ONS Labour Market February 2026. UK Unemployment Rate is 5.2%. Youth Unemployment Is Now at 14%

The latest ONS Labour Market data has been released today (17th February 2026). This is the latest estimate of employment, unemployment, economic inactivity and other employment-related statistics for the UK from the Office for National Statistics, looking at the last three months of Labour Market data (November 2025 to January 2026).

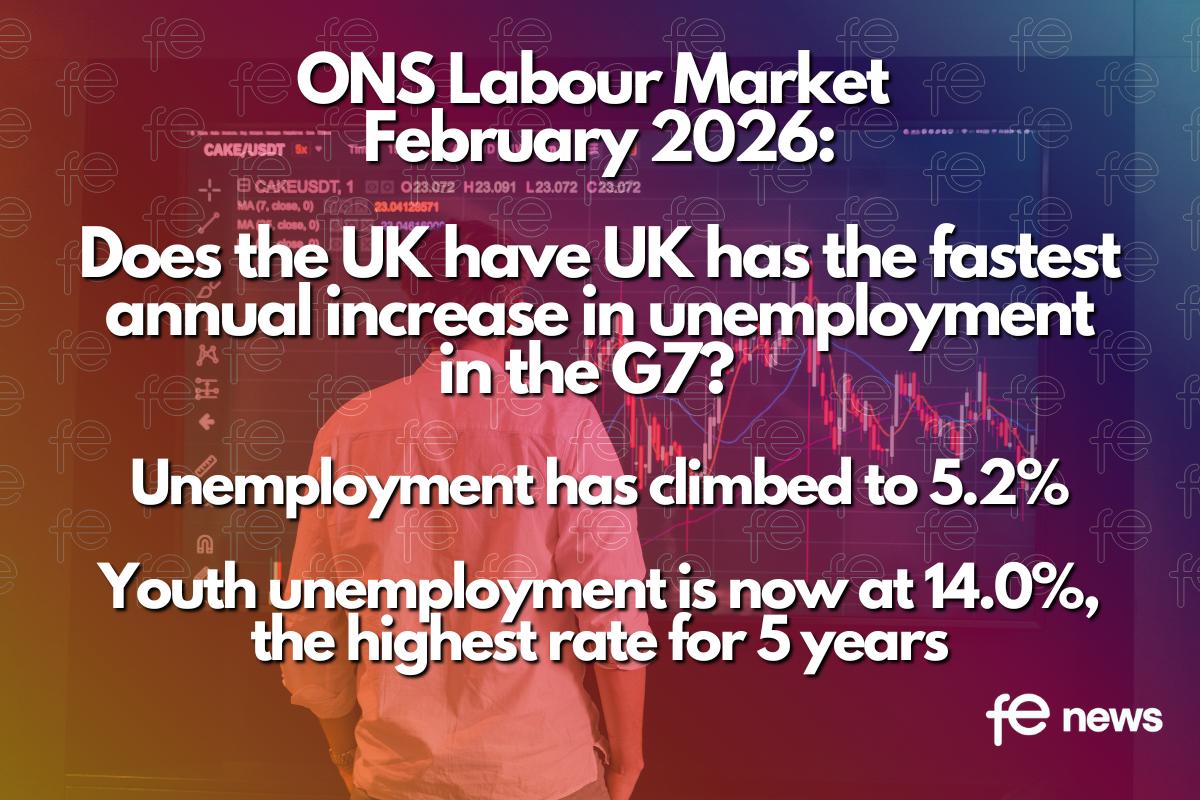

The UK Unemployment Rate is 5.2%. Youth unemployment is now at 14.0%, the highest rate for five years. The number of 18-24 year olds out of work has jumped by 80,000 on the quarter to 575,000. Work Foundation analysis: the data suggests the UK has the fastest annual increase in unemployment in the G7!

