Spring Statement and is the Chancellor committing to reviewing apprenticeships? Sector Reaction

The Chancellor has delivered the Spring Statement in Parliament today (23 Mar).

The Chancellor highlighted that UK employers are spending just half the European average on training their employees, the Chancellor said he will examine how the tax system – including the operation of the Apprenticeship Levy – can be used to encourage employers to invest in adult training.

Chancellor announces tax cut for nearly 30 million UK workers through rise in National Insurance thresholds – saving the typical employee over £330 in the year from July.

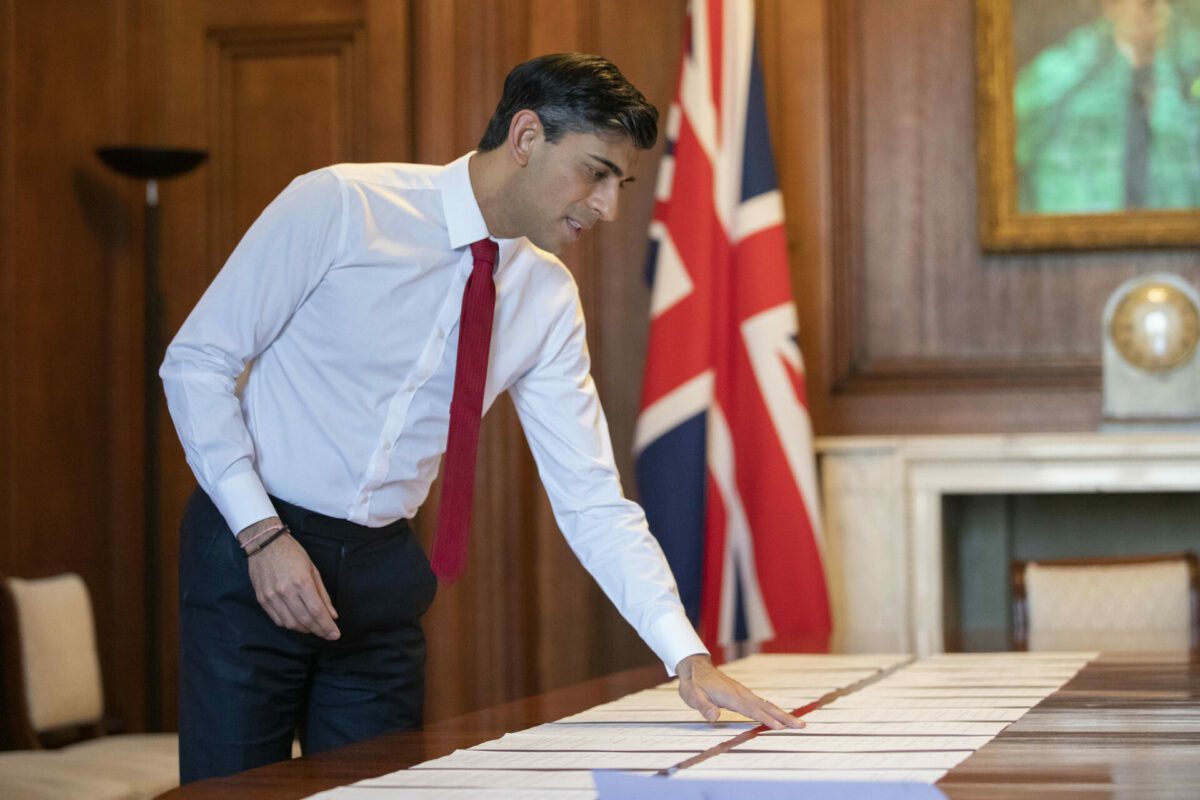

Unveiling a Tax Plan to give families further help with the cost of living, Rishi Sunak reduces fuel duty on petrol and diesel by 5p per litre for the next year – and announces a £5 billion income tax cut from 2024.

Spring Statement also sets out measures to boost investment, innovation, and growth – including a £1,000 increase to Employment Allowance to benefit around half a million SMEs.

Rishi Sunak announced that National Insurance starting thresholds will rise to £12,570 from July, meaning hard-working people across the UK will keep more of what they earn before they start paying personal taxes.

The cut, worth over £6 billion, will benefit almost 30 million working people with a typical employee saving over £330 in the year from July. This means the UK now has some of the most generous tax thresholds in the world.

The Chancellor also announced that the basic rate of income tax will also be cut by 1p in the pound in 2024, when the OBR expect inflation to be back under control, debt falling sustainably and the economy growing. The cut is worth £5 billion for workers, savers and pensioners and will be the first cut to the basic rate in 16 years.

The Chancellor also set out a series of measures to help businesses boost investment, innovation, and growth – including a £1,000 increase to Employment Allowance to benefit around half a million smaller firms.

Delivering the Spring Statement, Chancellor Rishi Sunak said:

“This statement puts billions back into the pockets of people across the UK and delivers the biggest net cut to personal taxes in over a quarter of a century.

“Like our actions against Russia, I have been able to do this because of our strong economy and the difficult but responsible decisions I have had to make to rebuild our finances following the pandemic.

“Cutting taxes means people have immediate help with the rising cost of living, businesses have better conditions to invest and grow tomorrow, and people keep more of what they earn for years to come.”

Delivering the statement, the Chancellor made clear that our sanctions against Russia will not be cost-free for people at home, and that Putin’s invasion presents a risk to our economic recovery – as it does to countries all around the world.

