recruit and for young people and adults alike to gain valuable training and a route in to employment is a positive step in the right direction.

“It is, however, the announcement around new ‘flexi-job’ apprenticeships that is particularly exciting. The option for apprentices to work with a number of different employers across their chosen sector will open up training routes that have been previously harder to navigate due to the flexible working patterns that are commonplace in many sectors. We’re already actively engaged in conversations with specialist recruitment agencies to scope out how we can best partner to deliver this innovate new approach to workplace training and we’re keen to speak with other recruiters for whom this announcement has piqued their interest.”

Helen Booth, Director of the HomeServe Foundation, said:

“Increasing – and for some age groups, doubling – apprenticeship incentives is good news because apprenticeships, particularly in the construction and trades sector, are critical to the recovery of UK plc.

“Lower incentives have been a barrier to apprentice recruitment for SME businesses and sole traders. These are the businesses who will play such key role in helping power us forward post-pandemic and will deliver so much of the UK’s infrastructure and Net Zero plans.

“Without this extra funding, which has been extended to September, there’s no doubt we would continue to see apprenticeship numbers fall and that would mean the UK’s economic recovery could be critically threatened.

“The further £126 million investment from the government to triple traineeships also recognises the important role creating better opportunities for boosting skills – in particular for young people – will play in the UK’s economic recovery.

“New research shows the trades sectors alone will need to recruit 228,000 apprentices to fill the skills void left behind by an ageing workforce, COVID-hit skills shortage and a drain of European skilled labour. Add to that the announced increase in green investment and decarbonisation targets, the need for a boost to these skills is huge, and it needs tackling now if we are to meet the soaring demand for home repair and improvements will follow.

“With 60 per cent of all home repairs work including boiler installations carried out by firms with nine or fewer workers, we need to give these smaller businesses the opportunity to power our economy forward.

“Better incentives and funding are crucial to this, but they also need guidance to simplify the process of training and hiring an apprentice, as well as advice and support to grow and seize the opportunities this Spring Budget offers them in 2021.

“Now we need to see the rapid scaling up of the training and recruitment of apprentices, but we also need to add more simplicity and flexibility for large employers to use their unspent Levy, so it can be redistributed to areas of most need, like trades skills apprenticeships.”

Playing a significant role in the provision of skills to help Build Back Better

Dr Neil Bentley-Gockmann CEO of WorldSkills UK, said:

Dr Neil Bentley-Gockmann CEO of WorldSkills UK, said:

“The Chancellor has set out an ambitious vision for rebuilding our economy which represents a significant opportunity for the skills sector.

“Continued increased investment in traineeships and apprenticeships is very welcome and if the recent Skills for Jobs White Paper has given us the framework for delivering the high quality skills that employers need to power economic growth, the Budget provides a challenging target to aim for. With a new infrastructure bank to encourage investment, plans for port developments for more offshore wind, freeport enterprise zones and city deals to encourage local economic development and job creation, it is clear that higher quality skills will be needed in all parts of the UK to turn these plans into reality.

“This creates an exciting opportunity for WorldSkills UK and our partners to play a dynamic role in helping develop a future economy which is global and outward-looking, using our international expertise to bring world-class skills back to the UK in key growth sectors such as advanced manufacturing, clean technology and digital, helping to attract overseas investment to all parts of the UK, better matching up skills demand from employers with local skills supply and providing young people with fantastic training and career opportunities.

“I look forward to working with all WorldSkills UK’s partners in governments, businesses and education, to champion the role that high-quality skills can play in delivering the Chancellors blueprint for our future economy.”

Ian Pretty, CEO, Collab Group, said:

Ian Pretty, CEO, Collab Group, said:

“Today, The Chancellor has made several important announcements as part of the 2021 budget. The Job Retention Scheme’s extension is significant, given the challenges faced by key economic sectors and employers across the UK. It was, however, mostly a continuity budget concerning skills policy with the Chancellor re-announcing previous government announcements on Restart, Kickstart and Lifetime Skills Guarantee initiatives. It was, however, good to see the Chancellor commit to doubling employer incentives for taking on new apprentices. The take up of these incentive payments has been lower than anticipated, and so more generous payments could be a useful mechanism to boost demand for apprenticeships.

“There are encouraging signs that the Office of Budget Responsibility projects the economy to recover faster than anticipated; however, there is no doubt of the scale of challenges that lie ahead. Skills and colleges will be at the heart of economic recovery efforts by helping people into productive and sustainable employment. This is why today we have published a document: “Colleges and employability,” showcasing case studies from across the Collab Group network. These case studies demonstrate the critical role that colleges will play to support people into work and revitalise local economies. Colleges will be indispensable to deliver on the Chancellors commitment to a green and inclusive economic recovery.”

CITB Policy Director Steve Radley said:

CITB Policy Director Steve Radley said:

“With the recovery from the crisis in sight, this welcome investment in infrastructure, traineeships and the new flexible apprenticeships, similar to our own shared apprenticeships scheme, will help support thousands of people into the construction industry just as employers are looking to hire them. Many employers reluctantly opted out of taking on an apprentice last autumn and extending the incentive to employ them is the right support at the right time.

“Extending traineeships will build stronger links with Further Education and build a bridge into apprenticeships and jobs for many young people. Our work with FE and employers on construction traineeships has demonstrated that both groups are committed to making this work.

“Government should build on this by quickly delivering on its pledge to help Apprenticeship Levy payers transfer their unspent funds to where they are needed, giving many smaller firms the firepower to drive the acceleration in apprenticeships to deliver the jobs-led growth the PM has promised.”