Payrolled employees in the UK fell by 121,000 (0.4%) between December 2024 and December 2025

Estimates for payrolled employees in the UK fell by 121,000 (0.4%) between December 2024 and December 2025, and decreased by 6,000 (0.0%) between November 2025 and December 2025. This is based administrative data from HM Revenue and Customs (HMRC). When looking at October to December 2025, the period comparable with the ONS Labour Force Survey (LFS) estimates, the number of payrolled employees fell by 130,000 (0.4%) over the year and by 46,000 (0.2%) over the quarter.

Now 30.3 million payrolled employees

The early estimate of payrolled employees for January 2026 decreased by 134,000 (0.4%) on the year, and by 11,000 (0.0%) on the month, to 30.3 million.

UK Unemployment rate is 5.2%

The UK employment rate based on the LFS for people aged 16 to 64 years was estimated at 75.0% in October to December 2025. This is down in the latest quarter, but unchanged on estimates of a year ago.

The UK unemployment rate for people aged 16 years and over was estimated at 5.2% in October to December 2025. This is up in the latest quarter and above estimates of a year ago. The UK economic inactivity rate for people aged 16 to 64 years was estimated at 20.8% in October to December 2025. This is down in the latest quarter and below estimates of a year ago.

UK Claimant Count is estimated at 1.691 Million

The UK Claimant Count for January 2026 increased on the month but decreased on the year to an estimated 1.691 million.

Vacancies have increased by 2000 between November 2025 and January 2026

The estimated number of vacancies in the UK has remained broadly flat across recent periods. Early estimates in November 2025 to January 2026 suggest a small increase of 2,000 (0.3%), to 726,000, compared with August to October 2025.

Wages: Public sector wages up 7.2% and 3.4% for the private sector

Annual growth in employees’ average earnings in Great Britain was 4.2% for both regular earnings (excluding bonuses) and total earnings (including bonuses) in October to December 2025. Annual average regular earnings growth was 7.2% for the public sector and 3.4% for the private sector. The public sector annual growth rate is affected by some public sector pay rises being paid earlier in 2025 than in 2024. This has caused a base effect that reached its peak last month and will phase out over the next few periods.

Annual growth in real terms, adjusted for inflation using the Consumer Prices Index excluding owner occupiers’ housing costs (CPI), was 0.8% for regular pay and 0.7% for total pay in October to December 2025.

There were an estimated 118,000 working days lost because of labour disputes across the UK in December 2025, with over two-thirds of working days lost in the health and social work sector because of the doctors’ strikes in England.

Sector Reaction

Responding to the latest ONS figures, Stephen Evans, chief executive at Learning and Work Institute (L&W), said:

“Low economic growth and rising employer costs continue to take a toll with a worrying one in seven 18-24 year olds now estimated to be unemployed. Overall, employment is falling, unemployment rising and vacancies flat. The data are, however, subject to revision: last months estimated 42,000 fall in payroll employment has now been revised to just 6,000. Nonetheless weaker hiring demand from employers, particularly in retail and hospitality where 122,000 fewer people are in payroll employment, is having an impact.”

Work Foundation – data suggesting the UK has the fastest annual increase in unemployment in the G7

Ben Harrison, Director of the Work Foundation at Lancaster University, a leading think tank for improving working lives in the UK, on the Employment :

“Today’s figures show a weakening and uneven labour market, with more people looking for work and with young people particularly impacted.

“Unemployment has climbed to 5.2%, its highest level in nearly five years. The number of people out of work has risen by 331,000 over the past year to 1.88 million, with data suggesting the UK has the fastest annual increase in unemployment in the G7.

“While overall employment appears broadly stable and the rise in redundancies has slowed, the pain is not evenly spread. Young people, disabled people and men are bearing the brunt of the rise.

“Youth unemployment is now at 14.0%, the highest rate for five years. This is particularly concerning as the number of 18-24 year olds out of work has jumped by 80,000 on the quarter to 575,000. More young people are actively seeking work, but too many are struggling to secure it.

“Vacancies remain subdued at 726,000, despite a slight uptick on the quarter. The Government clearly recognises the need to provide more support to help people back into work but many initiatives – such as jobs on wheels and youth guarantees – remain in pilot phases.

