New research highlights need to inform students of funding options before university

Giving an insight into the realities of managing money as a student, the findings from this year’s National Student Money Survey from @SaveTheStudent can help students and parents alike to prepare for a year that’s set to be like no other.

Save the Student’s annual survey was published on 9th September 2020 and, with responses from 3,161 university students from across the UK, it remains the largest independent survey of its kind.

Particularly for students who are considering university, or are preparing to start a degree this month, the uncertainties over what to expect due to the coronavirus pandemic are bound to lead many to consider their options.

Wondering how to help students prepare for the year ahead? One key way is to make sure they’re fully aware of the funding options, to prevent anyone from turning to last resorts to make money.

Commons sources of income for students

Before going into more detail about the findings, it’s important to note that the survey highlights a number of ways in which managing money as a student can be difficult. However, this in no way should lead students to decide against going to university if it’s the route they wish to take – instead, it can help them to prepare.

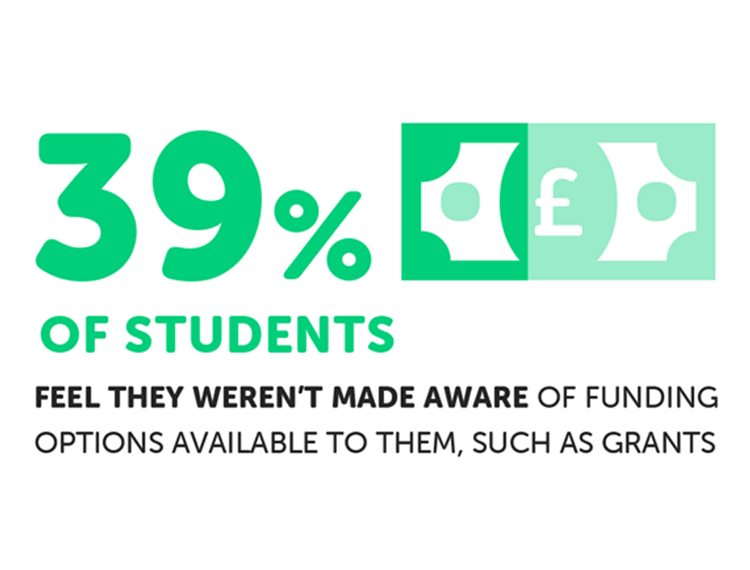

For example, the survey found that 39% of students feel they haven’t been made aware of the full range of student funding options. This stat alone highlights a small but significant way that parents and teachers can help to support new university students.

Just under three quarters of students rely on the Maintenance Loan for money – but the loan works out as £223 less than living costs each month for the average student. Because of this, students should look into boosting their income through other means as well.

The survey found that 74% of students got money from a part-time job, while 68% received money from their parents. However, for many, these two sources of income could be at risk due to the financial impact of the pandemic.

Where would students turn for cash in an emergency?

Now more than ever, it’s vital that parents and teachers are aware of where students would look for money in a cash emergency, to help inform them of their alternative funding options.

While 62% of students said they would turn to their parents for money in a cash emergency, and 56% would try to get more money from the bank, some students would turn to risker sources of money if they felt desperate.

15% said they would do drug trials, 5% would do gambling and 5% said they would get a commercial or payday loan.

As well as this, as many as one in 10 said they would do sex work in a cash emergency, despite only 4% of students saying they had already done it.

The percentage of students saying they would do it in an emergency is almost double the percentage saying they currently do it. This indicates that it is viewed as a way to make money as a last resort for students. To reduce the risk of students feeling like they have to do something they are uncomfortable with to get by, it’s definitely worth informing them of some reliable, low-risk ways to make money.

How students can get money at university

As well as applying for the Maintenance Loan if they are eligible, it is still worth students trying to get part-time jobs, despite the pandemic likely making this more challenging than usual.

And, if a parent or guardian feels able and happy to contribute some money, this can help a lot. This is especially the case as the government calculates Maintenance Loans with household income in mind. The more parents earn, the less a student receives as a loan, with the government thereby expecting parents to pay the shortfall.

On top of this, students should look into which scholarships, grants and bursaries they are eligible for.

Plus, with their student bank account, they should be able to access an interest- and fee-free overdraft. It’s worth them applying for the maximum overdraft so they can dip into it if they run out of cash. It’s particularly useful to use as a buffer if a Maintenance falls short towards the end of term.

And there are lots more money-making options open to them, such as freelancing, selling unwanted belongings online and answering paid surveys.

As well as this, when students budget effectively, they can make whatever money they have coming in stretch much further. This is particularly important to emphasise to anyone starting university, as one in 10 students don’t currently budget.

With preparation and a clear understanding of how to get money safely when they need it, students can start university knowing how best to respond to the financial challenges posed by the pandemic and keep on top of their finances.

Jake Butler, Save the Student’s money expert, comments:

“Students are heavily reliant on income from part-time jobs and their parents to get by, because Maintenance Loans do not reflect the true costs of student living.

“With these vital top-up sources at increasing risk due to the COVID-19 pandemic, thousands of students this year may have little choice but to drop out of university or turn to alternative ways of earning money such as sex work.

“Addressing student funding has to be the highest priority for Universities Minister, Michelle Donelan.

“Meanwhile, it’s more important than ever for students and parents to be aware of the financial pressures from the outset, so they can plan and budget effectively.”

Responses