Chancellor to examine the operation of the Apprenticeship Levy between now and the Autumn

Ahead of the end of the super-deduction, the government will work with businesses and other stakeholders to consider cuts and reforms to best support future investment. And with UK employers spending just half the European average on training their employees, the Chancellor said he will examine how the tax system – including the operation of the Apprenticeship Levy – can be used to encourage employers to invest in adult training.

The Chancellor highlighted that just 18% of 25-64 year olds have vocational qualifications and this is a third lower than the OECD average. He said he will work with businesses over the summer to examine and consider the Apprenticeship Levy and if it invests enough in Skills.

A Government spokesperson said:

“There will not be a formal review of the Apprenticeship Levy or system. We are committed to protecting the quality of apprenticeship training and improving the system to respond to the legitimate concerns raised by employers. We will ensure that apprenticeships continue to meet the needs of employers.”

Sector Reaction to the Spring Statement

Jane Hickie, AELP Chief Executive, on today’s Apprenticeship Levy announcement during the Chancellor’s Spring Statement:

“Ahead of the Spring Statement, we asked the Chancellor to use this as a chance to maximise jobs and skills. We look forward to seeing more details about the government’s plans to boost training investment and productivity rates by reforming the apprenticeship levy. However, we would strongly advise that levy funding should remain ringfenced for training and assessment only.

“Like everybody else, employers and training providers face rising costs over the coming months. Training providers will be disappointed there is little in today’s statement that offers the support they need”.

Tom Bewick, CEO of The Federation of Awarding Bodies (FAB) said:

“It looks like Rishi Sunak decided in the end to turn this annual financial update to the House of Commons into a mini-Budget, with a number of high-profile tax changes and some welcome announcements to support employment and skills.

“First of all, the equalisation of the NICs threshold with income tax, including the one penny cut in the basic rate to 19%, will make the employment of young people, apprentices and lower-paid workers more attractive in future. Of course, it will also help those workers with the cost of living too.

“The most welcome announcement from our point of view is the commitment by the Treasury to review the operation of the Apprenticeship Levy. Changes will be announced at the autumn statement.

“The brutal fact is that this payroll tax, levied on just 2% of British companies, has not delivered on its original policy goals because we have fewer people and companies, overall, engaged in apprenticeships than we did in prior to 2017. This is something the Federation and some of our members have been consistently campaigning on for years.

“We look forward therefore to making positive proposals to the government of how to improve the operation of the Levy, but crucially, to bring an end to the decline in employer investment in training which has halved over the past decade. As the chancellor himself pointed out, in the area of vocational technical qualifications, we are a third below the OECD average for workers with these skills; and UK firms invest about half the average of European counterparts. This has to change if we are genuinely serious as a country of building a world-class skills and technical education system by 2030.”

Kirstie Donnelly MBE, CEO City & Guilds said:

“We were cautiously optimistic to hear Government state in their budget announcement today that they will review the apprenticeship levy in the months ahead. This must happen if we are to drive up employer engagement in the system and ensure more people are able to benefit from apprenticeships in the future.

“We highlighted in our 2018 research with the CBI, Flex for Success?, that employers wanted greater flexibility in how they are able to spend their levy to allow them to better meet their skills needs – but two and a half years later this still hasn’t happened. The fact that the current system is not working for employers is undoubtedly contributing to the UK continuing to have far lower investment in workplace skills than many of our European counterparts.

“We’ve also shown in this year’s Great Jobs research that workers are crying out for training, saying that a lack of relevant skills is one of the main things stopping them from considering roles in many industries with skills shortages.

“To increase employer engagement and support workers, we have proposed that a broader skills levy should be introduced where employers pay more in (and /or more employers contribute) and are then able to spend funds on a broader selection of workforce training but with a percentage of funds ringfenced for apprenticeships to ensure that opportunities for people to ‘level up’ are not lost.”

The Lifelong Education Commission welcomes the Chancellor’s plan to revisit how the UK tax system can best incentivise employers to invest in adult education:

“We especially support the proposal to scrutinise the role of the Apprenticeship Levy, which as it stands is failing to meet the needs for which it was set up.

“The Apprenticeship Levy suffers from a severe lack of transparency: how much of the total take is underspent, and how much is recycled into the system. It has also moved quite far from its original intent. Rather than helping young people get a foothold in their desired careers, it is increasingly being used to support those already in the workforce upskilling through ‘in-work’ qualifications, including degree apprenticeships. These are also increasingly in non-technical skills such as leadership and management, which is fairly removed from the core vocational mission that apprenticeships are meant to represent.

“We believe that the Apprenticeship Levy needs to be overhauled, which includes making it a joined-up policy shared between HM Treasury and the Department for Education, under the auspices of the Apprenticeships and Skills Minister. In addition, a clear system of skills tax credits, modelled on the system of R&D relief, should be implemented to support wider in-work training. That way, the Apprenticeship Levy can be focused clearly and exclusively on the task of bringing young people into the world of work.”

Ben Harrison, Director of the Work Foundation, a leading think tank for improving work in the UK:

“The Spring Statement is unlikely to support those who need it most during the cost of living crisis.

“While a raising of the NICs threshold is welcome, overall the measures announced today will not provide economic security to the millions struggling to make ends meet in 2022. And the promise of tax cuts to come in 2024 will do little to reassure low income workers who are today already having to make compromises on day to day essentials including food and heating.

“The priority for the Spring Statement should have been ensuring Universal Credit would rise in line with inflation, to protect those most vulnerable to rising food, clothing and energy prices. In the absence of this, many more working families are likely to face hardship over the months to come.”