Construction traineeships will be open to any learner on an FE course, providing learning in a classroom to become adept at English, maths and digital skills, then a placement with an employer, honing those practical skills with workplace experience. The additional learning and development will enable more college students to get into construction jobs by providing a springboard for learners to start work or an apprenticeship

Mass unemployment has been averted, but more needed to support a jobs led recovery.

An Institute for Employment Studies spokesperson, said:

“Not for the first time, the Chancellor is banking on a strong bounce back as we reopen. But this didn’t happen last summer and it may not happen this summer either.”

“The Chancellor promised a budget to protect jobs and to rebuild our economy. But while the measures announced today are strong on the first of these, we’ve still a long way to go on the second.

“The good news first: furlough extension and further emergency business support mean that we’ll surely now avoid a mass unemployment crisis this year. If we can stay on the roadmap out of lockdown, unemployment may well peak even lower than the 2.2 million forecast released today.

“However with over 700 thousand fewer people in work, long-term unemployment nudging half a million, and 3.5 million people in jobs where they want more hours, we needed a lot more today to support a jobs-led recovery. Not for the first time, the Chancellor is banking on a strong bounce back as we reopen. But this didn’t happen last summer and it may not happen this summer either, given the huge spare capacity in firms and continued uncertainty from the pandemic and Brexit.

“The biggest risks that we face now are weak hiring, job insecurity and long-term unemployment. We needed to see more today on measures to support jobs growth, reskilling and new job creation in areas like social care, the green economy and local services.”

The road to recovery: Education needs digital investment

Dave Sherwood, CEO and co-founder at BibliU believes that beyond plans for a loosening of restrictions, the sector will need targeted support, and the Government needs to enable institutions to be able to upgrade to remote learning options by providing grants.

Dave Sherwood, CEO and co-founder at BibliU believes that beyond plans for a loosening of restrictions, the sector will need targeted support, and the Government needs to enable institutions to be able to upgrade to remote learning options by providing grants.

The Budget has made no mention of support for universities and the investment in digital technologies that education so needs to cater to a shift to remote or hybrid forms of learning in the near to long term. Universities are facing significant funding shortfalls and lack the resources and infrastructure to adapt to online or hybrid education effectively.

Universities must be empowered to shift from purely brick and mortar institutions to fully integrated digital ones. We must also see a similar package of support given to students, to ensure that their educational outcomes aren’t affected on accounts of their financial circumstances.

“Like many, the Higher Education sector has endured a torrid twelve months. Barring a limited number of ‘essential’ subjects, most institutions have been closed to students and staff alike, and this has had a number of implications economically, socially and education-wise. Students have spent almost £1 Billion on unused accommodation, and Universities have been left facing significant funding shortfalls. Further, despite the absolutely Herculean effort by educators to adapt courses for remote learning, the sad reality is that many faculties lack the resources and infrastructure to do this effectively, and this left more than a third of students unsatisfied with their academic experience.

“A re-opening of the sector, and a loosening of the restrictions necessary to combat Coronavirus will come as some but more needs to be done, and we need to see targeted support given to the sector. The pandemic has shown the value of investing in digital education technology, and the Government needs to enable institutions to devote to this resource by providing grants. Universities must be empowered to shift from purely brick and mortar institutions to fully integrated digital ones. We must also see a similar package of support given to students, to ensure that their educational outcomes aren’t affected by their financial circumstances.”

The importance of education and skills to our recovery from the pandemic

UCU general secretary, Jo Grady, said:

UCU general secretary, Jo Grady, said:

‘Today’s statement rightly recognises

‘Student and staff mental health has been a serious issue in education for many years, but the pandemic has compounded the issue and more funding aimed at mental health services across post-16 education is urgently needed to address this crisis.

‘Now is the time for the government to step up, fund the system properly, abolish fees and ensure that education is available and accessible to all. If the government is serious about ensuring equality of opportunity, it must ensure stable funding for the sector so institutions impacted by the pandemic do not rush to make damaging cuts to courses and jobs which would undermine future capacity.

‘We also need massively increased investment in adult and community learning, accompanied by a coordinated strategy to ensure that all adults – whether in workplaces or prison cells, care homes or colleges – can access the learning that is right for them. Increased funding and flexibility for apprenticeships is welcome but it removes the extra £500 incentive to employ younger people. Funding for apprenticeships should also be prioritised towards frontline delivery if we are to ensure they are an attractive option for young people.

‘Education staff have gone above and beyond during the pandemic to support their students and adapt to rapidly changing circumstances – decent pay and secure employment is the least they deserve. We need more investment in public services and fair pay for staff to ensure that we have the skills to get the country moving again. If this pandemic has taught us anything it’s that public services and key workers are the people who hold our country together. They must not pay for this government’s mistakes.’

Kevin Courtney, Joint General Secretary of the National Education Union, said:

Kevin Courtney, Joint General Secretary of the National Education Union, said:

“It is short-sighted and disappointing that the Government continues to ignore the funding pressures the education sector faces. The Government has said schools are a “national priority”, yet this Budget has provided schools with no new resources to manage coronavirus. Once again this Government has failed to pay attention to the educational professionals who see first-hand, every day, the detrimental impact under-funding of our education system has on the children and young people they teach or care for.

“A key proposal in the NEU’s Education Recovery Plan is to employ supply teachers and qualified teachers who have left the profession to support individualised and small group tuition when pupils and students return. It will be better and more effective to do this than go through private tutoring agencies, where much of the Catch-Up Premium is likely to be wasted in administration costs and profit for agencies. The Catch-Up Premium is far too small to make an impact as it only amounts to a few hours of one-to-one tuition.

