November Labour Market 2023: Sector Response

Payroll employment is at a record high at 30.2 million – 398,000 higher than this time last year and 1.2m higher than before the pandemic.

November Main Points

In August to October 2023, the estimated number of vacancies in the UK fell by 58,000 on the quarter to 957,000. Vacancies fell on the quarter for the 16th consecutive period, with vacancies falling in 16 of the 18 industry sectors.

Annual growth in regular pay (excluding bonuses) in Great Britain was 7.7% in July to September 2023, slightly down on the previous periods, but is still among the highest annual growth rates since comparable records began in 2001. Annual growth in employees’ average total pay (including bonuses) was 7.9%. This total annual growth rate is affected by the Civil Service one-off payments made in July and August 2023. In real terms (adjusted for inflation using Consumer Prices Index including owner occupier’s housing costs (CPIH)), annual growth for total pay rose on the year by 1.4%, and regular pay rose on the year by 1.3%.

There were 229,000 working days lost because of labour disputes across the UK in September 2023. The majority of the strikes were in the health and social work and education sectors.

UK payrolled employee growth for September 2023 compared with August 2023 has been revised from a decrease of 11,000 reported in the last bulletin to an increase of 32,000.

The estimate of payrolled employees in the UK for October 2023 increased by 33,000 on the revised September 2023 figure, to 30.2 million. The October 2023 estimate should be treated as a provisional estimate and is likely to be revised when more data are received next month.

Because of the increased uncertainty around the Labour Force Survey (LFS) estimates, we are publishing an alternative series of estimates of UK employment, unemployment, and economic inactivity. These figures were derived using growth rates from Pay As You Earn Real-Time Information (excluding the early flash estimate) and the Claimant Count for the periods from May to July 2023 onwards. This is to provide a more holistic view of the state of the labour market while the LFS estimates are uncertain.

These alternative estimates for July to September 2023 show that;

- the UK employment rate decreased by 0.1 percentage points on the quarter to 75.7%

- the UK unemployment rate was largely unchanged on the quarter at 4.2%

- the UK economic inactivity rate was largely unchanged on the quarter at 20.9%.

Read the complete labour report for November 2023 here.

Read last month’s Labour market and sector response by clicking here.

Pay growth is cooling rapidly amid a murky outlook for employment, says the Resolution Foundation

Private sector pay growth has almost halved in recent months, suggesting that higher interest rates are bringing about a turn in the labour market, the Resolution Foundation said today (Tuesday) in response to the latest data.

Headline nominal regular average weekly earnings grew by 7.7 per cent on the year – down on the previous months but still high by historic standards. Real earnings grew by 1.3 per cent.

However, the recent pay data hint at a sharper slowdown. Over the past three months, annualised private sector pay growth has almost halved from 10.5 per cent to 5.8 per cent, although this series is noisy. Recent RTI data show a similar trend – a high frequency measure of pay growth outside the majority-public sector industries has slowed from 8.2 per cent to 4.4 per cent over the past six months. Vacancies also fell for the 16th consecutive month, primarily in the private sector.

It’s not clear yet how this recent pay cooling is feeding through into the jobs market, with ONS data suggesting that both employment, unemployment and economic inactivity are largely unchanged. However, the experimental nature of this data, and the fact that RTI is subject to major revisions mean that the outlook for the jobs market is murky.

Nye Cominetti, Principal Economist at the Resolution Foundation, said:

“Beneath strong headline data, pay growth looks to be cooling rapidly in the private sector. A rapid cooling will reassure the Bank of England that rising rates are having their desired affected, though for workers it could mean that the recent period of rising real wages is ending soon.

“Data limitations mean that the outlook for jobs murky. While vacancies keep falling, there’s no sign yet of a big rise in unemployment that some people fear.”

IES Analysis

This briefing note sets out analysis of the Labour Market Statistics published this morning. As with last month, there is no Labour Force Survey (LFS) data published today as the ONS works to make methodological improvements, so today’s briefing covers data on vacancies, wages, payrolled employees (from HMRC ‘real time information’) and new ‘experimental’ estimates of employment, unemployment and economic inactivity.

Overall, today’s figures look suspiciously like those published last month – with the new experimental estimates all exactly the same as those published in October, and estimates of payrolled employees and of wage growth also almost unchanged. The impression is of a labour market that is treading water in an economy that isn’t growing either.

Of course things are not exactly the same as last month, and a closer reading has some broadly positive and also negative signs. Most positively, nominal wage growth remains very high – still running at above 7% year-on-year, and growing strongly for both public and private sector employers. Inflation has not fallen as much as we might like, but it has fallen enough to leave pay growth in real terms slightly positive, up by just over 1% on last year. However it does also look like pay growth has now peaked and will likely start to fall, and even with recent improvements in real pay we are earning barely any more than we did back in 2008.