“To Get Britain Working, Ministers must prioritise a twin focus on rapidly expanding tailored employment support and ensuring those returning to work are able to access secure, and well-paid jobs across the country.”

The ONS published its latest labour market figures this morning. The Recruitment and Employment Confederation (REC) Chief Executive Neil Carberry said:

“There are no surprises in today’s data as unemployment continues to rise and pay falls back to long-term norms. Nothing here should slow the Monetary Policy Committee on its interest rate path.

“There is some good news, as vacancy numbers have clearly levelled off. In line with business surveys, we expect to see this improve in months to come as firms enter a cyclical upturn in hiring. But it will take more than this to reverse the rise in unemployment. Some of this is driven by a welcome unwinding of the long tail of inactivity that the UK, almost uniquely, saw from the pandemic. But too much of it comes from the caution firms are now showing about hiring.

“What should concern policymakers is that firms can grow by hiring, or by other routes. By structurally raising the costs of taking a chance on people on multiple fronts over the past five years, governments have put the employment chances of those at the margins at more risk, even as these policies favour those in established roles. If politicians don’t want to move to a labour market which tolerates a much higher rate of unemployment, they should stop doing the things that drive it. That should start with the threat to flexible work opportunities posed by the Employment Rights Act’s guaranteed hours proposal.”

Jonathan Moyes, Head of Investment Research at Wealth Club said:

“The latest unemployment and wage growth data came in weaker than expected.

“Whilst the labour market is clearly weakening, and has been weakening since mid 2024, wage growth has been relatively strong. This has been a perplexing situation for economists, particularly those at the Bank of England. Wages have typically been a blocker on additional rate cuts for fears of stoking inflation. Today’s reading on the health of the economy show thr two key metrics, wages and jobs, starting to move in tandem again.

“Will the weakness in wages now trigger the Bank of England to look again at its likely path for inflation? Wage growth may be the last domino to fall as inflationary pressures in the economy appear to be melting away. What’s clear is the economy is weak, employment is weak, and it looks like wages are weak.”

Barry Fletcher, Chief Executive at Youth Futures Foundation, comments:

“The Office for National Statistics’ latest labour market data has been released today, showing that unemployment continues to increase at a rapid pace. Around 1 in 7 (14.1%) young people not in full-time education are now unemployed – up from 1 in 10 (10.0%) four years ago, when the UK was emerging from the pandemic. That means an estimated 469,000 16–24-year-olds not in full-time education are out of work and actively looking for a job. Over the past year, unemployment among young people has risen, while economic inactivity, those not in work and not actively looking, has fallen.”

“In the last few days, the OECD has highlighted that Britain’s youth unemployment rate has risen above the European average for the first time since records began in 2000. This not only demonstrates the scale of the issue we face, but that young people continue to bear the brunt of this labour market downturn.”

“While we have recently seen much needed Government focus and investment to support more young people into work through employment support and apprenticeship reform, more will be needed to meaningfully tackle the youth employment challenge.

“As our Youth Employment 2025 Outlook reveals, the prize of sustainably addressing the UK’s stubborn employment challenge for our young people and the economy is enormous. If the UK matched the Netherlands’ youth participation rate, approximately 567,000 more young people would be in work or education, boosting the long-term economy by £86 billion.”

The Welsh Government says:

“Evidence from a range of sources suggest the labour market in Wales has followed similar trends to the UK since the pandemic. Latest figures from the Annual Population Survey (APS) show the unemployment rate for people aged 16 and over in Wales was 4.5% compared to the UK rate of 4.2%.

“We have supported about 46,000 jobs this Senedd term through business support, and last week a record 20 renewable energy projects in Wales got UK Government backing with the potential to create thousands more new jobs.

“As we’ve said before, we’re quoting the Annual Population Survey because of concerns about the reliability of Labour Force Survey data. In fact, the Office for National Statistics (ONS) itself advises caution when taking these statistics as the only measure of the labour market in Wales. For greater accuracy it is recommended that a range of sources are used, while the ONS develops a new survey.”

Responses