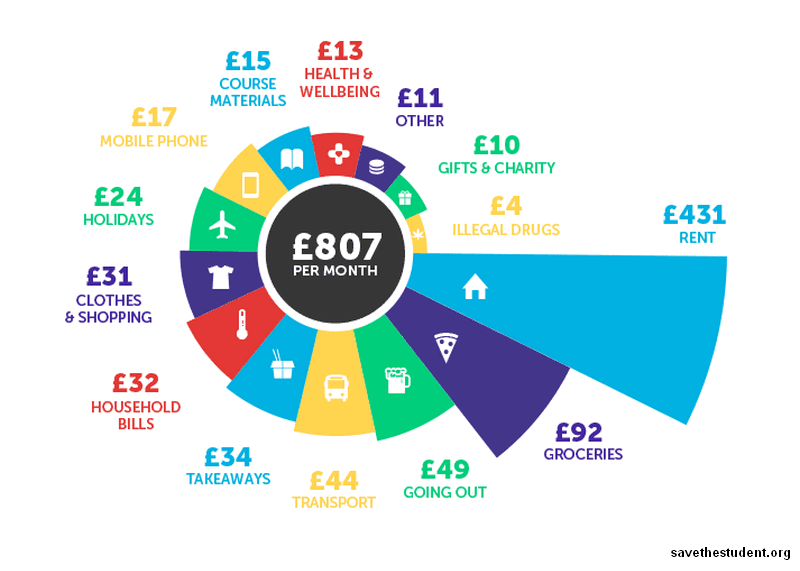

Students spend £807 a month on living costs at university, and most of it goes on rent

It’s getting more expensive to go to university – not because of tuition fees, but because living costs have gone up around the UK. According to the National Student Money Survey 2019, students now spend an average of £806.62 each month. That’s £37pm more than in 2018.

The National Student Money Survey 2019 reveals just how much new starters and returning students need to budget for uni – and where the money comes from.

Key student stats:

- UK average living costs: £807pm (up 4.8%)

- Ulster University cheapest (£573pm), London universities most expensive (£900pm)

- Parents contribute £134pm, but 1-in-3 students say it’s not enough

- 57% suffer poor mental health due to money worries (up 11%)

- 4% do adult work to raise cash (doubled since 2017)

- 25% have no savings

- Starting salary expectations fall 7.4% to £19,707 (with wide gender gap)

- 73% don’t expect to ever repay their full Student Loan.

The survey, by money advice site Save the Student, shows housing is the largest cost to be mindful of: undergrads now spend £431pm on rent alone, up from £406 in 2018. They also have to budget for household bills, groceries, transport and extra course costs, among others.

Crucially, however, Student Finance lags behind costs. The average* Maintenance Loan instalment is equivalent to £540pm, meaning undergrads have to magic up an extra £267pm.

The financial pressure weighs heavily on students, who report low mental health or disrupted grades, sleep and social life because of money worries. While a small percentage (4%) of students turn to adult work to make ends meet, the figure has doubled since 2017.

Third-year student, University of Sussex: “Why do you think so many of us suffer from mental health issues, or abuse drugs and alcohol? I have no idea how so many students cope financially.”

However, some hardship may be avoidable if students are given better money advice. According to the survey, 77% of undergrads wish they’d been told more about money before starting uni. Close to half (43%) feel they weren’t told about grants and other funding available to them – meaning some may have missed out on financial support they’re entitled to.

Better communication and clarity about the parental contribution would also help families struggling to meet unexpected costs. The survey reveals that parents pay an average of £134pm, yet 1 in 3 students feel they don’t get enough to live on.

Second-year student, University of Liverpool: “My parents don’t have enough to make up the difference in my Student Loan because every penny they earn gets spent on living costs but because their income looks ‘good’ … Student Finance expect me to live on a smaller loan.”

10 creative ways students have saved or made money

- My friend once sold fake nudes (knees in my lacy bra) to get money over Tinder

- Ordering clothes and shoes and bags online, using them once and then returning them

- I got an infection in my arm but refused to buy the antibiotics and tried using salt water – ended up in hospital and got given antibiotics, which were free at this point…

- I started embroidering designs into plain t-shirts instead of buying expensive clothing, it turns out people love my designs and I now sell them on Depop

- There’s a shortage of netball coaches in the south west, due to a lack of coaching courses in this area. I am a level 2 qualified coach. Within a month, I had three paid netball coaching jobs, including for a junior regional team

- I used to busk at the races which was a great money maker, even with just four songs

- I started my own Etsy business making earrings that I design and get laser cut at uni

- Selling fake nude pics: I used the crease in my arm from my elbow … and my sister (a make up artist) would help me dress it up with hair from kiwi skin

- Slept in a bus station instead of a hotel

- Eaten lambs livers I got for 14p in Tescos reduced section. Awful.

Jake Butler, Save the Student’s money expert, comments:

“Our findings reveal that current maintenance loan allowances fall woefully short of reality. In too many cases students are forced to desperate measures in order to simply continue their studies. Addressing the funding gap must be the highest priority for returning Universities Minister, Jo Johnson.”

*Average maintenance loan based on a student living away from home (outside London), and with a household income of £35,000.

Survey polled 3,385 university students in the UK between 24th April-30th May 2019

About Save the Student: Founded in 2007, we’re the UK’s largest student money website, serving over 1.5 million monthly visits. As the cost of university continues to rise, we’re working harder than ever to support students and graduates across the country. We do this by sharing engaging financial advice, deals, comparisons, tools, jobs, news and conducting national surveys.

Responses