ONS Labour Market Data: More People Looking For Fewer Available Jobs: With 2.3 Jobseekers Per Vacancy

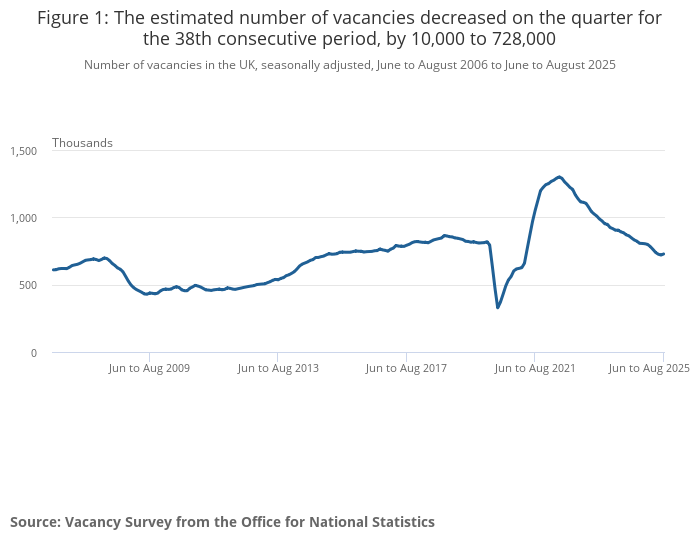

The latest ONS Labour Market info has been released for the Quarter May to July 2025. There are now more people looking for fewer available jobs, with a 10,000 Drop in Vacancies and Payrolled Employees Fell by 142,000 in the quarter. This is the 38th consecutive period where vacancy numbers have dropped compared with the previous three months, with vacancies decreasing in 9 of the 18 industry sectors.

- The UK employment rate for people aged 16 to 64 years was estimated at 75.2% in May to July 2025. This is up in the latest quarter and above estimates of a year ago.

- The UK unemployment rate for people aged 16 years and over was estimated at 4.7% in May to July 2025. This is up in the latest quarter and above estimates of a year ago.

- The UK economic inactivity rate for people aged 16 to 64 years was estimated at 21.1% in May to July 2025. This is down in the latest quarter and below estimates of a year ago.

- Estimates for payrolled employees in the UK fell by 142,000 (0.5%) between July 2024 and July 2025, and by 6,000 (0.0%) between June 2025 and July 2025.

- The UK Claimant Count for August 2025 increased on the month, but decreased on the year to 1.686 million.

- The estimated number of vacancies in the UK fell by 10,000 (1.4%) on the quarter, to 728,000, in June to August 2025. This is the 38th consecutive period where vacancy numbers have dropped compared with the previous three months, with vacancies decreasing in 9 of the 18 industry sectors.

- The estimated number of workforce jobs in the UK was 36.8 million in June 2025, this is a decrease of 182,000 (0.5%) from March 2025, but an increase of 139,000 (0.4%) from the level of a year ago.

- Employment in the public sector was estimated at 6.17 million in June 2025, an increase of 17,000 (0.3%) compared with March 2025, and an increase of 75,000 (1.2%) compared with June 2024.

- When looking at May to July 2025, the period comparable with the ONS Labour Force Survey (LFS) estimates, payrolled employees fell by 125,000 (0.4%) over the year, and by 51,000 (0.2%) over the quarter.

Vacancies are down on the quarter and are below pre-coranavirus pandemic levels

Job vacancies fell by 10,000 (1.4%) over the quarter to 728,000 between June and August 2025. This marks the 38th consecutive three-month period of declining vacancy numbers, with job openings decreasing across 9 of the 18 industry sectors. The total estimated vacancies were down by 119,000 (14.0%) in June to August 2025 from the level of a year ago, and are 67,000 (8.4%) below their pre-coronavirus (COVID-19) January to March 2020 level. The number of unemployed people per vacancy was 2.3 in May to July 2025; this is up from 2.2 in the previous quarter (February to April 2025).

The number of payrolled employees continues to fall.