Steve Collinson, Chief HR Officer for Zurich UK comments on the the Government committing to reviewing apprenticeships:

“We welcome the Government’s commitment to reviewing the Apprenticeship Levy. As a major UK employer, we have an established apprenticeship programme and continue to upskill our employees across the board as we shift towards a more digital economy. The current framework needs to incorporate more flexibility so that organisations can use more of the funding to reskill employees into new roles via different training routes and a broader choice of courses. Current restrictions mean employees can only benefit from training in their current role, which is a barrier to growth opportunities. Given skills shortages in areas such as data and automation, added flexibility in the levy makes sense for everyone.”

Simon Carter, Director at RM:

“After two years of economic turmoil, it looks as though the UK Government sees now as a time to batten down the hatches and ride out the financial storm. And while it won’t come as good news to many, there are some positives to take away from Rishi’s stoic response today.

“With everyone suffering from higher costs – whether that is energy bills, staff salaries, or simply the cost of materials – the Chancellor was simply not in a position to hand out windfalls in today’s Budget announcement – no matter how much individual groups demanded it. For the education sector, whilst there is no new money announced, there will be people very relieved that the Government has not gone back on its committed £55bn investment in our schools and other education institutions.

“While there’ll almost certainly be a pinch in the short term, there’s no question that the country’s future prosperity will come from ensuring our leaders of tomorrow receive the very best education today. Only by making high-quality education a constant for everyone, and making schools and colleges increasingly equitable, can employment and social mobility improve for the betterment of the country’s economy.”

Ben Hansford, Chief Operating Officer, Apprenticeship at Firebrand Training argues that the Chancellor should leave the Apprenticeship Levy alone:

“While it’s good to hear the government acknowledge the skills gap and productivity crisis in the UK and the role that apprenticeships can play, further meddling in the Apprenticeship Levy will not help to close this. “Apprenticeships work well and are popular for both learners and employers. With apprenticeships lasting from 12-36 months, the Levy is currently working well for employers that pay it and can help them to plan ahead for their longer term skills needs. However employers have skills gaps today that need to be addressed more urgently. For this there are a range of initiatives, such as the recent Skills Bootcamps and paid for commercial training, that address these shorter term skills needs. “Many groups like the Confederation of British Industry (CBI) have been lobbying for more flexibility around what, other than apprenticeships, the Levy can be spent on, the government needs to be careful how flexible they make the Levy. Too much flexibility can cut into the recovering apprenticeship numbers and, in turn, affect the progress being made to close the skills gap and address the productivity crisis which would be detrimental to the UK economy.”

Alice Barnard, Chief Executive of Edge Foundation:

“We’re pleased the Chancellor acknowledged the importance of vocational skills in the spring statement, including a commitment to review the apprenticeship levy.

“The UK currently faces a significant skills shortages gap, costing the economy an eye-watering £6.1 billion per year. Apprenticeships have a key role to play in delivering the skills this economy needs.

“However, our report ‘The benefits of hindsight’ found the levy has in some cases incentivised employers to train existing staff at the expense of younger learners. It’s time we think again about the levy, and to refocus it towards young people, SMEs, and on high quality routes into apprenticeships.”

Ben Blackledge, WorldSkills UK Deputy CEO said:

“It is good to see people and skills at the heart of the Government’s plans to rebuild our economy. We know from benchmarking the UK’s skills with other countries that we are not as competitive as we should be.

“Industries are changing rapidly and, as the Chancellor highlighted today, we are already falling behind other countries in developing the skills that we need. We have to build a system that keeps pace, rewards innovation and is ready for the challenges of tomorrow.

“Our research into skills gaps found that 60% of firms expect their reliance on advanced digital skills to increase by 2026, while 41% said advanced digital skills help them innovate, improve productivity and grow their business.

“We welcome plans to boost business investment in training so employers and inward investors can access the skills they will need to innovate and grow, and so young people can access the training they need to thrive.

“As the international arm of the UK skills sector, WorldSkills UK is bringing our unique knowledge of world-class standards and international best practice to support the development and promotion of a UK skills system that is truly world-class.

“Our Skills Taskforce for Global Britain is convinced that a responsive skills system is particularly important in attracting inward investment and being internationally competitive. Next month the taskforce will set out how the UK must develop a world-class skills economy needed to drive thriving sectors such as tech, advanced manufacturing and life sciences.”

Mary Pooley, NCFE Director of Strategy, Policy and Insight:

“The impact of COVID, the ongoing situation in Ukraine and the current energy crisis means that people in the UK are set to face a challenging period. We welcome the measures the Government have put in place to support levelling up and greater investment in skills, and we encourage people to take full advantage of the wide array of options available for retraining and upskilling. A central tenet of the Levelling Up White Paper’s ambitions was to use education as a lever to create prosperity. We support this mission and believe that skills and technical education are an essential mechanism to achieve increased prosperity.

“The Apprenticeship Levy is a critical part of the Apprenticeship system, and for some time NCFE has called for reform. Since its creation, there have been fewer apprenticeship opportunities for 16–18-year-olds, and this issue needs to be addressed.