Vacancy data also presents a mixed picture, with vacancies continuing to fall back but remaining well above pre-pandemic levels. Our view is that recent falls are likely more reflective of the labour market starting to function a bit more normally – fewer people moving jobs, fewer leaving the labour market, more competition for vacancies – than of a general slowdown in demand, although there are definitely some signs of things slowing down too. These signs are perhaps most pronounced in the PAYE data on employees by age and industry, which point to recent falls in the number of young people in work, and in employment in hospitality and construction – all of which tend to be warning signs that demand is weakening.

Looking ahead to next week’s Autumn Statement then, there is enough in today’s data – and in previous releases which included findings from the Labour Force Survey – to suggest that we should be doing more to boost labour and skills supply, which in turn could help meet shortages, support economic growth, raise living standards and control inflation. We set out at the end of the briefing the need for action in three areas next week, to:

- Help more people to get into work, particularly by widening access to employment support;

- Reform skills support to allow for more co-investment in flexible, demand-responsive training; and

- Work better with employers – to improve access to advice and support around recruitment, workplace practice and employee support, and to expect more from employers in return.

Download the paper here.

Sector Response

The Chancellor of Exchequer, Jeremy Hunt said:

“It’s heartening to see inflation falling and real wages growing, keeping more money in people’s pockets.

“Building on the labour market reforms in Spring, the Autumn Statement will set out my plans to get people back into work and deliver growth for the UK.”

Secretary of State for Work and Pensions, Mel Stride MP said:

“We are leaving no stone unturned to help people into work, with a record number of employees on payrolls – up nearly 400,000 in the last year alone with 3.9 million more people in work than in 2010.

“With our ambitious welfare reforms, including the expansion of free childcare and extra support for people with health conditions, we are taking long term decisions that will grow the economy and change lives for the better.”

TUC General Secretary Paul Nowak said:

“Our economy is in the relegation zone.

“Unemployment remains 225,000 higher than a year ago with vacancies continuing to decline.

“Working people are far worse off than they were when the Conservatives took office.

“If pay packets had been growing at pre-crisis levels, workers would be on average nearly £15,000 better off. And across parts of the economy, real wages are still shrinking.

“The Conservatives’ economic mismanagement is costing people their jobs and livelihoods.It’s time for change.”

Neil Carberry, REC Chief Executive, said:

“These figures are a further sign demand in the labour market – while much softer than a year ago – remains resilient. Vacancies remain higher than pre-pandemic. But the overall picture is more nuanced than a year ago, with temporary work and sectors like hospitality and healthcare doing better than permanent roles, and jobs in IT and construction. Pay is still rising – but this is now being driven by pay awards designed by employers to help staff facing rising prices, not labour market competition for staff.

“Our stubborn economic inactivity rate shows why the Autumn Statement must deliver on welfare to work if we are to encourage more people to enter or re-enter the jobs market. Extending successful programmes like Restart would make sense.

“The labour market is just marking time waiting for economic growth to return. Let’s have a plan from the Chancellor next week to get economic growth going, which will get more employers back into hiring.”

Stephen Evans, chief executive at Learning and Work Institute, said:

“The ONS has again released a limited set of data due to low survey response rates, making it difficult to assess the current picture. But most signals point towards a flattening labour market, with vacancies continuing to fall and most measures of employment little changed. Real earnings are growing again as inflation falls, but fastest in sectors like finance and still £12,000 lower than if pre-financial crisis trends had continued. The big picture remains of weak growth in the economy and real earnings, with employment historically high but wide gaps between groups and areas. That’s the backdrop for the Chancellor’s Autumn Statement.”

Tony Wilson, Director at the Institute for Employment Studies said:

“The labour market is continuing to cool, with vacancies now down by a quarter of a million over the last year and by sixty thousand in the most recent quarter. The latest payroll data also suggest that employment for young people is falling, by around 30,000 in the last quarter, and in industries more sensitive to a slowdown like hospitality and construction. So far, this slowdown isn’t feeding through into significantly higher unemployment, with many people still outside the labour force entirely and continued shortages in some parts of the economy helping to keep pay growth at close to 8%. Looking ahead to the Autumn Statement next week then, with economic growth flat and employment still well below pre-pandemic levels, there is a clear need to do more to try to boost employment and support growth. This should include extending access to employment programmes like Restart for the two million people who are outside the labour force and want to work, as well as reforming the Apprenticeships levy to allow more flexible, shorter-term help to support reskilling.”

Jack Kennedy, Senior Economist at the global hiring and matching platform, Indeed, commented:

‘The UK labour market continues to soften. Vacancies fell by 58,000 to 957,000 in the three months to October, down for a sixteenth consecutive period.

The latest ONS experimental figures suggest the unemployment rate was unchanged at 4.2%, while the employment rate dipped slightly to 75.7%. The inactivity rate was stable at 20.9% and remains above pre-pandemic levels.

Regular pay growth dipped to 7.7% year-on-year in the three months to September, down from a peak of 7.9%, though remains elevated. Workers are belatedly seeing their wages rise in real terms, at 1.3% year-on-year. A further substantial fall in consumer price inflation is expected to have occurred in October, perhaps below 5%, which will deliver a further boost to the value of pay packets.