“The past year has shone a light on the shocking reality of poverty in the UK. Even before the pandemic, 4.2 million children – the equivalent of 9 pupils in every class of 30 – were trapped in poverty. Recent research predicts the number of children growing up in poverty is rapidly approaching 5 million. The Government must act urgently to establish and invest in a cohesive strategy to eradicate child poverty from the UK to ensure that no child is left behind. The extension of Universal Credit top up credit of £20 per week for the next 6 months is a welcome move towards tackling systemic disadvantage and is something that should be made permanent.”

“The extension of the furlough scheme is obviously welcome, but the Chancellor continues to ignore obvious defects in the scheme; in particular its voluntary nature which means that groups of workers such as school supply staff are routinely excluded from it.”

Oli Meager, Vice President of Career Mobility at Degreed, said:

“While it’s encouraging to see the Chancellor supporting SMEs in gaining the management skills they need to increase productivity, this is a very narrow commitment to upskilling a small segment of the UK workforce.

“Workers at all levels are in desperate need of upskilling and when it comes to leadership and management skills, our recent research shows that these are highly in demand by workers in many roles and sectors across the UK. To recover at pace, we need to invest in all the workforce, not just parts of it.

“The question also remains as to whether SME managers, who are already overstretched, will be able to make the time for 50 hours of classroom-based training. To be effective, it’s vital that the learning on this scheme isn’t divorced from the reality of running a business, and that on-the-job learning is at the heart of it. Especially when teaching people skills such as management, on-the-job learning is more effective than solely classroom-based learning as it reinforces newly learned skills over time and gives real-world applications.

“Finally, for the UK to emerge strongly from the current economic crisis, upskilling programmes like this can’t just be a one-off commitment – businesses need to play a larger part in their workers’ skill development. To spearhead this change, many will have to be incentivised to do so and that’s where the Government can play an integral role in building skills for all workers.”

Jo Holmes, Children, Young People and Families Lead, British Association for Counselling and Psychotherapy (BACP)

“Whilst today’s welcomed budget announcement includes some mental health provision for veterans and victims of domestic abuse in England and Wales, it is simply not enough. The ongoing mental health crisis needs to be addressed immediately with our young people.

“Yet again there is no mention of any statutory funding for school counselling services in England following the huge impact of the last year on the mental wellbeing of pupils. It is vital we provide schools with counselling resources to help young people emerge from the shadow of the pandemic and flourish both academically and socially.

“Over three quarters (78%) of parents believe counselling or psychotherapy should be available to all pupils. Whilst Wales, Northern Ireland and Scotland already have statutory funded school counselling services, England does not. England urgently needs to catch up with the other UK nations in the mental health support it offers. Today’s announcement will do nothing to promote this.”

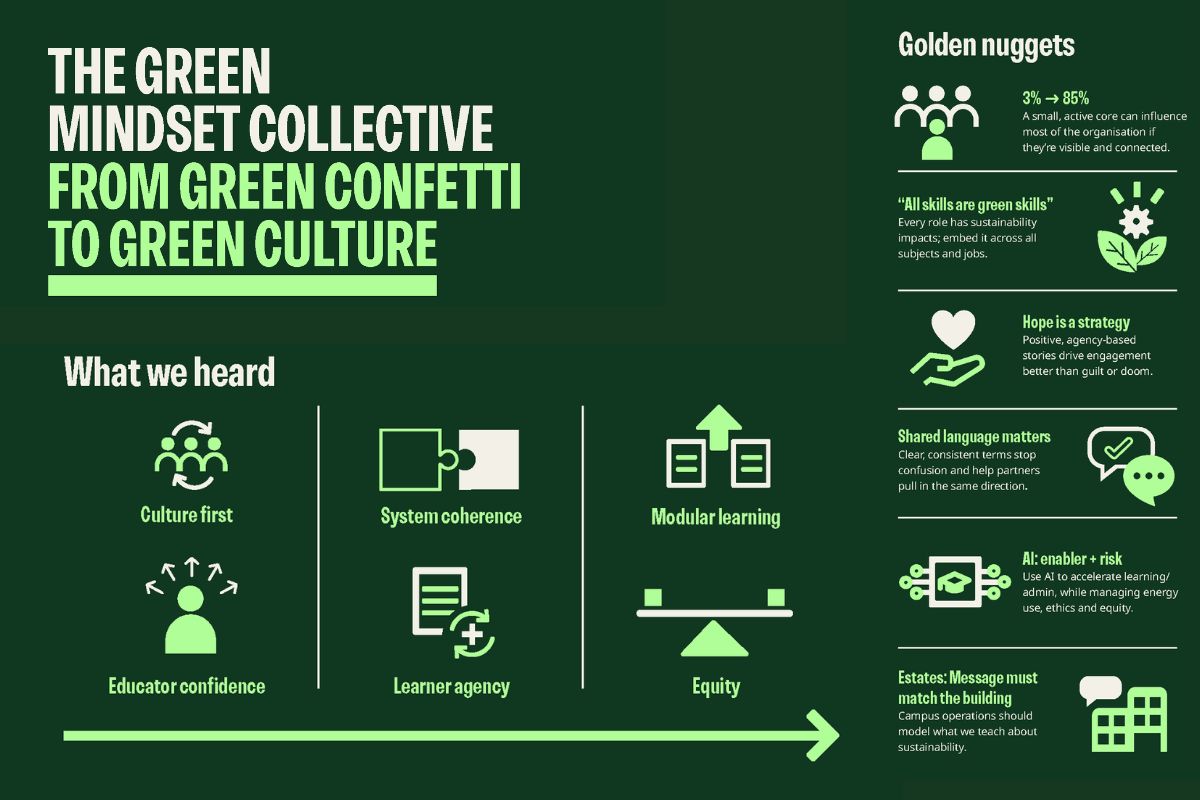

The UK Chancellor has today announced additional incentives to encourage employers to provide employment and training opportunities for young people, and develop their skills. Dina Potter, Global Head of Social Impact at National Grid, comments on the critical role of businesses in futureproofing the UK’s workforce, and how this goes hand in hand with building back better and tackling the green skills gap:

“Now more than ever, businesses have a critical part to play in addressing disparity and supporting young people. The actions they take today could make a real difference to the next generation of talent and our future business leaders.