“Apprenticeships are perfect to bridge the gap between education and employment, and it’s pivotal that they are used to open doors for those who might not otherwise have access to opportunities with the potential to change lives. As part of the Government’s review, they should consider implementing a ringfenced, government funded budget for this age group, to ensure that there is a viable apprenticeship route available alongside A Levels and T Levels”

Anthony Painter, Director of Policy at the Chartered Management Institute said:

“The Chancellor’s argument for investment in People, Capital and Ideas is important, and we support his review into the operation of the Apprenticeship Levy. Helping SMEs and others access all-levels, all-age training provision is vital to their growth. Going forwards, further tax and other financial incentives for businesses and employees will be needed to support high-quality, productivity-enhancing training provision, in the skills the country will need for the future. We also look forward to exploring how the Government’s various skills and training policies, like the Lifelong Loan Entitlement, will be coordinated to deliver impact greater than the sum of their parts.

“In the Plan for Growth, the Innovation Strategy, the Net Zero strategy and the Levelling Up White Paper, this Government has highlighted the key contribution that management and leadership skills make to the economy, society and the environment, through encouraging innovative practices, spreading technical skills throughout the workforce, boosting tech adoption, and addressing inequality between places. Because of the centrality of future managers to seeing these agendas bloom, CMI believes that now is the time for the Government to consider a new cross-governmental, whole UK approach to developing the UK’s leadership and management capability. Such a strategy would underpin the ‘people’ element of the long-term plan for innovation and enterprise.”

Commenting on the Chancellor’s spring statement, Geoff Barton, General Secretary of the Association of School and College Leaders, said:

“We are disappointed that the Chancellor failed to address the financial pressures facing the education system amidst soaring inflation, and the fact that many experienced teachers and leaders will see the real value of their pay fall under the government’s current pay proposals.

“Schools are reporting huge increases in their energy bills and the government expects them to fund pay awards out of these stretched budgets too. We are gravely concerned that they are facing a fresh funding crisis. This is compounded by the inadequacy of the proposed pay award for many staff which comes after a pay freeze and is likely to worsen retention rates.”

Andrew Baldwin, Head of Public Affairs at Association for Project Management (APM), the chartered membership organisation for the project profession, said:

“We welcome the Chancellor’s announcements today recognising the importance of skills development and training. We will wait to see the specifics, but know that much more needs to be done to support project management skills specifically.

“Our research shows that 75% of project professionals feel there needs to be greater professionalisation of project skills in their sector and over a third feel the skills shortage faced by the profession has not improved over the past five years.

“We also call on the government and business leaders to invest in developing not only their dedicated project specialists but also to professionalise the ‘accidental project managers’ who may not identify as project professionals but who are nevertheless delivering projects as part of their role. Systemic training for all will support more effective delivery of existing and future projects.”

Hannah Birch, Managing Director Europe at end-to-end managed services provider Ensono, commented:

“This is a Spring Statement that is laser focused on the future of the UK economy. By stepping up its investment in skills and training, the government is providing vital assistance to drive innovation across UK businesses in the years ahead. As we continue to experience an ongoing talent shortage – particularly in the tech sector – better training and skills opportunities will build a stronger talent pipeline, helping to alleviate the skills shortage in the long term.

“As part of this investment in skills, it’s great to see the government take steps to encourage more organisations to launch apprenticeship schemes, streamlining the process as much as possible. As an alternative to university education, apprenticeships broaden the number of possible educational paths into different sectors, enabling a wider pool of candidates to pursue their chosen career. At Ensono we’ve seen the benefits of apprenticeships first-hand, with individuals bringing value through fresh perspectives and varied life experiences.”

Kevin Hanegan, Chief Learning Officer at Qlik

“In the Budget, the Chancellor cited the deficit of UK technical skills and how UK employers spend just half the EU average on training their employees. Unfortunately this comes as no great surprise. Research from Qlik revealed the most commonly held belief among British business leaders is that it is an individual’s responsibility, over that of their current employer or educational institutions, to prepare themselves with the skills for the future workplace.

“This is despite 81% of C-level execs expecting that the skills requirement within their organisation will change significantly in the move towards the digital and data-led workplace, impacting the employability of those without these key skills. For example, 88% believe employees without data literacy – the skill predicted by employees and business leaders alike to be the most in-demand skill by 2030 – will be left behind in the future workplace.

“And this isn’t just a problem for the economy. This lack of skills investment will have a very real impact on workplace inequity. 76% of British C-level execs recognise the shift will put certain groups at risk of being left behind. Three quarters of whom believe working parents, neurodiverse employees and younger professionals that don’t have the same level of education as others on the global talent market are among the greatest at risk.

“More must be done to close this skills gap. UK employers are not yet doing enough to prepare their workforce with the digital and data literacy needed to succeed in the years to come. It is time for the Government to step in and ensure this skills gap is closed.”

Dr Patrick Roach, General Secretary of the NASUWT-The Teachers’ Union, said:

“Our members were looking to the Chancellor today to signal he recognises and is prepared to take the necessary measures to help alleviate the growing financial pressures they are facing.

“While the announcements about fuel duty and National Insurance will offer some modest assistance, our members are still facing a deepening crisis in making ends meet and there was little in today’s statement that will offer them much comfort or reassurance.

“Our most recent research shows that two thirds of teachers are ‘somewhat worried’ about their financial situation and 22% are ‘very worried’.

“Over half of teachers reported having to cut back their expenditure on food during 2021, with some having to resort to using food banks or other forms of charitable assistance. Four in ten reported having to cut back their expenditure on essential household items and 12% have taken a second job.

“With inflation now rising at its fastest level in 30 years, teachers need a pay award for 2022/23 which will both meet the current cost of living pressures and which will begin to tackle the 19% real-terms erosion of their salaries they have endured since 2010.

