August ONS: Unemployment Rises to 4.7% as Wage Growth Slows to 4.6%

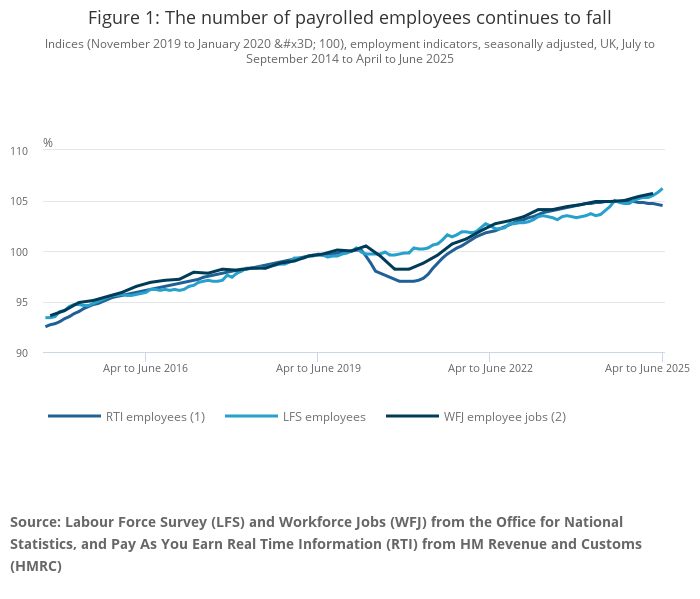

UK labour market data for June and July 2025 reveal critical shifts that demand immediate strategic attention from sector leaders. While employment rates edge higher, payrolled jobs continue falling, vacancies have dropped for the 37th consecutive period, and wage growth is losing momentum ahead of expected autumn policy changes.

Hiring in the Downturn

The sustained collapse in job vacancies presents a rare opportunity for strategic hiring. Vacancies fell by 44,000 (5.8%) to just 718,000, with 16 of 18 industry sectors reducing their hiring activity. This dramatic pullback in competitor recruitment creates openings for businesses with strong balance sheets to secure top talent at reduced competition levels.

The ONS Vacancy Survey confirms many firms are now reluctant to recruit or replace departing workers, suggesting those continuing to hire aggressively could gain significant market share in human capital. The 37-period consecutive decline represents the longest sustained reduction in hiring activity on record, indicating this is not a temporary adjustment but a fundamental shift in business confidence.

The New Wage Strategy

Earnings growth deceleration demands immediate compensation strategy review. Total earnings growth slowed to 4.6% from 5.0% in the previous quarter, falling below market expectations of 4.7%. This marks a critical inflexion point for businesses balancing talent retention against cost control.

The public-private wage divergence continues to widen, with public sector increases at 5.7% versus private sector growth of 4.8%. This gap creates particular retention risks for private sector employers competing for skilled workers, especially in sectors with high public-private talent mobility such as technology, healthcare, and professional services.

The Employment Relationship

A significant divergence between payrolled employee data and broader employment figures signals fundamental changes in working arrangements that sector leaders must understand. While payrolled positions fell by 149,000 over the year, the employment rate actually increased to 75.3%, suggesting accelerated shifts toward contractor, gig, and alternative employment models.

This trend has immediate implications for workforce planning, benefits provisioning, and operational flexibility. Businesses may need to rapidly adapt HR infrastructure to manage increasingly hybrid employment models while competitors struggle with traditional full-time hiring approaches.

Competitive Positioning

With vacancy reductions occurring across 16 of 18 sectors, businesses maintaining hiring momentum will gain disproportionate competitive advantages. Economic inactivity falling to 21.0% indicates available talent is increasing precisely when most competitors are pulling back from recruitment.

The Claimant Count decreased to 1.695 million, suggesting unemployment benefits claims are falling even as survey unemployment rises to 4.7%, potentially indicating workers are transitioning between roles rather than becoming truly unemployed. This creates opportunities for fast-moving employers to capture transitioning talent before it reaches traditional recruitment channels.

Policy Preparation

Real wage growth remains positive at 0.9% for regular pay, providing a buffer for businesses planning compensation adjustments ahead of anticipated autumn tax increases. However, the deceleration in nominal wage growth suggests this buffer is narrowing rapidly.

Industrial relations remain stable with only 38,000 working days lost to disputes in June, indicating labour tensions have not yet materialised despite economic pressures. This stability window may be temporary as policy changes approach.

