The festive cheer spreads little joy for single parents this Christmas

New Equifax research reveals a fifth of single parents are unsure how they will finance the festivities this year

Christmas puts financial pressure on most people, but according to new research[1] commissioned by credit information provider, Equifax, single parents bear the brunt of that strain.

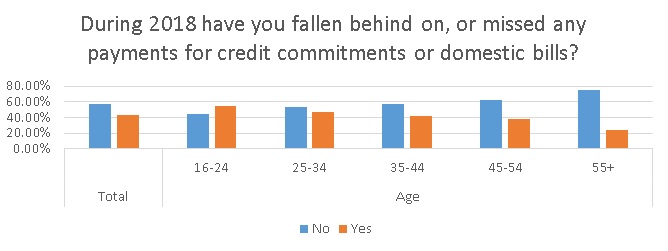

According to the Censuswide research, 44% of single parents have missed payments on credit commitments or domestic bills during 2018, with the youngest parents (16 -24) struggling the most (55%). And the festive season brings further financial stress, as over half (62%) feel under pressure to give their children everything they want, even if it will stretch their finances in the New Year. Older single parents (35-44 year-olds) feel this pressure most with 67% admitting that it’s hard to leave anything off the gift list.

The findings also reveal, that if they lost their main source of income, around 880,000[2] single parents would last less than a fortnight before having to ask for financial help from family or friends.

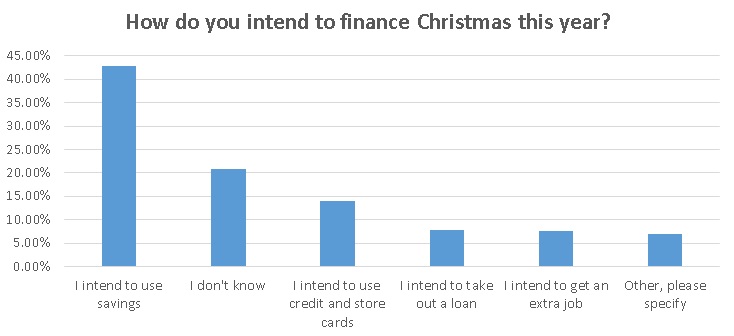

To help manage the expense of Christmas the survey found just under a third (31%) save each month to prepare for the costs, with 23% going as far as to buy presents in the summer sales. Yet a fifth (21%) of single parents are still unsure about how they will finance the festivities this year.

Lisa Hardstaff, credit information expert at Equifax comments: “It’s hard for most families to cope with all the seasonal spending in just one month, leaving many struggling with credit card debt going into the New Year. And this is even more pronounced for single parents, who only have one source of income.

“However, budgeting and planning for big expenses plays a vital role to help ease the financial burden. The first step when it comes to budgeting is to gather as much information about your financial situation as possible. It is easy to underestimate where your money is being spent – if you save all your receipts over a month you can often identify areas where you can make savings. For example, instead of buying a coffee on your way into work, if you make one at home, that could save you over £600 a year.

[1] Equifax survey conducted by Censuswide of 1,002 single parents November 2018

Responses