“The Chancellor claimed the Government will stand by families over the cost of living. For too long teachers have been abandoned by this Government, with a failure to invest in them or provide working conditions which support their wellbeing or work/life balance.

“The decision on the forthcoming pay award will be the litmus test of whether there is any reality behind the Chancellor’s rhetoric.”

Paul Whiteman, general secretary of school leaders’ union NAHT, said:

“It is extremely disappointing that the Chancellor has once again ignored the serious financial challenges facing schools within his spring statement. Like every household and business, schools are facing crippling rises in energy costs, to be funded from already stretched budgets. Every pound diverted to pay for increased energy bills is a pound that can’t be spent on children’s learning.”

Naomi Phillips, Deputy Chief Executive and Director of Policy and Research at Learning and Work Institute said:

“We welcome the Chancellor’s focus on business investment in innovation and skills. Our research shows that employer investment in skills has fallen over the last decade, and too often the Government’s support for employer training has reinforced existing inequalities in access and opportunity, rather than tackling them. The review announced today needs to address these imbalances both for people and places through major reforms, including to the apprenticeship levy.

“In terms of the labour market, the Government continues to ask the wrong question and has not meaningfully addressed the growth in economic inactivity in older workers, disabled people and people with long-term health conditions. More support is needed for people who have fallen out of the workforce who can return but need to retrain or reskill. Overall, today’s measures don’t do enough to help people who are out of work to weather the cost of living crisis.”

Amy Norman, Senior Researcher at the SMF, said:

“Apprenticeship numbers have been slipping for years now and the picture is particularly bleak for young people, with the proportion of under-19s starting apprenticeships falling by almost half since 2016/17. A good idea is being implemented poorly.

The Apprenticeship Levy has faced challenges since its introduction five years ago, so it is welcome to see the Chancellor recognise this by promising a review. Building greater flexibility into apprenticeships and how businesses can use Levy funds should be a cornerstone of reform.”

“Employer investment in skills and training is a key piece of solving Britain’s on-going productivity puzzle. Reforming the “Apprenticeship Levy is an opportunity to address skills gaps, help young people into work, and boost the productivity of British businesses.”

James Lloyd-Townshend, Chairman and CEO at Revolent

“People are in desperate need of government support and while today’s measures offer a glimmer of hope to some, without further protection against rising costs a large percentage of the population are going to be forced into making drastic decisions about their future. For some it’ll be a case of cancelling day-to-day luxuries, which will have a massive impact on businesses across the country, putting further strain on them as they continue to recover from the effects of the pandemic. For others, it’ll be looking at how they can increase their income, and that means drastic career decisions.

“That’s great news for industries like tech that are already facing a critical skills shortage and are in desperate need of additional manpower—it’s an area of work that offers a lucrative salary in a relatively stable and high-growth sector—but the knock-on effect for other industries as people desert existing careers in order to simply survive, could be catastrophic for the UK.

“The government needs to act properly to ensure that people are equipped to take advantage of upskilling programmes based on a genuine desire to retrain, rather than making panicked decisions while trying to make ends meet. Without it, they’ll leave more gaps across the UK’s workforce that need to be filled, and strangle economic growth as we look for further ways to tackle this.”

National Union of Students UK President Larissa Kennedy commented:

“The Chancellor’s Spring Statement is a disgrace for students, young people and graduates. This was a moment where students desperately needed a lifeline from this Government; instead this is a nail in the coffin.

“Students are paying hundreds of pounds extra in energy bills, relying on foodbanks thanks to soaring inflation, and being forced to choose between heating and eating. Instead of addressing these issues, today’s announcements saw the Government say that they will be taking an extra £35 billion from graduates thanks to their student loan changes over the next five years.

“Today’s statement was steeped in calculated cruelness. With the cost-of-living crisis getting worse, the Chancellor could have used today as a chance to show he has listened to our experiences. He could have introduced rent protections, offered basic levels of maintenance support, and reversed his plans to cut the student loan repayment threshold. This would have protected the most vulnerable students – so it’s no surprise the Government ignored us.

“Students from across the UK are desperate for something radically different – that’s why thousands joined the Student Strike earlier this month. As the Chancellor continues to fail students and apply sticking plasters to the current marketised system, it exposes just how broken the profit-driven model is. The Government needs to finally commit to a new vision for education, which is fully funded, lifelong and accessible for all”.

Camellia Chan, CEO and Founder at X-PHY, a Flexxon brand comments on the UK’s commitment to R&D:

“It is welcome news that today’s Spring Statement made good on its promise to support business innovation, by reforming R&D tax credits so they are more effective. This will help businesses contribute to the government’s Innovation Strategy and empower the UK to become a ‘science superpower’, as it champions emerging technologies such as AI. This is a potentially big deal, not just for the UK, but the rest of the world too, as this level of investment drives competition and innovation forward.

“The Innovation Strategy seeks to harness technology and foster an innovative business landscape. A workforce of diverse and skilled workers is needed to fulfil these ambitions for the UK. This is particularly necessary for the cybersecurity industry, in which there is a significant shortage of talent. The government must invest in skills training and education to make sure the country’s R&D plans succeed. Nurturing and investing in local talent is fundamental to closing the skills gap. In Singapore, we have initiatives from Enterprise Singapore and the Workforce Singapore Agency talent matching efforts, for example. The UK government understands how important R&D is for the health of the economy and must realise how valuable technology talent has become.”