Strategic Implications

The data suggests businesses face a critical decision point. Conservative approaches to hiring and wage growth may preserve short-term margins but risk long-term competitive positioning as talent becomes increasingly scarce and mobile. Conversely, aggressive talent acquisition and retention strategies during this downturn could generate significant future returns when economic conditions improve.

The ONS cautions that Labour Force Survey volatility continues due to methodological improvements, but the consistency of the RTI payrolled employee decline across 10 of the last 12 months provides reliable strategic intelligence for workforce planning.

Sector Reaction

Stephen Evans, chief executive of Learning and Work Institute (L&W), said:

“The labour market continues to cool with payroll employment down an estimated 164,000 over the past year and vacancies falling for the 37th month in a row. Employment falls are largest in retail and hospitality. These sectors also have the strongest pay growth, so it’s likely the combination of a weak economy, rising minimum wage and employer costs is having an impact on jobs. As well as boosting the economy, we need to widen employment support, with only one in ten out-of-work disabled people getting help to find a job each year.”

Kate Shoesmith, Deputy Chief Executive, The Recruitment and Employment Confederation (REC) said:

“The labour market remains challenging, with many businesses maintaining a cautious approach to hiring. But if we are to harness the optimism businesses tell us they have for future recruitment later this year, we will need the Autumn Budget to offer employers a bit more bandwidth on costs.

“The resilience of the UK labour market is apparent in today’s official statistics, with the number of people in work slightly up and unemployment only slightly higher than in the previous quarter. Tackling economic inactivity, which saw a fall over both the quarter and the year, remains the single greatest challenge for this government if they are to ever achieve their goal of 80% employment.

“Our labour market picture is mixed. Construction and blue-collar industries are showing a gentle return to hiring, which is often a strong indicator for the wider economy, alongside sustained demand for engineering skills. But hospitality and retail saw a slow start to the summer amid cost headwinds.

“With pay growth steadying overall after a volatile few years – prompted in part by inflating-busting rises in national minimum wage rates – now is the time for pragmatism from the Low Pay Commission before they make any further decisions on pay rates, and as the Bank of England continues to monitor interest rates closely. Business cannot afford further cost rises.”

Isaac Stell, Investment Manager at Wealth Club said:

“The UK’s latest labour market data points to growing signs of economic strain and an absence of momentum.

“Although the employment rate saw a slight increase in June, rising to 75.3%, this comes against a backdrop of weakening economic activity and falling demand. One of the clearest indicators of this slowdown is the continued decline in job vacancies, which have now fallen for the 37th consecutive period across most sectors.

“Both the Chancellor and the Bank of England will have their eyes firmly fixated on wage growth, which slowed to 4.6%. This deceleration signals weakening employer confidence and reduced capacity to offer competitive compensation. This will of course raise concerns about household spending power and with it broader economic resilience. With tax rises in autumn looming, the data is unlikely to regain momentum from here.”

Arushi Bhasin, Senior Economist at Youth Futures Foundation, comments:

“Today’s ONS labour market data shows that unemployment rates among young people not in full-time education remain worryingly high. Between April to June 2025, 414,000 jobless 16-24 year olds were actively looking for work. That’s equivalent to an alarmingly high rate of 12.6%. Compared to 2022, when youth unemployment was particularly low, 144,000 more young people are now unemployed.

“Meanwhile, nearly 1 in 5 (19.6%) young people not in full-time education remain economically inactive. An estimated 806,000 16-24-year-olds are not in full-time education and are neither in work nor actively seeking it. This marks a sharp rise since 2021 as the UK emerged from the pandemic, when the rate stood at 15.3% and 558,000 young people were economically inactive.

“Last month, we were pleased to publish our new strategy for 2025-2028. It sets out a bold and focused roadmap for the next four years – anchored in evidence, driven by ambition – to dismantle barriers, shape policy and practice, and secure meaningful futures for all young people.

“Against a backdrop of stubbornly high youth unemployment and economic inactivity, setting ambitious objectives that recognise the scale of the challenge is vital. That’s why we have set two ‘North Star goals’: for England to have the lowest NEET rate in the OECD by 2050, and to remove the gaps in education, employment or training outcomes for marginalised young people. If we can achieve both of these things, the UK economy stands to gain £69 billion, but more importantly, we create a society where no young person is left behind.”

Responses