The early estimate of payrolled employees for August 2025 decreased by 127,000 (0.4%) on the year, and by 8,000 (0.0%) on the month, to 30.3 million. The total number of vacancies has decreased by an estimated 571,000 since its peak in March to May 2022. ONS said that the August 2025 estimate should be treated as a provisional estimate and is likely to be revised when more data are received next month.

The largest increase was in the health and social work sector, with a rise of 80,000 employees; the largest decrease was in the accommodation and food service activities sector, with a fall of 90,000 employees.

UK payrolled employee growth for July 2025 compared with June 2025 has been revised from a decrease of 8,000 reported in the last bulletin to a decrease of 6,000; this is because of the incorporation of additional real time information (RTI) submissions into the statistics, which takes place every publication and reduces the need for imputation.

Estimates from January to March 2025 include the full effect of the improvements in LFS data collection and sampling methods introduced from January 2024. However, ONS are continuing our efforts to further improve the response to the survey. Consequently, estimates may be subject to the effect of these further improvements, which may have an ongoing impact on the survey. An increased volatility will remain in the LFS estimates for mid- 2023 and throughout 2024, so ONS are advising additional caution when interpreting survey change measures.

The UK employment rate for people aged 16 to 64 years was estimated at 75.2% in May to July 2025. The employment rate is up on the quarter and the year, but is still below pre-coronavirus pandemic rates.

Annual growth in employees’ average earnings in Great Britain for regular earnings (excluding bonuses) was 4.8%, and for total earnings (including bonuses) was 4.7% in May to July 2025. Annual average regular earnings growth was 5.6% for the public sector and 4.7% for the private sector. RTI pay data are also published and provide a provisional, timelier estimate of median pay. The two data sources generally trend well for mean total pay.

Annual growth in real terms, adjusted for inflation using the Consumer Prices Index including owner occupiers’ housing costs (CPIH), was 0.7% for regular pay and 0.5% for total pay, in May to July 2025.

Annual growth in real terms, adjusted for inflation using the Consumer Prices Index excluding owner occupiers’ housing costs (CPI), was 1.2% for regular pay and 1.0% for total pay, in May to July 2025.

There were an estimated 83,000 working days lost because of labour disputes across the UK in July 2025. Most of the strikes were in the health and social work sector.

Sector Reaction:

Responding to the latest ONS figures, Dr Helen Gray, chief economist at Learning and Work Institute (L&W), said:

“The outlook for the UK labour market remains concerning in the latest ONS figures. While economic inactivity is falling, a sizeable number of those returning to the labour market appear to be seeking work, rather than entering employment. The number of available job vacancies continues to fall while the levels of redundancies currently under consideration by employers suggest job losses may rise over the coming months. These signs of labour market weakness present particular difficulties for young people seeking to make the transition into the labour market, and in particular the 1 in 5 young people not in education, employment or training who have been assessed as too ill to work.“

Ben Harrison, Director of the Work Foundation at Lancaster University, said:

“Today’s figures highlight the challenge the Government faces in turning the economy around as the labour market continues to show signs of cooling.

“Unemployment continues to creep up. It is now at the high level in just under four years at 4.7%, and up 194,000 on the year. Concerningly for Ministers seeking to create additional pathways to work, there are now more people looking for fewer available jobs – with 2.3 jobseekers per vacancy. And the risk remains that unemployment rises further in the months ahead.

“The cooling labour market has also impacted wage growth. Nominal wage growth slowed to 4.8%, which is the first time it has dipped below 5% for three years since June 2022. Worryingly, this period of consistent pay growth has not fed through to real wages. Workers remain only £24 better off since the start of the Financial Crisis in August 2008.

“The combination of stagnant living standards and sticky inflation means that people are still likely to feel pessimistic about their household finances one year into the new Parliament. Only half of workers (48%) believe wage increases are keeping up with the cost of living and just 43% expect an above inflation pay rise in the next 12 months.