SJ Boulton, Global Curriculum Lead at Labster comments on the lack of announcements around education:

“It was disappointing to hear so little on increasing investment for the education sector today. The impact of the pandemic is still being felt by schools and students across the country, and so we need to ensure future leaders can access education and training that inspires them. Education has experienced the start of a technology revolution, with the switch to virtual and hybrid learning methods. However, the attainment gap has widened at the same time. As a result, we need to be seeing an increase in government funding to prevent the skills gap from widening further. Investment in education technology can help plug the gap, if embraced at a national level. The benefits of virtual learning – especially when combined with classroom teaching from our excellent teachers in the UK – provide an opportunity to bridge the skills gap, future-proof learning, and empower educators, businesses and individuals by opening the door to high-quality education, wherever they are.”

Dr Arianna Giovannini, interim director of IPPR North said:

“This Spring Statement was the Chancellor’s opportunity to put public money where government’s mouth is. But he seriously missed the mark and failed to announce the substantial measures needed to support people on the lowest incomes, and level up the UK. This puts at risk the credibility of the government’s flagship levelling up agenda – which barely featured in the Chancellor’s speech – with real, dramatic consequences for people’s lives.

“People in the North will now rightly begin to question whether the government is serious about its pledge to raise prosperity and close regional divides. The growing chasm between rhetoric and reality is all too familiar to us.

“The only way to change this is for the Chancellor to return to Parliament and deliver a concrete investment plan now, alongside a set of targeted policies that improve people’s lives, to show that the levelling up agenda is not just another empty promise.”

On energy, Jonathan Webb, a senior research fellow at IPPR North said:

“Over one million households in the north of England are currently experiencing fuel poverty. With energy costs set to rise further next month, this number is only going to grow. The Spring Statement has simply not gone far enough.

“The government can and must make it affordable for people to heat their homes right now. This means providing more immediate, direct financial support that covers the cost of energy increases and avoids asking for money back at a later date.

“An ambitious programme of housing retrofit, combined with greater financial support to help low-income households to install options like heat pumps, is essential to prevent further energy crises, protect families, and the planet in the future. This must go further than the promised VAT cuts for energy efficiency measures, which won’t create a significant incentive for low-income households and will do little to help those that do not own their own home and are reliant on their landlord to improve their property”.

On the cost of living, Erica Roscoe, a senior research fellow at IPPR North said:

“Across the North we’ve seen in work poverty increase over the last decade and we now find ourselves facing the most significant cost of living crisis in a generation which is inevitably going to see the 3.5 million people across the North fall deeper into poverty despite being in work, alongside thousands more as prices increase while wages remain the same.

“The Chancellor had the opportunity today to support those on the lowest incomes – people who are going to be hit the hardest by this crisis – by using our social security system effectively and he has chosen not to do so. Those on the lowest incomes need to be offered support most urgently through measures like re-instating the Universal Credit uplift and increasing the value and eligibility of support for those hardest hit”.

Rachel King, Director, Breathe, commented:

“With the forecasted cost of living increase set to apply more pressure on an already financially strained population, businesses must recognise the upcoming burdens and support their people through the shift. People want and expect more from their employers, and now more than ever staff will vote with their feet if a company doesn’t suit them or respect their needs and boundaries.

“As costs are set to rise, firms should look beyond the basic salary offering and examine current benefits packages, too, to ensure they still add value to the lives of UK workers and are fit for purpose. Flexible working arrangements, for example, should be offered as standard if businesses hope to retain their best people. Otherwise, it’s very likely we’ll see more reshuffling and resignations as we move further into 2022.”

Dr Mary Bousted, Joint General Secretary of the National Education Union, said:

“If the Government is serious about protecting living standards and building a strong economy, it must reverse the real terms cuts to teacher pay. Instead, with RPI inflation reaching 8.2% and in the midst of the worst cost-of-living crisis in decades, the Government plans yet more real terms pay cuts for teachers.

“The Government plans pay increases for most school teachers of only 3% in September 2022 and 2% in September 2023. These paltry increases are well below current and expected inflation, so teachers face another big pay cut in real terms following the long period of pay cuts dating back to 2010. With inflation so high, the impact of this year’s pay cut on living standards could be even worse than last year’s teacher pay freeze. Teachers and lecturers in post-16 settings, and other educators including support staff and supply teachers, also face huge cuts to the real value of their pay against inflation.

“Enough is enough. More pay cuts will increase the already serious teacher recruitment and retention problems that are clearly impacting negatively on children and young people’s education. The Government’s plan to inflict more real terms pay cuts is a damaging and dogmatic political choice.

“The Chancellor’s refusal to increase education funding in the face of this inflation surge signals a return to the austerity of the 2010s. The real-terms growth rate for the Spending Review period (2022-23 to 2024-25) was 2% a year on previous inflation assumptions – already lower than the previous Spending Round. The Institute for Fiscal Studies estimated recently that at least a quarter of the real terms increase in spending will be wiped out through inflation. The higher inflation goes the more will be lost. The Chancellor has missed an opportunity to protect our children’s futures.”

Ashwini Bakshi, managing director of Europe and Sub-Saharan Africa at Project Management Institute (PMI)

“Above all, we hope to see a lifeline given to young people, our next-gen leaders, that are struggling to take their first steps into the world of work. The Prince’s Trust recently found that a quarter of 16-25 year olds worry they don’t have the skills to do the jobs available to them, and over half have lost confidence in their ability since the dawn of the pandemic. For every day we leave this issue untreated, the future of the UK’s workforce – and critical national agendas such as net zero and levelling up – suffers.

