December Labour Market 2023: Sector Response

There were 131,000 working days lost because of labour disputes across the UK in October 2023. Three-fifths of the labour disputes were in the health and social work sector. In October 2023, 49,000 workers were involved in labour disputes, the lowest number since June 2022.

December Main Points:

In September to November 2023, the estimated number of vacancies in the UK fell by 45,000 on the quarter to 949,000. Vacancies fell on the quarter for the 17th consecutive period, the longest consecutive run of quarterly falls ever recorded but still above pre-coronavirus (COVID-19) pandemic levels.

Annual growth in regular pay (excluding bonuses) in Great Britain was 7.3% in August to October 2023, this growth continues to remain strong but is not as high as in recent periods. Annual growth in employees’ average total pay (including bonuses) was 7.2%. Annual average regular earnings growth for the public sector was 6.9% in August to October 2023, and is among the highest regular annual growth rates since comparable records began in 2001. Annual average regular earnings growth for the private sector was 7.3%.

In real terms (adjusted for inflation using the Consumer Prices Index including owner occupiers’ housing costs (CPIH)), annual growth for total pay rose on the year by 1.3%, and regular pay rose on the year by 1.4%.

The estimated number of workforce jobs in the UK in September 2023 was a record 36.8 million, an increase of 210,000 from June 2023. The total number of jobs includes both employee jobs and self-employment jobs. The estimated number of employee jobs has been on a largely upwards trend since September 2020, resulting in a record high of 32.5 million in September 2023.

The estimate of payrolled employees in the UK for November 2023 was largely unchanged compared with the revised October 2023 figure, down 13,000 to 30.2 million. The November 2023 estimate should be treated as a provisional estimate and is likely to be revised when more data are received next month.

UK payrolled employee growth for October 2023 compared with September 2023 has been revised from an increase of 33,000 reported in the last bulletin to an increase of 39,000.

Because of the increased uncertainty around the Labour Force Survey (LFS) estimates, we are publishing an alternative series of estimates of UK employment, unemployment, and economic inactivity. These figures were derived using growth rates from Pay As You Earn Real Time Information (excluding the early flash estimate) and the Claimant Count for the periods from May to July 2023 onwards. This is to provide a more considered view of the labour market while the LFS estimates are uncertain.

These alternative estimates for August to October 2023 show that:

- the UK employment rate (for those aged 16 to 64 years) was largely unchanged on the quarter at 75.7%

- the UK unemployment rate (for those aged 16 years and over) was largely unchanged on the quarter at 4.2%

- the UK economic inactivity rate (for those aged 16 to 64 years) was largely unchanged on the quarter at 20.9%

The Chancellor of Exchequer, Jeremy Hunt said:

“It’s positive to see inflation continue to fall and real wages growing.

At the Autumn Statement, I announced an ambitious set of measures to get more people into work and boost economic growth. This includes a significant expansion of health support and an over £9 billion per year tax cut for employees and the self-employed, worth over £450 for the average worker,”.

Further information:

- Whole economy total pay growth has fallen from 8.5% in the three months to July to 7.2% in the three month to October. This fall in headline earnings growth partly reflects one-off payments to parts of the NHS workforce in June no longer being reflected in headline data.

- There were 30.2m employees on payroll in December, which is 1.2m above pre-pandemic levels

Read the complete labour report for December 2023 here.

Read last month’s Labour market and sector response by clicking here.

As the year concludes, Reed has revealed their overview of the job market. Explore it here.

Pay growth follows inflation down as jobs market treads water, says the Resolution Foundation

Pay growth has declined markedly in recent months – tracking the sharp recent fall in inflation and a looser labour market – the Resolution Foundation said today (Tuesday) in response to the latest ONS labour market data.

The Foundation notes that while headline annual pay growth in the three months to October remained high – at 7.3 per cent for regular pay excluding bonuses – more recent data point to a sharp fall in pay growth.

Looking the rise in pay over the last three months, pay growth fell to 4.2 per cent on an annualised basis, while the level of private sector pay actually fell in cash terms between September and October (though this data is volatile).

Using the same measure on RTI data, typical pay growth for private sector payrolled employees fell to 2.8 per cent in November, down from 4.8 per cent in October and 6.2 per cent in September.

The jobs market also showed signs of continued slow loosening, with the number of job vacancies falling for a 17th consecutive month, and the number of payrolled employees falling slightly (by 13,000) between October and November, although the latter data are provisional and are likely to be revised.