“As the potential for tax rises looms at the upcoming Autumn Budget, Government must ensure it does not increase the pressure on lower income workers who have borne the brunt of this squeeze in recent years.”

Abigail Coxon, Senior Economist at Youth Futures Foundation, comments:

“Today’s ONS labour market figures underline the ongoing challenge of youth unemployment. Among young people aged 16 to 24 not in full-time education, unemployment remains unacceptably high. In the last month, 388,000 young people were out of work and actively seeking work, representing a rate of 11.8%.

“Economic inactivity remains a serious challenge. Around 1 in 5 young people (19.6%) not in full-time education – or around 802,000 individuals – are neither in work nor looking for work. This continues the sharp rise seen since the UK emerged from the pandemic, when the rate stood at 15.3% and 558,000 young people were economically inactive.

“Against a backdrop of persistently high youth unemployment and inactivity, the new Secretary of State for Work and Pensions, Pat McFadden MP, has rightly urged the nation to be more ambitious for our young people – recognising the impact this can have on economic growth.

“Our strategy reflects this ambition through two North Star goals; for England to achieve the lowest NEET rate in the OECD by 2050, and to eliminate the gaps in education, employment and training outcomes for marginalised young people.

“Achieving these goals would deliver a £69 billion boost to the UK economy – but more importantly, it would mean a society where no young person is left behind.”

The ONS published its latest labour market figures this morning. The Recruitment and Employment Confederation (REC) Chief Executive Neil Carberry said:

“A slower labour market in the early summer is no surprise – it reflects what business surveys have been telling us. Firms were struggling with low growth and rising employment costs from National Insurance to National Minimum Wage to energy, and from fears about the Employment Rights Bill. But the picture has steadied, and our members report a slightly brighter outlook for the rest of the year after a longer and tougher hiring summer slowdown than usual.

“Private sector wages are normalising, with upward pressure now driven by government choices on public sector pay and the National Minimum Wage. This is significant, given the impact of these figures on the costly Pensions Triple Lock next year.

“The NHS workforce is now remarkable in scale, reaching a record size this month. With the fiscal position so tight, government must now focus on productivity rather than just ever more numbers. This means proper workforce thinking and a focus on what works, not ideology. We can deliver a well-supported, engaged NHS workforce that achieves more with the same. Part of this is not wasting money – like spending more on temporary bank staff when on-framework agencies are typically more cost-effective with the same high or higher standards. “With more recent business surveys a little more positive than the early summer, employers want to see government back them to deliver growth. That means a Budget without the nasty cost surprises of last year and far greater pragmatism on the delivery of their employment agenda. That would give firms the confidence to shift gears and help labour market momentum to build.”

Nicholas Hyett, Investment Manager at Wealth Club said:

“On one level this data shows a stable labour market performing as expected – albeit not particuarly strongly. Unemployment is holding steady and in line with expectations, while wages continue to rise faster than inflation.

“However, underneath that there are some worrying signs. Vacancies have fallen by 10,000 in the quarter to August, a 38th consecutive fall, and is less than half the number of people currently claiming unemployment benefits. With the estimated number of work force jobs also falling, it looks like the UK economy is simply not creating enough jobs and that problem is slowly worsening.

“With wages rising faster than inflation, and inflation itself still high, it seems unlikely the Bank of England will ride to the rescue with interest rate cuts in the near term. This is not the pro-growth economy the government was hoping for when it was elected, and there is a real danger that economic conditions continue to cool as we go through autumn.”

Jack Kennedy, Senior Economist at Indeed, says:

“There were few surprises in today’s figures, which show a continued gradual cooling of the labour market alongside pay growth that’s easing but still running too hot for the Bank of England.”

“There’s little in the data to shift the Monetary Policy Committee’s thinking ahead of Thursday’s interest rates decision, where policy is widely expected to remain on hold. The Bank remains stuck in a bind between weak demand and stubborn inflation pressures, meaning any rate cuts may be off the table until 2026.”

“There are fewer jobs but stubborn pay pressures – and a policy headache that won’t go away.”

Responses