1 in 3 workers feel underpaid but men most likely to ask for a pay rise

Recent research into the impact of the cost-of-living crisis on UK employees revealed that women were less likely than men to have requested a salary increase this year despite being equally affected by rising living costs.

Of the 1,000 people polled by HR software provider Ciphr, around a third (35%) are said to be discontent with what they are being paid to do their jobs.

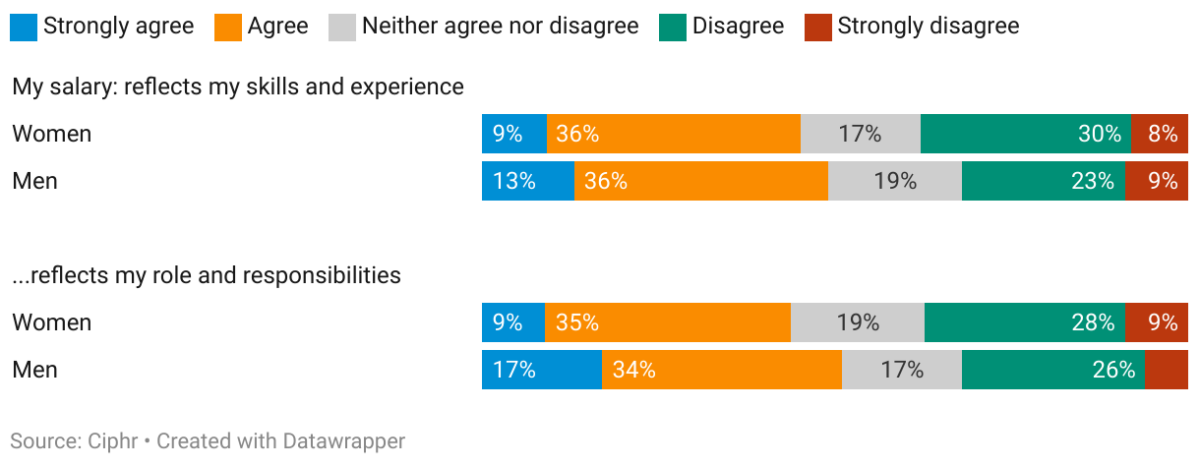

Nearly two-fifths (38%) of the female employees surveyed don’t think that their salary adequately reflects the value they bring to their organisation with their skills and experience, compared to less than a third (32%) of male employees surveyed. A similar number of people also disagree with the statement ‘my salary reflects my role and responsibilities’ (37% of women vs 32% of men).

In comparison, around half (51%) of men do feel adequately rewarded for their efforts, with 49% agreeing that their salary reflects their skills and experience, and 51% that it is reflective of their current role and responsibilities. Less than half of women (45%) agree with either of those statements.

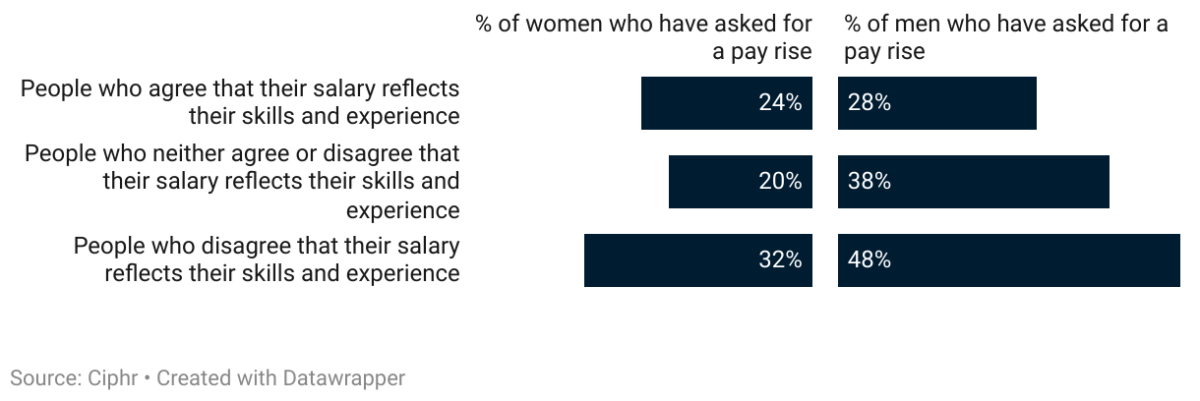

Conversely, despite more women feeling underpaid, men are more likely to have requested a raise recently – with one in three (36%) male workers, compared to just one in four (26%) female workers, having asked for a pay rise.

Men who aren’t happy with their pay are even more likely to push for higher wages. Nearly half (48%) of those who disagree (and strongly disagree) that their salary matches their skills and experience have asked for more money. Just a third (32%) of women who feel the same way have done the same.

Even men who can’t decide if they are being paid fairly or not, are still, statistically, more likely to have asked for a pay rise than women who know that they are unhappy with their wages (38% vs 32% respectively).

Generally, men were also shown to be more likely to have asked for a cost-of-living bonus (14% vs 7% of women surveyed), for a promotion (22% vs 17%), or for more employee benefits to top up their income (16% vs 11%). Worryingly, this notable gender ‘ask gap’ (where women ask for, or expect, lower salaries than comparable men) could be contributing to, and compounding, existing pay gaps at many organisations.

As it currently stands, according to the Office for National Statistics, the UK’s median gender pay gap is 14.9% for all employees (and 8.3% for full-time employees), with women’s hourly pay lagging men’s hourly pay in most occupations. Women working in the private sector also have to contend with a bigger pay gap than those in the public sector (19.6% vs 15.9%).

Claire Williams, chief people officer at Ciphr, says:

“Much has already been written about how the salary ‘ask gap’ can contribute to pay inequality. It happens when people, usually women, sell themselves short by accepting a lower salary than they are perhaps ‘worth’ because they perceive the salary they are being offered as fair. Or, as highlighted by Ciphr’s latest research, they don’t ask for a pay rise at all – even if they are unhappy with their wages – maybe because they don’t feel confident, or empowered, in asking for a higher salary.

“These employees then potentially end up being paid a lower market rate – sometimes compounded over years – than they should be, compared to others with similar skillsets, qualifications, and experience. This isn’t good for them, or their employer, because people who don’t feel valued are much more likely to be looking elsewhere for a new job. And, until this cycle is stopped, it will keep perpetuating pay gaps.

“The onus is on employers to do more to fix this. As the ONS earnings figures show, disappointingly, the gender pay gap is still as wide as ever in many industries. Employers must be held accountable for doing what they can to reduce salary discrepancies – where they see them – within their organisations to ensure that all employees are being fairly financially rewarded for their efforts, and the value they bring to the business. Better representation of women and ethnic minorities at all levels, in all roles, is a vital part of driving this change and achieving pay equality. It’s also the best way of attracting and retaining the best employees long-term.”

The results of Ciphr’s latest cost of living survey are available here.

Ciphr is a leading UK-based provider of integrated HR, payroll, learning and recruitment solutions. Ciphr also offers off-the-shelf and bespoke eLearning content and diversity and inclusion consultancy services through its recent acquisition, Marshall E-Learning. More than 600 organisations use the group’s people management solutions globally across the public, private and non-profit sectors.