“As we look towards a green economic recovery and the objective to build back better from the pandemic, there is a clear argument for aligning new training and skills initiatives with the UK’s climate ambitions. Young people are critical for futureproofing the country’s workforce and plugging the green skills gap to ensure the UK has the right capabilities to reach net zero. Green jobs need to be at the heart of delivering the green industrial revolution, tackling climate change and addressing unemployment.

“By leveraging programmes such as apprenticeships, employers can create new career paths while diversifying their own workforce and accessing different ways of thinking, which can in turn provide better solutions to new challenges. Developing these skillsets can help build long-term resilience and competitive advantage, and could be key to future business success and growth.”

Clare Barclay, Chief Executive Officer, Microsoft UK said:

“In the technology industry many businesses, particularly SME’s, are still short of the skilled people they need to help grow and power the recovery. Apprenticeships are key to plugging that gap. Increased incentives and financial support is the right approach at the right time.”

Jack Parsons, UK’s Chief Youth Officer said:

“I’m utterly over the moon that more investment and energy is going into supporting our young people who need our help more has ever and it’s great to see more investment in both traineeships and apprenticeships. The businesses across the country that I’ve already spoken to are delighted that these incentives are in place to support and kickstart young people’s careers. The recent conversation that The Chancellor and I had around Hope, skills and opportunity – this part of the budget does that for young people. The Chancellor has delivered on that, thank you on behalf of young people.”

Robin Mills, Managing Director, Compass Group UK & Ireland said:

“We welcome the Chancellor’s Budget announcement today to invest further in apprenticeships, which will help set a framework for jobs and skills post-pandemic and support the aspirations of young people and key workers”.

Denise Hatton, Chief Executive, YMCA England & Wales:

“Young people are essential to building back the future of this country’s economy, and the support of schemes such as Kickstart, alongside additional investment in apprenticeships and traineeships, are a vital step in establishing a recovery path for young people in order to mitigate the economic impacts and secure a job post-COVID. This budget provides the three essential ingredients in order for young people to get into work and progress in their careers: experience, employment and decent pay. Young people have been faced with deep uncertainty about what is next for them in the wake of COVID-19, and so significant investment and a long-term strategy was needed to help them build towards a brighter future. This was rightly unveiled by the Government today and will be music to the ears of many.”

Andrew Harding, FCMA, CGMA, Chief Executive — Management Accounting, The Chartered Institute of Management Accountants, part of the Association of International Certified Professional Accountants:

“The Chancellor has addressed the most pressing and immediate risks for the business sector in light of the incredibly challenging times.

A year of disruption and extensive restrictions has taken its toll on the business community and now that the sector has some certainty, it can start to move forward and level back up.

“It’s good to see the Chancellor focus on investment and building long-term skills and improving productivity for the business sector bringing real benefits to people and businesses. We especially welcome his pledge to double the apprentice levy for businesses to three thousand pounds for each adult and his £126m package to boost traineeships. The Chancellor has clearly listened to the industry and responded with decisive action.

“We’re pleased to see the Chancellor’s measures on the short-term continuation of grants and loans for SMEs and the wider business community, as well as the extension of the business holiday rates until the end of June. We also believe that the temporary relief on expenditure on plant and machinery, including the 130 per cent super-deduction for main-rate assets, will be highly beneficial to stimulate business investment and growth.

“However, the Chancellor has missed an opportunity to secure and stimulate employment by not freezing employer’s National Insurance Contributions. Such a measure would have helped bolster new job creation.

“In addition, we believe that the Chancellor should have included mandatory training as part of the income support scheme. The government has consistently missed this opportunity in previous announcements. Those receiving furlough won’t all return to their pre-pandemic jobs and action must be taken to ensure that they have the necessary skills to launch their new careers.

“Overall, this Budget is an opportunity for businesses across all parts of the country to focus on levelling-up and tackling the challenges of today as well as building lasting recovery for tomorrow.”

Commenting on the budget’s incentives to run apprenticeship and trainee programmes. Claudia Harris, CEO of software bootcamp Makers said:

In response to the Chancellor’s speech today, CEO of Impetus, Eleanor Harrison OBE said:

In response to the Chancellor’s speech today, CEO of Impetus, Eleanor Harrison OBE said:

“The package announced in today’s budget doesn’t deliver the opportunities that young people, who have been hit first and hardest during this pandemic, need.

“The Chancellor made clear he understands the need to do more for those in low paid and less secure work. We agree, but as a part of this he needs to do more for young people. We need further investment in measures like traineeships, apprenticeships, and the Kickstart Scheme, or there won’t be enough opportunities and hundreds of thousands of young people furthest from the labour market will continue to be let down.

“Increasing apprenticeship incentives for all ages must ensure there’s enough focus on hiring young people. With the furlough scheme due to end in September and Kickstart closing just three months later, young people need more time to apply to become the Chancellor’s ‘Generation Kickstart’.

