UK Universities Facing Intense Credit Crunch

A job advert for a Policy Expert on Higher Education Financial Sustainability to join the Department for Education (@EducationGovUK) caused some excitement when it appeared a few weeks ago.

Universities are not immune to financial downturns. Observers noted that the threat of a university going into administration is now so high that the government is appointing someone to brief ministers not only on how insolvency arrangements work but also now to shape potential intervention if institutions are at risk of closure.

The postholder would be working on: “the increasingly important and high-profile policy area of the financial sustainability of Higher Education (HE) providers.

“There is a considerable range of income and cost pressures and risks facing the HE provider sector currently and over the coming years.

“The Office for Students (OfS) has responsibilities in the new HE regulatory regime for monitoring HE financial sustainability and for protecting students’ interests against risks such as course, campus or provider closure.

“We are also seeking to develop our own comprehensive understanding of HE provider financial sustainability issues. This will enable us to ensure the Department’s policy development takes into account potential financial sustainability implications, and to advise Ministers accordingly.”

The OfS was created by the 2017 Higher Education and Research Act amongst other things to monitor sector and institutional financial health and this role is to address any perceived gap specifically “understanding the OfS approach to its functions…as well as considering whether the department’s concerns about risks might vary from the regulator’s”.

Tellingly the role will also include: “developing the departmental policy position in relation to potential intervention in the face of the risk of provider financial failure (where OfS as regulator is the primary actor)”.

Since 2017 however the financial position for many institutions deteriorated with the government’s decision to abolish the student numbers cap cited as one key factor.

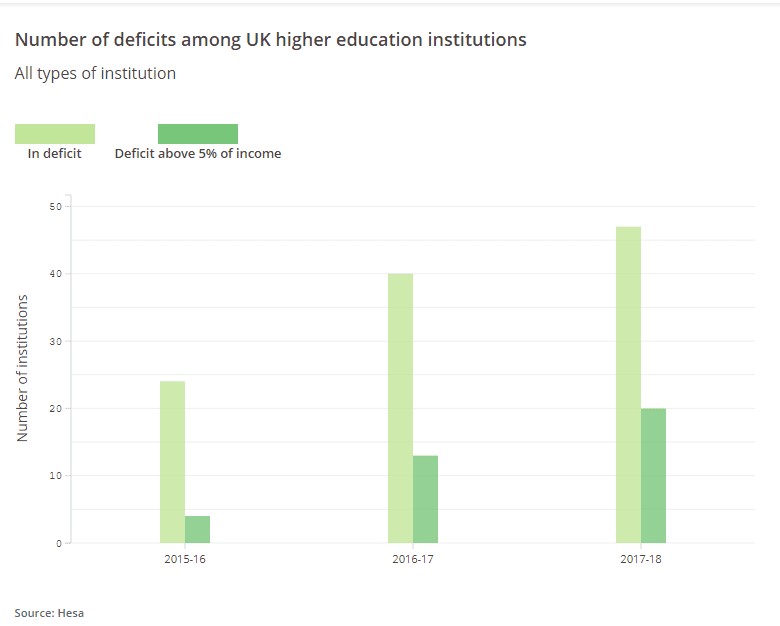

47 UK HE institutions, more than a quarter, posted a deficit in 2017-18, up from 40 the year before and 24 in the year before that. Even Cambridge University will post a £30 million deficit this year.

The law that set up the OfS and was to open up the sector to new providers has also created a regime that would allow a university to “exit the market” or go bust in plain English.

Sir Michael Barber, head of the OfS, has already told universities that there will be no bailouts and they must not think they are “too big to fail” as banks did during the financial crisis. Ministers have also said that they will judge particularly harshly universities that have borrowed to expand on projected growth of student numbers that may never materialise.

The financial outlook for universities and other HE institutions is uncertain for several reasons.

The number of school leavers is falling, there are risks around Brexit and research money and grants coming from EU institutions. The government review on tuition fees could also lead to sharp falls in income.

Nick Hillman, director of the Higher Education Policy Institute, was in favour of the creation of a position and having expert advice on financial realities so close to policy makers and regulators:

Nick Hillman, director of the Higher Education Policy Institute, was in favour of the creation of a position and having expert advice on financial realities so close to policy makers and regulators:

“The department needs expertise in insolvency, mergers, buyouts, transferring students and so on. A single policy advisor is unlikely to be enough, after all, if any significant provider does go under, it may be partly a result of government policy so it’s right government plays a role.”

Hillman has previously warned of a consensus that too many institutions are borrowing too much and that there are unprecedented levels of uncertainty. He continued: “Oxford, Cambridge and some other universities will always be fine but others will be facing a genuine credit crunch in 2019”.

If you were still interested in applying for the position of Policy Expert, we’ve got some more bad news for you. Applications have now closed.

Responses