“This afternoon, we expect the government to acknowledge the urgency of the skills gap and demonstrate leadership through widescale investment. While it was encouraging to see the government’s skills and post-16 education bill passed last month, this must act as a catalyst for change rather than a box ticked off the list.

“The bottom line is that schools, universities and businesses urgently require learning solutions that can be implemented now to support students and professionals looking to start or rejuvenate their careers over the next 12 months. We must learn from the volatility of the last two years and future-proof UK professionals by embedding agility and adaptability into their profiles and developing their digital, green, and soft skills. By adopting this focus, the government can best position the country to lead globally on today’s complex challenges – from climate change to digital transformation – and deliver meaningful value to individuals, organisations and the communities they are part of.”

Dave Innes, Head of Economics at the Joseph Rowntree Foundation, said:

“Security is only real if it’s for everyone – the choices the Chancellor has made today won’t deliver any security for those at the sharpest end of this crisis, instead he has abandoned many to the threat of destitution.

“The Chancellor has acted recklessly in pressing ahead with a second real-terms cut to benefits in six months, while prioritising people on middle and higher incomes.

“Changes to National Insurance won’t help those who aren’t working or can’t work due to disability, illness or caring responsibilities, and exposes them to an increased risk of becoming destitute. This means they will face regularly going without absolute essentials such as food, energy and basic hygiene products.

“We can’t build a strong or secure economy by weakening the incomes of the poorest. With benefits reaching their lowest level in real terms since 1985, the Chancellor had ample opportunity with his increased headroom to uprate them in line with inflation to protect those most at risk.

“The Household Support Fund is a drop in the ocean when we consider the number of people who will reach crisis point in the coming months, from the pressure of energy bills alone.

“The Chancellor has asked us to judge him on his actions over the past two years, and while some of his previous choices have helped the worst off, he now risks plunging many into destitution.

“Make no mistake – this dire situation will leave millions in despair as a direct consequence of the Chancellor’s irresponsible choices today”.

Grant Glendinning, Executive Principal North and Strategic Lead for Apprenticeships at NCG commented:

“NCG very much welcomes the review of the Apprenticeship Levy, announced in the government’s Spring Statement.

“Whilst the Levy has great intentions to support people into skilled careers, it is currently overly complex and burdensome, freezing out smaller businesses without the resource to support the process. Even those larger employers funding the levy need to utilise the benefit so often that it is often directed to existing employees, rather than to the recruitment and development of new talent.

“The result is that both the number of small businesses and the number of young people accessing apprenticeships have fallen since its inception. This can’t be right – it is counter to Levelling Up and doesn’t contribute to the much-needed recovery of the UK economy.

“What we need is to re-establish a culture of employers investing in varied training again, by offering a more flexible way for levy payers to use their contributions, freeing them up to enable investment in wider training opportunities outside of apprenticeships, which are likely to be more targeted and impactful for existing employees. We also need to see much more effective and straightforward mechanisms developed for levy payers to share unused funds with SMEs which need them.

“The remaining levy should be directed to those who, through apprenticeships, can start meaningful careers. This will breathe life into apprenticeship creation and support employers to develop their own, skilled workforce of the future.”

Ian Forrester, COO of Clearly Drinks commented:

“Following the Spring Statement delivered by the chancellor, Rishi Sunak, a review of The Apprenticeship Levy is likely to be part of a new tax plan set to be finalised in the autumn. Apprenticeships are an integral part of developing future talent and within many industries including manufacturing, getting the right skills can be challenging. In order to plug the skills gap, we very much welcome the proposal of additional support from the Government on apprenticeships to help the sector afford to build talent from the ground up.

“Apprenticeships are a key part of our business strategy which includes our World Class Operator programme, in partnership with Derwentside College, which provides internal training to create highly skilled individuals as well as offering apprentices on-the-job paid experience. Here we are able to offer successful candidates a guaranteed interview, with an opportunity for employment and a competitive salary at Clearly Drinks.

“Not only can apprenticeships help manufacturing businesses continue to grow and develop their current fleet of frontline workers on the production line, but they also help those looking to further their career have a clear progression path and develop transferrable skills. There is some fantastic undiscovered talent out there, and we hope a review of The Apprenticeship Levy will help peers within the sector consider how we can all champion alternative routes into employment.”

Sean Haley, Chair of Sodexo UK & Ireland responds to the spring statement:

“At Sodexo we are so pleased that the Chancellor took time in what was a critical and highly-anticipated spring statement to talk about apprenticeships and the apprenticeship levy.

The themes he picked up on are all areas we have previously identified as opportunities for change.

“As an employer of currently circa 1,000 apprentices, we would welcome the opportunity to accelerate the skills element of the apprenticeship standards to bring faster proficiency in our learners’ on the job activities. This would be particularly valuable for the small businesses and not for profits to which we gift in excess of £300,000 of apprenticeship levy each year, to drive increased productivity. The way employers are allowed to pay training providers is rigid and means that training cannot be flexed to best suit the needs of the learner and the organisation.

“A good example is the training an apprenticeship chef will receive. On average, they will be on an 18-month programme during which they will receive monthly skills training on different core skills such as bakery, butchery and fish preparation. Alongside this, they will receive mentoring and on-the-job training as they move through the course. Given the skills shortage in that sector at present, it would be far better for the levy to be redistributed to allow intensive delivery of the skills training elements upfront and then spend the remainder of the course embedding their knowledge, skills and behaviour (KSB). The current system just does not allow for that. But it should, so we would welcome the Government addressing this.