“The Budget today cushions the blow for businesses in the short and medium term but offers little help to the young people who are most likely to be furloughed or unemployed, risking the future of our economy and communities. Alongside the Chancellor’s investments in business support to restart the economy, we need to see a corresponding investment in the nearly 200,000 young people who have been unemployed for over six months and our future workforce. Without more Help to Grow our young people, this budget falls short.”

Eleanor Weaver, General Manager, Luminance said: “The Chancellor’s investment in skilling and training initiatives further demonstrates the Government’s continued commitment to nurturing the UK workforce. But financial investment is not enough alone. Britain will only stay at the front of the pack when it comes to nurturing junior talent with the right technology strategy in place.”

“The Government’s ‘Help to Grow’ scheme aimed at SMEs is an initiative that will be critical in cementing the UK’s position as a ‘science superpower’. By partnering with technology providers and higher education institutions, businesses can equip their employees with digital skills and leverage AI. This will ultimately boost productivity in their workforces whilst also delivering value and efficiencies back into their organisation.

“With new funding there also needs to be new strategies employed, especially with the backdrop of a remote working world. It’s not enough just to accept money for traineeships – businesses need to be dynamic and think on their feet about ways to engage young talent while remote working from the kitchen table; mentorships, peer learning and eLearning training programmes are all good starting points.”

Protecting jobs and livelihoods

Extending furlough is a short-term solution to the fundamental structural changes to our economy

Paul Naha-Biswas, CEO and Founder at recruitment tech platform Sixley, said:

“The extension of the furlough scheme is very welcome, but it is ultimately a short-term solution as we all adjust to the fundamental structural changes to our economy caused by the pandemic. If the Chancellor is committed to preventing unemployment tipping over five million, then he must act now to ensure the workers impacted by these changes are not left behind. This means providing back-to-work help as the furlough scheme winds down, along with training in digital skills and a more even spread of demand and supply-side support across the economy.”

“Lockdown has changed consumer behaviour for the foreseeable, with shoppers now prioritising digital and online services. A similar trend occurred in the 2008 financial crash, leading to the rise of digital-first brands like Spotify and Uber. We’re all praying for a fast bounce-back from the COVID-19 pandemic, but we need to appreciate that not all sectors of the economy will recover evenly.”

Kate Palmer, HR Advice and Consultancy Director at Peninsula, said:

“As the government plans to relax lockdown restrictions, hopefully for the last time, it has remained clear that the pandemic’s ongoing impact on businesses is far from over. To this end, eyes will have all turned to the Chancellor today to announce how he intends to support companies across the UK as we, hopefully, head back to normality.

“A significant aspect of today’s Budget is the extension of the furlough scheme, something that has provided a lifeline to businesses across the country since it was originally put in place in March 2020. The news that it is going on until the end of September will undoubtedly be extremely welcome to many employers, especially those that are still not expecting to open until at least June, such as nightclubs. If all goes to plan, this means that the furlough scheme will remain an option for employers for a few months after restrictions are expected to be lifted entirely on 21 June, which will hopefully help them to slowly bounce back from the major disruption they may have seen.

“An interesting development is that, once again, employers will be asked to start contributing to the scheme from July, something that we previously saw introduced last year as the government aimed to wind the scheme down before it was extended. Whilst this may at first glance be concerning for employers, they should remember that by July, the government is aiming for life to be, essentially, much more normal, and likely anticipate the need to use the scheme will be much diminished. However, whether this means they will start to clamp down on who can actually use it following 21 June does remain to be seen.”

Paul Holcroft, Managing Director at Croner, said:

“As the governments of England, Scotland, Wales and Northern Ireland plan to relax lockdown restrictions, hopefully for the last time, it has remained clear that the ongoing impact of the pandemic on businesses is far from over. To this end, eyes will have all turned to the Chancellor today to announce how he intends to support companies across the UK as we, hopefully, head back to normality.

“A significant aspect of today’s Budget is the extension of the furlough scheme, something that has provided a lifeline to businesses across the country since it was originally put in place in March 2020. The news that it is going on until the end of September will undoubtedly be extremely welcome to many employers, especially those that are still not expecting to open until at least June, such as nightclubs. If all goes to plan, this means that the furlough scheme will remain an option for employers for a few months after restrictions are expected to be lifted entirely on 21 June, which will hopefully help them to slowly bounce back from the major disruption they may have seen.

“An interesting development is that, once again, employers will be asked to start contributing to the scheme from July, something that we previously saw introduced last year as the government aimed to wind the scheme down before it was extended. Whilst this may at first glance be concerning for employers, they should remember that by July, the plan is for life to be, essentially, much more normal across the devolved nations, with the UK government likely anticipating the need to use the scheme will be much diminished. Crucially, businesses will be able to use flexible furlough for quite some time.

“What we have yet to hear is whether the government will start to clamp down on who can actually use the scheme as restrictions are relaxed, such as the requirement to have already been previously furloughed after a certain date that we saw last year. The Budget did not also state any plans to resurrect the Job Retention Bonus, through which employers were to be provided financial incentives to keep staff on following the end of the scheme, something that was eventually cancelled when it was extended in October.

“Looking outside of the furlough scheme, it is clear that the budget is heavily focussed on encouraging businesses to bounce back strongly following the end of lockdown, with increased options for grants and loans focussing on sectors that have suffered the most during the pandemic. The government also remains committed to encouraging the creation of a skilled workforce going forward, announcing that employers will be provided yet more incentive payments to take on new apprentices for a period of time this year.

