There’s a hole in my bucket… Continuing Apprenticeship reforms

Last week in Birmingham a new package of Levy reforms were announced….

- Was it the end of the Severn bridge ’hard’ funding border? X

- Was it an end to the 10% SME contribution? X

- Was it investment in EPA capacity? X

- Was it clarification on the status of EU Apprentices post Brexit? X

- Was it that employers can pass on more of their unspent levy? – YES it was!

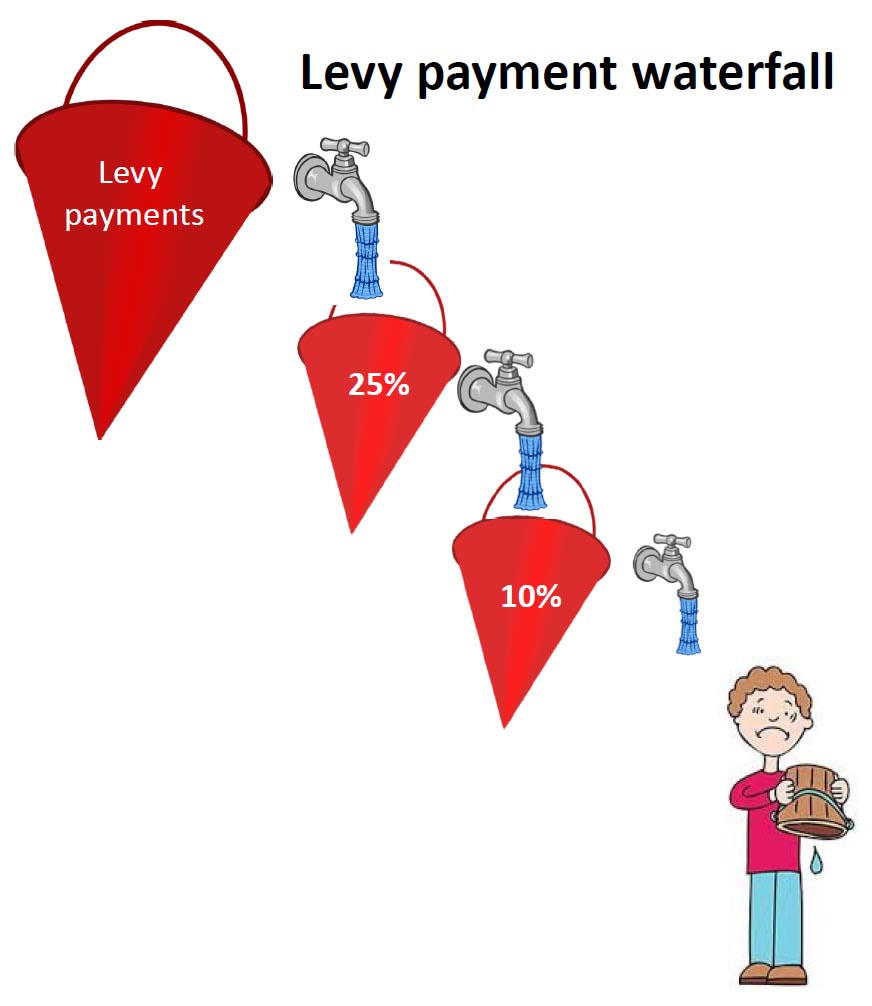

With 75% of the levy unspent it is easy to see why the idea of a funding ‘pass the parcel’ was seen as a good idea, and I am sure someone somewhere has asked for this.

But I would be very surprised if many employers have got anywhere near transferring 10% of their unspent levy never mind asking to distribute more. Was this was near the top of anyone’s wish list?

Surely it would have been more helpful to instead allow UK employers to spend their UK levy on their UK staff?

Surely it would have been more helpful to instead allow UK employers to spend their UK levy on their UK staff?

While the 25% transfer appears to be a useful enhancement, as it gives employers more control, it does further shift the burden of funding management from Government agency onto employers who could now become responsible for the management of up to £50m per month of Apprenticeship funding… it is almost like a subcontracting of the levy.

It also creates yet another funding division, as those SME employers that have a generous levy paying ‘friend’ will not have to pay the compulsory 10% contribution – whereas those who don’t will; creating two different SME costings for apprenticeships that work in addition to the micro employer exemption.

Spare change

Of course there will be more levy money to move around now too. Cuts to the caps of popular standards from 01 Jan will both dampen demand and reduce the amount being spent on the training of each affected learner.

The standards that they think no one will fight for have gone first – and with no provision for inflation built in there is a perpetual annual 3% reduction built in too..

No wonder FE does badly with HMRC at budget time, when our own agencies voluntarily offer up rate reductions and eternal, annual cost savings!

How can we support more Apprenticeships at smaller businesses?

Smaller businesses have always played a key role in Apprenticeships and although this is still true for younger learners, with smaller businesses much more likely to employ school leavers, overall the levy has altered the balance towards larger employers. We need to fight to keep SMEs in Apprenticeships.

So the question remains how do we provide attractive and simple funding support for those SMEs without a supportive big levy brother or sister?

Currently this is managed via the annual ESFA funding allocation and contracting systems. Which have the advantage of being well established and of preventing over spending – but which are prohibitive for new entrants and lead to a game of ‘hunt the funding’ for smaller employers…

There is a definite sense of have and have nots in Apprenticeships with levy payers able to guarantee their funding whilst SMEs are subject to the limitations of ESFA allocations.

If we can guarantee employer NI savings for every apprentice under 25 why not guarantee the funding for their training too?

And if a total SME funding guarantee is too much to underwrite then the answer might lie in either giving each non-levy paying employer an ‘apprenticeship allowance’ – perhaps related to their number of employees – using Blockchain technology to facilitate real time funding allocations.

I.e. each employer could have a guaranteed annual allocation of 2 apprentices plus a further number based on a (for example) 1 apprentice per 10 employees ratio.

The current system of historical provider allocations and subcontracting and or petitioning of levy sponsors doesn’t provide the certainty or flexibility that workforce development requires.

And it makes sense to base allocations on employers now – not providers – giving them the levers of control.

2020 vision

In his speech the Chancellor invited us all to put our thinking caps on to assist with a ‘review of the levy from 2020’.

I have no doubt that good ideas are always welcome, but by basically suggesting that the whole system is up for discussion (again) we again give out the signal that this is not a serous long term government and business partnership.

Which is of course what we do need in order to create the world class system that we all crave.

Lets just keep making smaller adjustments (such as those proposed by the select committee) as we go and not hit the panic just yet – please!

Richard Marsh, Apprenticeship Partnership Director, Kaplan Financial – a Mega training provider!

Copyright © 2018 FE News

Responses