Finally, the ONS says that rates of employment, unemployment and inactivity were flat in the three months to October, but these data are particularly uncertain as we await an expanded Labour Force Survey in January.

Sector Response

Minister for Employment, Jo Churchill MP said:

“This year the number of employees on payroll reached a record high in the UK Labour Market – up over 300,000 on the year.”

“Our transformational Back to Work plan with £2.5 billion will help thousands more people access the wide ranging benefits of work and boost our economy.”

Helen Gray, chief economist at Learning and Work Institute, said:

“As ONS has only published a partial set of labour market statistics for the past few months, our ability to explore the nuances underlying today’s headline figures is again limited. There has been little change in the key indicators in recent months, with the rates of unemployment, employment and economic inactivity all the same in the August to October quarter of 2023 as in the May to July quarter. However, ONS have not published information on the reasons for economic inactivity, the educational status of young people and the duration of unemployment spells since their September 2023 release. This means that turbulence may be passing unnoticed below the apparent stability in the labour market.”

Louise Murphy, Economist at the Resolution Foundation, said:

“The UK’s historically high level of pay growth over the summer has been a major concern for policy makers, as it risks keeping inflation higher for longer for everyone.

“But just as price pressure fell back sharply in October, so too has pay growth, as the big rises from earlier in the year fall out of the data. This will reassure Bank of England policy makers seeking to bring inflation down.”

Tony Wilson, Director at the Institute for Employment Studies said:

“Today’s figures suggest that the labour market is continuing to cool but isn’t crashing. Employment remains steady, unemployment is flat and there are still nearly a million vacancies in the economy. Pay growth is also still strong, at above 7%, but tends to lag other indicators and so is likely to ease up in the coming months. This is all good news given the large rises in interest rates that we’ve seen over the last year or so, but there are signs now that these rises are starting to have an effect – with vacancies now down by over a quarter from their peak in 2022, employment for young people falling over the last year, and fewer jobs in hospitality too as people cut back. There are also signs in data published last week that redundancies are rising, with nearly 40,000 people at larger firms notified that they are at risk of losing their jobs, the highest figure since the depths of the pandemic in 2020.

“Looking ahead, it’s likely that things will continue to weaken next year and while we can hope for a fairly soft landing, we should also prepare for it to be a bit more bumpy than now. There are still more people out of work than before the pandemic, and when demand weakens it tends to be those who are most disadvantaged who lose out the most. So we need to keep focusing on how we can better engage and support those out of work to fill the jobs that are still being created, and help employers to continue to grow their businesses and fill their jobs.”

Ben Harrison, Director of the Work Foundation at Lancaster University, UK:

“Today’s limited data release shows workers have seen real pay grow by 1.4% on the year as wages continue to rise above inflation. This strong wage growth risks hiding the fact that the majority of workers are poorer than in 2008, and the Office for Budget Responsibility have warned real wages will not return to those levels until 2028.

“With a slowdown in hiring as vacancies falling for the 17th consecutive quarter to 949,000 and economic inactivity holding steady at 20.9%, we may see the strong levels of wage growth subside quickly in the New Year. This could be particularly bad news for workers in sectors such as construction, where pay growth is only just above inflation.

“At the Autumn Statement, the Chancellor announced further ‘carrot and stick’ measures to get people with long-term health conditions back to work. Due to data limitations, we have had no new insight on the levels of inactivity due to long-term sickness in the UK since September – which had hit a record 2.6 million people.

“Given new measures could see benefits withdrawn from those with long-term health conditions and disabilities if they are unable to find a job within 18 months, it is vital the Office for National Statistics revert to normal service so the impact that both the rhetoric and policy measures have on some of the most vulnerable people in society can be analysed.”

Neil Carberry, REC Chief Executive, said:

“The labour market is clearly slowing, but employment is being underpinned by the fact that labour supply is so tight.

“Today’s data reflects emerging trends from our monthly Report on Jobs that pay pressures are receding. We expect that to continue as the high pay settlements paid by employers in 2023 fall out of the data over the next six months. In the medium-term, there is a risk of inflation returning and lower growth if we don’t address the challenges raised by shortages through skills investment, a focus on productivity and a more sensible approach to immigration for work. That’s why firms want to see government adopt a people and productivity focused industrial strategy.