“It remains to be seen what the overall impact of this Budget will be on businesses in the coming years, and indeed there seemed to be nothing in here about what finances would look like should there be a resurgence of the virus at a later date. For now, it seems the government expects two things: that Covid restrictions, and the furlough scheme necessary to sustain business through them, will indeed be something for history books alone come the Autumn.”

Jonathan Richards, CEO and Founder of Breathe comments:

“Although the roadmap out of lockdown has been announced, small and mid-sized businesses everywhere will be anxiously monitoring the budget tomorrow and waiting for news of further COVID-19 support, after what has been a particularly tough year for businesses in the hospitality, leisure and retail sectors. The proportion of private sector workers on furlough is at its highest level since last summer, so it’s critical that the Chancellor announces measures to support businesses and their people as restrictions gradually begin to lift. Extending the VAT and business rates relief will also be welcomed by many, providing vital assistance to get back up and running.

“Providing strong support to businesses will not only enable them to thrive; economic support from the government will allow them to focus on their people and nurture a strong company culture. Building an inclusive culture will retain top talent and allow businesses to embrace both the challenges and opportunities of Brexit with ease.”

How to keep furloughed and existing staff engaged

Danni Rush, Chief Customer Officer at Virgin Incentives for advice on how business can keep furloughed and existing staff engaged:

“Furlough has been a crucial support for many employers and employees, and will continue to offer an important economic lifeline as we hopefully emerge from the grips of the worst of the pandemic soon. However, it may have also unfortunately led to a stagnant labour market – with furloughed workers left in limbo, unsure whether to stick with their current employer or twist.

“With unemployment reaching 5% at the end of 2020 – a four-year high – employees still in full time work may be more hesitant to seek new job opportunities elsewhere, preferring the job security at their current employer even if they’re unhappy in their role rather than facing a competitive jobs market.

“This is a new conundrum almost unique to the pandemic economy, which employers must tackle – and HR departments offer the best possible way to overcome the challenge. For furloughed staff, employers must continue to maintain open and regular lines of communication to ensure they feel engaged with the business and aren’t tempted to look elsewhere. This may be as simple as an email or a call to check in on them and their wellbeing, or a regular company newsletter to keep them up to date with the latest company developments. Alternatively, some businesses may wish to offer furloughed employees bespoke financial support or gifts to show their support – for example, a hamper of treats. Doing so can also help to ensure furlough staff look forward to eventually returning to work and are motivated to contribute when they are finally reintegrated to the workforce.

“For retaining those staff members who are still working, employers could consider part time furlough as a compromise to help keep people working if financially viable. Additionally, employers should explore wellbeing support for mental health which has understandably suffered as a result of the ongoing social restrictions. This could start with creating an ‘open door’ policy both in the workplace and virtually, and could include access to an independent, free 24/7 Employee Assistance Programme (EAP). Businesses may also consider enhancing their employee offering by bolstering their suite of staff rewards and incentives. For example, by offering team treats or recognising achievements with financial or non-financial bonuses, including an experience to look forward to or a gift card for the employee to choose from a range of flexible options.”

IPPR North Director Sarah Longlands said:

“We welcome the steps that the government have taken to support business and jobs at this time but there was very little in today’s Budget to help bolster the creaking foundations of the North’s economy such as poor skills, health and child poverty. It particularly neglected to help local government which has been at the forefront of the Covid efforts in towns and cities across the country.

“Ultimately this was a Janus-like Budget. Whilst announcements on moving the Treasury to Darlington and establishing the National Infrastructure Bank in Leeds give the pretence of a government that cares about the regions and levelling up, ultimately, powers and resources remain highly centralised.

“Recovery in the North will take longer and so what we needed today was long term, comprehensive investment plan for recovery. What we got doesn’t feel like a genuine attempt to ‘level up’ but a short-term package of measures to win votes ahead of elections in May”.

Responding to the Budget, Cllr James Jamieson, Chairman of the Local Government Association, said:

Local recovery

“Tackling the economic challenges ahead is a huge task. It is councils who know their local areas best and must be able to lead efforts to rebuild and level up our economy, get people back into work and create new hope for communities. It is good that councils have been placed at the heart of the delivery of new funds such as the Levelling Up Fund and Community Renewal Fund. We look forward to working with Government on the detail but are concerned by the prospect of competitive bidding processes at a time when councils want to be fully focused on protecting communities and businesses from the impact of the pandemic.”Business support

“Emergency government grants distributed by councils have been a vital lifeline to struggling businesses worried about the future during the pandemic. It is good that further funding will be provided to support businesses and councils remain ready to use their local knowledge and expertise to distribute this new money quickly.”

Furlough/jobs

“The COVID-19 pandemic could lead to the number of long-term unemployed people across England reaching 1.2 million. The furlough scheme has been vital in securing jobs that may have otherwise been lost so it is important that it has been extended. It will be crucial to ensure people seeking to re-enter the labour market get the local support, advice and training they need to face the future. Councils stand ready to work in partnership with the Government at the earliest stage to shape new and re-design existing Plan for Jobs initiatives, so they are effective and connected on the ground to ensure no community is left behind.”

Universal Credit

“Many households could be economically vulnerable for some time so we are pleased that the Chancellor has announced an extension to the universal credit uplift. We remain clear that this must be kept in place for as long as it is needed so that households are not pushed into financial hardship as a result of vital support being withdrawn. The mainstream benefits system will need to provide the first line of support to those in need with councils given adequate local welfare funding to provide additional help.”