The questionable veracity of the ONS figures derived from the Labour Force Survey means it’s hard to confidently assess how fast the labour market is rebalancing, particularly on the labour supply side. But there are reasons to believe, as the Monetary Policy Committee does, that wage growth will prove fairly persistent into next year.

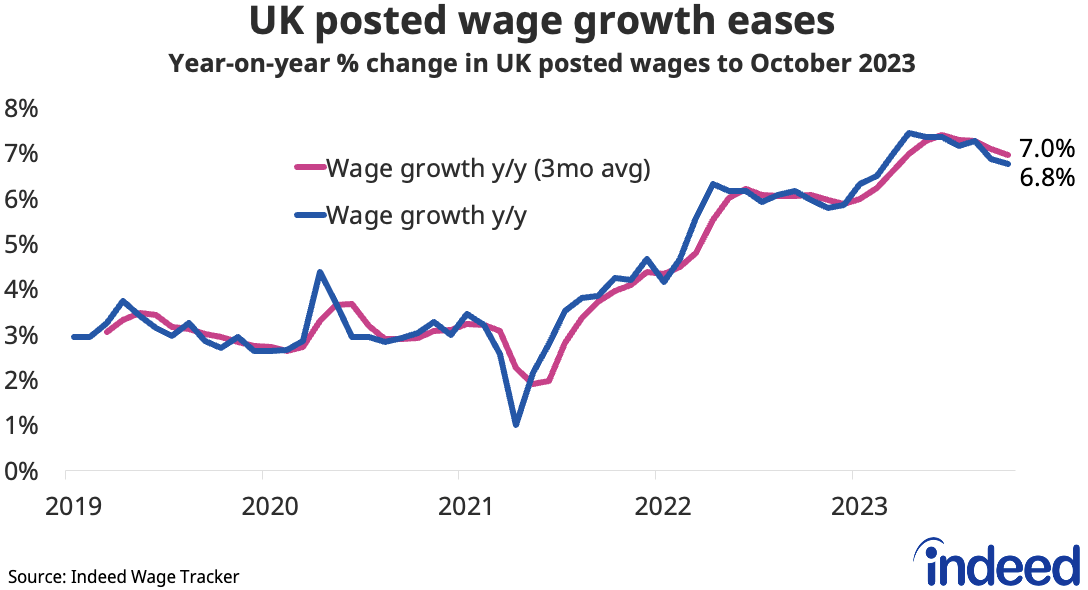

The Indeed Wage Tracker, based on posted wages for new hires, edged down to a six-month low of 7.0% year-on-year in October, from 7.1% in September. Wage growth remains high though in a range of predominantly lower-paid occupations including hospitality, manufacturing, distribution, cleaning and childcare.

This reflects lower jobseeker interest in those categories versus pre-pandemic, while Brexit has added to hiring challenges. Moreover, the Chancellor has committed to at least a 5.6% rise in the national living wage next April.’

Ben Harrison, Director of the Work Foundation at Lancaster University, said:

“Today’s limited data release indicates pay growth is tracking above inflation at 7.7% but we shouldn’t get carried away.

“Real pay growth may be at its highest level for two years, but regular wages have only risen by 1.3% on the year. Insecure and low paid workers are still struggling to make ends meet – our recent research with the Chartered Management Institute shows almost half of insecure workers couldn’t pay an unexpected bill of £300 if it was due within the next seven days.

“While the number of vacancies has fallen to 957,000, which remains well above pre-pandemic levels, experimental estimates for economic inactivity suggest it has remained stable at 20.9%. However, without data for long-term sickness – which was at a record 2.6 million when last reported in September 2023 – we are missing a vital part of the jigsaw.

“With so much uncertainty surrounding the true picture of the labour market, it’s critical that the Chancellor confirms that welfare payments will be uprated next year in line with inflation. And he should resist calls to further increase benefit sanctions on some of the most vulnerable people in society – which the Government’s own research suggests does not result in more people moving into work.

“Instead, the focus should be on improving the quality of jobs available and providing more tailored support for jobseekers with different needs.”

James Reed, Chairman, Reed.co.uk, comments:

“Examining Reed.co.uk’s data for October, it’s evident that the pace of salary growth is showing signs of moderation compared to earlier months in 2023. With a year-on-year increase of 5.3 percent, October represents the second slowest growth this year.

“Looking at the year as a whole, the figures reveal a gradual decline in the rate of salary increase. Comparing the latest data to earlier months, such as March with a 7.7 percent increase, and May with a 6.8 percent increase, it’s clear that the momentum has tempered.

“Although this is not the case for all industries. Examining sector-specific trends, the retail sector stands out with an inflation busting 13 percent year-on-year increase in salaries. This is possibly a response to intense staffing pressures in the run-up to Christmas, as demand for festive workers outstrips supply.”

Responses