Why Do Companies Have to Purchase Payroll Software?

Important points companies have to think before buying Payroll Software

This guide is about payroll software. We recommend reading it alongside either our selecting business software guide (for medium and large organizations) or our selecting business software for small business success. These offer advice and tricks for selecting all types of business software. You might also be interested in our 5 things to think about when buying accounting software.

1. Allow yourself enough time.

Allow plenty of time to analyze and test systems, and create a migration plan if switching from another payroll solution. This must be consistent with your company’s business cycles, resource availability, fiscal years, and legislative changes.

2. Payroll software will not transform you into a payroll expert.

Payroll is a highly specialized role in many businesses, and as a result, the software is highly customizable. It is up to you, as a buyer and user, to determine what is relevant to your own business.

Employees become ill, take vacations, have children, and must leave. All of these events necessitate specific actions to be taken with the software – and you must be clear about how your company will handle these processes.

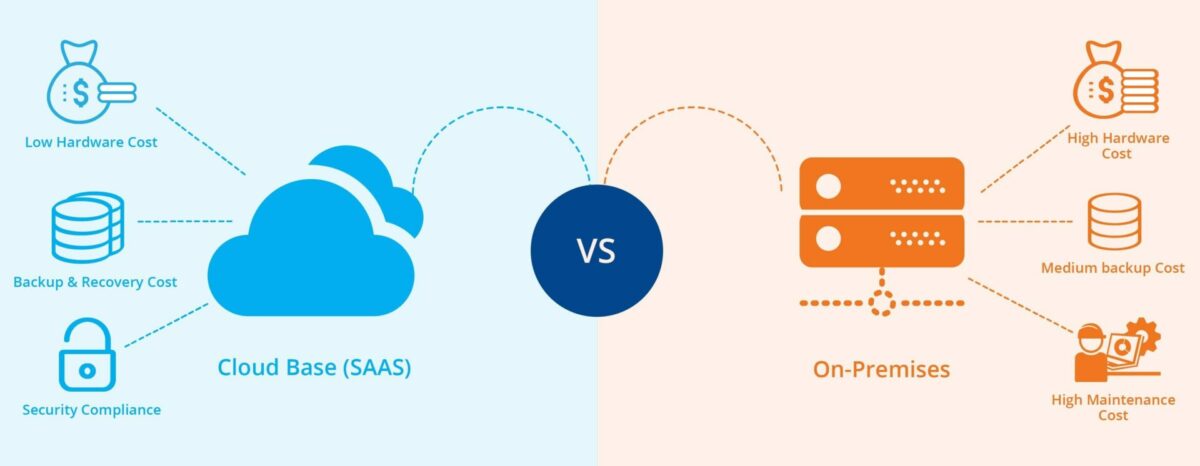

3. On-Premises vs. Cloud

Should you go with an on-premise or cloud solution? Some Cloud solutions have fewer features and configure than on-premise systems, but they benefit from being hosted and upgraded for you and may offer more capabilities for collaboration with others.

4. Before you buy, try it out.

Many payroll software vendors provide free trials. These may be appropriate for your company to use. However, you should be aware that some software may automatically submit RTI (Real Time Information) data to HMRC; as a result, and in order to meet data protection requirements, you should never use real-world data for setup and testing. Use dummy PAYE references, for example.

5. Recognize the expenses

What is included in the price of the payroll software? Is there an additional charge for support, and are there different support packages available? What are the costs of upgrades if the company expands? Is the type of assistance you require available when you need it.

Furthermore, On-Premise and Cloud options frequently have different commercial models, with On-Premise costs often being more ‘upfront-loaded,’ whereas Cloud costs are more evenly distributed over the life of the solution. Consider which payroll model best fits your financial situation.

Responses