Council funding/social care

“Councils continue to lead local efforts to protect lives and livelihoods from COVID-19 but still face substantial cost pressures and income losses. The Government has provided a significant financial package of support so far to help but the ongoing financial impact and unpredictability of the pandemic means this support must be kept under review. We continue to call on government to meet – in full – all cost pressures and income losses incurred by councils as a result of the pandemic.

“Further action is also desperately needed to immediately shore up social care services, and to secure the long-term future of care and support. The Government must urgently bring forward its proposals, including a clear timetable for reform, so that we can finally put social care on a sustainable footing and enable people to live the lives they want to lead.

“Public finances are undoubtedly under huge strain but investment in our local services will be vital for our national economic and social recovery. Alongside sustainable long-term investment for councils in the forthcoming Spending Review, bringing power and resources closer to people is the key to improving lives, tackling deep set inequalities and building inclusive growth across the country as we move forward.”

On home ownership, Senior Research Fellow Jonathan Webb said:

“For young people right across the country, owning their own home is an increasingly distant prospect and the chancellor’s announcement today will do little to change this. 95 per cent LTV mortgages are nothing new and higher value mortgages risk saddling buyers with even more debt. England’s broken housing market has priced too many people across the country out of accessing a home of their own, including in the North. In Greater Manchester for example, house prices have increased 35 per cent in the past 5 years. Even with access to more capital, aspirational buyers simply cannot save at the required rate to buy a home.

“To ensure we have enough homes that everyone can afford, the government needs to fix the root causes of England’s broken housing market. This requires reform of the planning system and building more genuinely affordable homes, including social rented housing. Building these homes will not only create more jobs; it will also give people affordable housing options when it comes to renting or buying. This would ensure that everyone can afford to live in and contribute to our great cities, towns and villages, regardless of age or income.”

On support for high streets, Senior Research Fellow Jonathan Webb said:

“Today’s announcements will provide some relief for high street businesses. However, the support offered falls short of a long-term plan to revive our high streets and there is a serious risk that many retailers, arts venues and hospitality businesses might go under before they have a chance to get back on their feet. IPPR’s recent analysis has shown that more than half a million employers are already at risk of bankruptcy. Many of these will be located on our high streets. Alongside this, high streets have been facing long standing pressures including rising business rates and competition from online retailers. A long-term plan is needed to support a new and ambitious role for high streets in the years to come.

“Business rates are no longer fit for purpose and today was a missed opportunity to outline much needed reforms. Combined and local authorities must also be given more powers and resources to plan and shape the future of our high streets. They can work with retailers, hospitality and the arts sector to drive the renewal of our cities and towns”.

On the announcement that Treasury North will be based in Darlington, Research Fellow Marcus Johns said:

“This economic campus is a welcome announcement. It will have a local economic impact and, with the right employment strategy, could provide opportunities to local people over time. We welcome the recognition that policy development should be informed by the experiences of people living across the UK, not just the corridors of Whitehall.

“But, levelling up cannot be achieved through moving civil servants out of London alone. It does not undo jobs lost through austerity and it is not a replacement for devolution. This proposal would have been stronger if it accompanied a real commitment to English devolution and clarity on how this northern economic campus would facilitate devolution. Central government needs to let go of power—devolving it and resources to drive change, so that local communities across the country can drive their own prosperity”.

On infrastructure and the announcement that the UK Infrastructure Bank will be opened in Leeds, Research Fellow Marcus Johns said:

“This Budget was an opportunity for the Chancellor to start delivering this Government’s longstanding promises of an infrastructure revolution. But we are still none the wiser about what will be delivered when. The National Infrastructure Strategy, published four months ago, should have been a catalyst for change, but it needed the Chancellor to take it forward and he has neglected to do so.

“After decades of underinvestment in our transport infrastructure, the North needed this Budget to finally commit to turning a corner. But, with the news of a 40 per cent budget cut to Transport for the North this year, and little to signal national government’s commitment to Northern transport today— it is fair to say the North’s patience with central government has more than worn thin.

“The announcement of a Leeds-based UK Infrastructure Bank to invest in green infrastructure and levelling up is good news. Specific access for local authorities is very welcome too. But, new investment here with cuts to transport elsewhere demonstrates a lack of strategic infrastructure planning”.

On the newly announced freeports, Research Fellow Marcus Johns said:

“Instead of pursuing a bold transformative economic agenda to level up, the Chancellor has opted to create eight freeports in England, including three in the North. Levelling down regulations, creating new loopholes for tax dodging, and promoting low-wage competition will not level up the North. The evidence suggests that freeports displace activity, at cost, rather than create new opportunities. This is not what is needed to provide a post-pandemic economic recovery. We needed to see a commitment long-term investment in people—in skills, training, and health—and devolved economic resources so that local places can target economic support. Today’s opportunity for our region to see broad economic prosperity in the recovery and beyond has been missed.”

On cash for levelling up, Researcher Amreen Qureshi said:

“The levelling up fund will not empower local communities, and it does not scale up to the challenges we have before us.

“Investment to level up should not involve bidding wars for insufficient pots of money. The North’s economy will thrive when all parts of the North are thriving, with a strategy that plays to their strengths, not playing them off against each other.

“Levelling up should not be dictated from Westminster, where the purse strings are held tight and decision making is centralised. Funding to regions needs to strengthen local communities to emerge from this crisis safer than when we went into it”.

Helen Barnard, Director of the Joseph Rowntree Foundation, said:

“It is unacceptable that the Chancellor has decided to cut the incomes of millions of families by £1040-a-year in six months’ time. He said this Budget would “meet the moment” but this decision creates a perfect storm for the end of this year, with the main rate of unemployment support cut to its lowest level in real terms since 1990 just as furlough ends and job losses are expected to peak. This makes no sense and will pull hundreds of thousands more people into poverty as we head into winter.