“The number of vacancies is knocking on a million and, despite the longest period of falling numbers on record, is still above pre-pandemic levels. This shows the scale of the challenge we face. It’s time for the first priority to be growth – that’s the only way to bring the tax burden down and fund public services, and it requires our economy to be at the front of the government’s mind.”

TUC General Secretary Paul Nowak said:

“The UK economy remains in dire straights.

“Pay growth slowed in October with real wages still worth less than in 2008.

“And unemployment is 200,000 higher than a year ago with vacancies falling for the seventeenth consecutive period.

“13 years of Conservative mismanagement has cost workers up and down the country dearly.

“The Tories have turned Britain into a stagnation nation. It is time for change.”

The TUC highlighted how if pay packets had grown at pre-crisis levels, workers would be on average £14,700 better off.

Jack Kennedy, Senior Economist at the global hiring and matching platform, Indeed, commented:

“The labour market continues to gradually cool. Vacancies fell for a seventeenth consecutive period in the three months to November and are now down 27% from their peak, though remain above pre-pandemic levels. The unemployment rate was stable at a still fairly low 4.2%, while employment and inactivity were also unchanged, albeit these estimates continue to have only ‘experimental’ status. Hiring conditions are likely to continue to gradually ease in 2024 as the labour market rebalancing proceeds.

“The latest figures showed regular pay growth easing but it remains very high at 7.3% year-on-year. Wage growth remains one of the key metrics for Bank of England rate setters and how persistent it proves into 2024 will be a key determinant for the timing of any monetary policy easing.

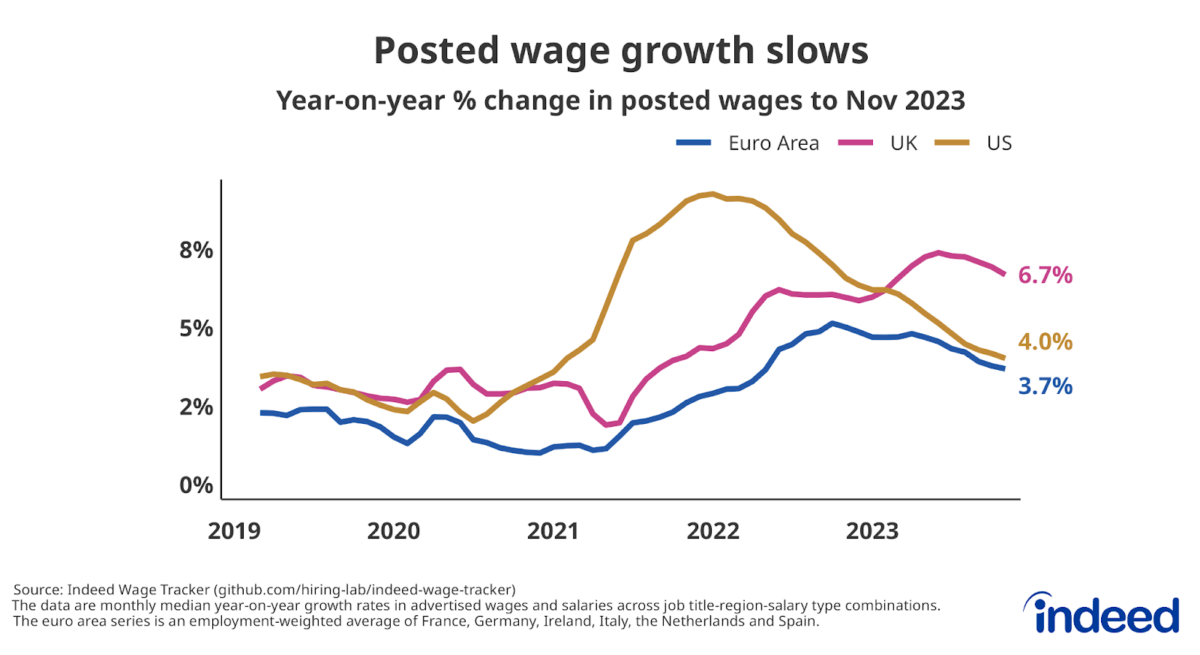

“More timely evidence from the Indeed Wage Tracker shows wage growth for new hires cooling further in November to 6.7% year-on-year, down from a peak of 7.4% in June. But pay pressures remain far stronger than in the US (4.0%) and euro area (3.7%), which is why the Fed and ECB are expected to cut interest rates sooner than the Bank of England, despite the UK growth outlook being weaker than peers.”

Responses