“We would also like to see the Government enable organisations employing apprentices – particularly smaller businesses and not for profits – to use a set proportion of the levy to not just pay for skills development but also to cover the cost of the tools of the trade those apprentices need. Without these, their ability to achieve the high-quality learning provision we all want them to have is impaired. I am aware of the ongoing debates around this approach and the concerns about the degree to which the system could be open to abuse, however this is something that was made possible for Kick-starters so we do feel it should be available to apprentices.

“Lastly, we like so many other businesses welcomed the extended incentivisation to include all new start apprentice hires – introduced during the pandemic. We would encourage the government to extend this incentivisation along with more guidance to ensure this payment is only used to better the apprenticeship offer, promote hire of new start apprentices and drive quality.

“The comparatively low spend by UK companies on training employees, identified in this spring statement, is concerning. The Levelling Up challenge should be a priority for us all and training is one of the ways we can really begin to address inequalities in communities across the country. Plus, we have huge looming skills gaps which apprentices and the levy could play a significant role in closing. It is incumbent on us all to address this now and support smaller businesses and not for profits to help them address it too.”

Cost of Living

The immediate help for people with the cost of living and support for businesses comes as part of a wider Tax Plan announced by the Chancellor that will also create better conditions for growth and will share proceeds from growth more fairly – ensuring people can keep more of what they earn.

National Insurance thresholds will rise to £12,570

To ease cost of living pressures for almost 30 million employees, the Chancellor announced that from July 2022, National Insurance thresholds will rise to £12,570 to align with the income tax personal allowance. This simplification means that, from July, 70% of workers who pay NICs will pay less of it, even after accounting for the Health and Social Care Levy. Of those who benefit from the threshold increase, 2.2 million people will be taken out of paying NICs altogether.

Basic rate of income tax cut from 2024

The Chancellor also announced plans to cut the basic rate of income tax from 20p to 19p from 2024. The historic £5 billion tax cut for workers, pensioners and savers will be worth £175 on average for 30 million people and will be the first cut to the basic rate in 16 years. This will be delivered in a responsible and affordable way, while continuing to meet our fiscal rules.

Supporting vulnerable families

Mr Sunak also announced that there will be an extra £500 million for the Household Support Fund, which doubles its total amount to £1 billion to support the most vulnerable families with their essentials over the coming months. The Chancellor also reduced the VAT on energy saving materials such as solar panels, heating pumps and roof insulation from 5% to zero for five years, helping families become more energy-efficient.

This cost of living support comes on top of the measures that the Chancellor has already announced over the recent months to support families. This includes a £9 billion energy bill rebate package, worth up to £350 each for around 28 million households, an increase to the National Living Wage, worth £1,000 for full time workers, and a cut to the Universal Credit taper, worth £1,000 for two million families.

Boosting Investment, Innovation and Growth

To lift growth and productivity among UK businesses, Mr Sunak set out plans to boost private sector investment and innovation and bring in a new culture of enterprise.

He increased the Employment Allowance – a relief which allows smaller businesses to reduce their employers National Insurance contributions bills each year – from £4,000 to £5,000. The cut is worth up to £1,000 for half a million smaller businesses and starts in two weeks’ time, on 6 April. As a result, 50,000 of these businesses will be taken out of paying NICs and the Health and Social Care Levy, taking the total number of firms not paying NICs and the Levy to 670,000.

The Chancellor also announced two new business rates reliefs will be brought forward by a year to come into effect in April 2022. There will be no business rates due on a range of green technology used to decarbonise buildings, including solar panels and batteries, whilst eligible heat networks will also receive 100% relief. Together these will save businesses more than £200 million over the next five years.

Chancellor to examine the operation of the Apprenticeship Levy between now and the Autumn

Ahead of the end of the super-deduction, the government will work with businesses and other stakeholders to consider cuts and reforms to best support future investment. And with UK employers spending just half the European average on training their employees, the Chancellor said he will examine how the tax system – including the operation of the Apprenticeship Levy – can be used to encourage employers to invest in adult training.

The Chancellor highlighted that just 18% of 25-64 year olds have vocational qualifications and this is a third lower than the OECD average. He said he will work with businesses over the summer to examine and consider the Apprenticeship Levy and if it invests enough in Skills.

The Chancellor committed to improving R&D reliefs too. UK business R&D investment is less than half of the OECD’s average as a percentage of GDP, so R&D tax reliefs will be reformed to deliver better value for money for the taxpayer while being more generous where they can make the most difference. The scope of reliefs will also be expanded to cover data, cloud computing and pure maths.

The support for SMEs comes on top of 50% business rates relief for eligible retail, hospitality, and leisure properties, also coming in this April and worth £1.7 billion for small businesses. The Help to Grow Management and Digital schemes, worth thousands of pounds per business, and the £1 million Annual Investment Allowance are also available to continue supporting UK businesses.

Further announcements

The Spring Statement also confirms that:

- A new Efficiency and Value for Money Committee will be set up to cut £5.5 billion worth of cross-Whitehall waste – with savings to be used to fund public services.

- £50 million new funding will be provided to create a Public Sector Fraud Authority to hold departments account for their counter-fraud performance and to help them identify, seize and recover fraudsters money.

- Local residents across the UK will benefit from a fresh set of infrastructure projects as we open the second round of the £4.8 billion Levelling Up Fund. It will continue to focus on regeneration, transport and cultural investments.

Responses