“Even before Coronavirus, incomes were falling fastest for people with the lowest incomes due in large part to benefit cuts. Ministers know this short extension offers little relief or reassurance to the millions of families, both in and out-of-work, for whom this £20-a-week is helping to stay afloat. This cut to Universal Credit will increase hardship when the economic crisis is far from over and undermine our national road to recovery.

“It is not too late for the Chancellor to do the right thing: announce an extension of the £20 uplift to Universal Credit for at least the next year. It is also totally indefensible that people who are sick, disabled or carers claiming legacy benefits continue to be excluded from this vital support. The Government must urgently right this injustice.”

On housing, Helen Barnard added:

“With billions going into propping up already high house prices through the Stamp Duty Holiday and the Mortgage Guarantee Scheme, it’s galling to see the government choose to ignore millions of renters who are already worried about mounting arrears. Many will be left struggling to keep a roof over their heads at the same time as financial support is pulled away.”

Caroline is a childminder from Northern Ireland who had to claim Universal Credit when the pandemic hit and is part of the Covid Realities project exploring the impact of the pandemic on parents and carers on low incomes. In response to the Budget she said:

“This decision is another cliff edge to dread. It leaves us facing the winter months with uncertainty again. We don’t know how the economy will recover, yet we face more insecurities for those on low income and on Universal Credit. Through Covid Realities, I know that so many families face this insecurity, and it’s just making our daily life – which is already so difficult – only harder still. I wish things could be different. I wish the government would listen to us.”

Lola is a parent of two from the south-east who receives Universal Credit and is also part of Covid Realities. She said:

“This short-term decision on Universal Credit just feels like it’s prolonging the inevitable. It fails to give us the clarity and the security that we need. It brings back all the same worries and anxieties that millions of families have been experiencing in the run up to this announcement; and that we’ll have again when this extension comes to an end this winter.”

Reacting to the Chancellor of the Exchequer’s Spring Budget today, Nick Molho, Executive Director of the Aldersgate Group, said: “It is welcome to see the Budget acknowledge the importance of an investment-led recovery, which will be essential to supporting the UK’s economic growth and the development and deployment of low carbon technologies and services [1]. Whilst today’s announcements set a useful framework towards economic recovery, there are a number of significant missed opportunities within key areas such as housing and transport that must be picked up in the Government’s upcoming net zero strategy, which needs to provide a cross-economy roadmap to reach our net zero target by 2050. [2]”

Nick Molho added: “The establishment of the first UK Infrastructure Bank in Leeds is a crucial step in this journey, with an initial capitalisation of £12bn and £10 billion of guarantees. We would urge Government to include environmental objectives in the Bank’s remit in order to increase the UK’s resilience in the long-term. [3] Further information on the UK’s first sovereign green bond is also welcomed, but it will be essential that the funding is aligned with our net zero objectives in order to support a sustainable economic recovery. The recognition of net zero and sustainability in the updated remit of the Monetary Policy Committee of the Bank of England is also a helpful signal to support the transition to a low emissions economy.”

Nick Molho added: “However, the Budget falls short of providing certainty for the housing sector by not explicitly setting out further funding for the Green Homes Grant. This is a concerning omission and one that must be rectified at the earliest opportunity with additional policy measures that address supply chain and skills issues. This clarity and support will be vital in decarbonising the housing sector, alongside regulatory standards and fiscal incentives to support investment in energy efficiency and low carbon heat.”

Dr Adam Marshall, Director General, BCC said:

“There’s much to welcome in this Budget for business communities across the UK. The Chancellor has listened and acted on our calls for immediate support to help struggling businesses reach the finish line of this grueling marathon and to begin their recovery. Extensions to furlough, business rates relief and VAT reductions give firms a fighting chance not only to restart, but also to rebuild. We particularly welcome the massive ‘super deduction’ investment incentive that the Chancellor has put in place for the next two years. This responds directly to our call to encourage those businesses that can to invest and grow. While no business will relish paying higher rates of Corporation Tax in future, the impact of the Chancellor’s tough decision is blunted by the big new incentives for investment, lower rates for the smallest firms, and the extension of Coronavirus support measures in the short term. This Budget provides reassurance to businesses, provided that they are able to restart and rebuild according to the Government’s road map. If firms face unexpected bumps in the road, the Chancellor must be prepared to take action until the economy is firing on all cylinders again.”

Jonathan Geldart, Director, Institute of Directors said:

“This Budget provides a strong foundation for businesses to recover from the pandemic, with the tools needed to plan for the long term. The extension of key economic support measures will support firms as the economy reopens, while policies to boost skills, investment, and productivity growth hits the right note to boost the UK’s long-term growth prospects.

Craig Beaumont, Chief of External Affairs, Federation of Small Businesses said:

“There are some very positive measures in today’s Budget. Expansion and extension of furlough is important, and the expansion and extension of the self-employment scheme to include the newly self-employed was a major campaign led by FSB. We are very proud to see that adopted, bringing help to hundreds of thousands. Business rates relief and confirmation of cash grants and VAT 5% extension are also key asks of ours and moves to improve management and digital skills in SMEs are promising. We will be going through the detail on the super deductions on business investment. There remain major moments still to come, including decisions on tax to come later this month and the fundamental downward business rates review. We will continue to try to find ways to help those that need income support, more on job creation, and to ask for measures to come like the job retention bonus.”

Derek Cribb, CEO, IPSE said: