Free meals in further education funded institutions

Guidance to help provide free meals to disadvantaged 16 to 18 year old students in further education funded institutions.

Who this guide is for

This guide is departmental advice from Education and Skills Funding Agency (ESFA). This advice is non-statutory, and is designed to help further education (FE) funded institution understand their obligation to provide free meals to disadvantaged students.

Free meals: a summary

The 1996 Education Act requires maintained school and academy sixth forms to provide free meals to disadvantaged students who are aged over 16. In the 2014 to 2015 academic year this requirement was extended to disadvantaged students following FE courses at the range of FE funded institutions. Funding Agreements place a legal duty on institutions to comply with this requirement.

Institutions must make a free meal available for all eligible students for each day the student attends their study programme, where this is appropriate.

Institutions receive funding at a rate equivalent to £2.41 per student per meal.

Students aged over 19 who are continuing on the same study programme (19+ continuers) they started before they turned 19 or who have an Education Health and Care Plan (EHCP) are eligible for a free meal where they meet the criteria.

Where institutions receive both a free meals in further education and a 16 to 19 Bursary Fund discretionary bursary allocation, they may use the funding as a single allocation.

Changes for the 2018 to 2019 academic year

For the 2018 to 2019 academic year, the list of eligible benefits for free meals has been amended. From 1 April 2018, Universal Credit will have an income threshold (a maximum net earned income of £7,400).

All students already receiving free meals on or after 1 April 2018 continue to be eligible to receive free meals whilst Universal Credit continues to roll out. This protection applies to students who were eligible for free schools meals (FSM) prior to moving into further education provision. Institutions should continue to provide these students with free meals until the end of the Universal Credit rollout period.

Once Universal Credit is fully rolled out any students receiving free meals will continue to be eligible to receive them until they complete their 16 to 19 funded education. This applies to any students aged 19+ who are continuing students or who have EHCPs.

Any student who becomes eligible for free meals after the net earned income criterion is introduced but before Universal Credit is fully rolled out (in March 2023) will also continue to be eligible even if they subsequently become ineligible due to changes in their circumstances during this period. Institutions should continue to provide these students with free meals until the end of the rollout period and until they complete their 16 to 19 funded education. We have included an expanded section on transitional protection in this guide.

Eligibility for free meals

Institution eligibility

Students must be enrolled in further education provision funded via ESFA to be eligible for a free meal. Eligible institutions are:

- general further education colleges, including specialist colleges

- sixth-form colleges

- commercial and charitable providers

- higher education institutions (HEIs) with 16 to 19 funding from ESFA

- specialist post-16 institutions (SPIs)

- local authorities (LAs) and FE institutions directly funded for 16 to 19

- 16 to 18 traineeship providers

- European Social Fund (ESF) only institutions

- 16 to 19 only academies and free schools

- 16 to 19 only maintained schools

Student eligibility

Age

To be eligible to receive a free meal in the 2018 to 2019 academic year a student must be aged 16 or over but under 19 on 31 August 2018.

Students aged 19 or over are only eligible to receive a free meal if they are continuing on a study programme they began aged 16 to 18 (‘19+ continuers’) or have an Education, Health and Care Plan (EHCP).

These 2 groups of aged 19 plus students can receive a free meal while they continue to attend education (in the case of a 19+ continuer, this must be the same programme they started before they turned 19), as long as their eligibility continues.

The following groups of students are not eligible for free meals in further education:

- students aged between 14 and 16 (these students are already covered by free school meals (FSM) provision)

- students aged 19 or over at the start of their study programme, unless they have an EHCP or are a 19+ continuer

- apprentices, including those with an EHCP

Eligible benefits

Free meals are targeted at disadvantaged students. Free meals in further education defines disadvantage as students being in receipt of, or having parents who are in receipt of, one or more of the following benefits:

- Income Support

- income-based Jobseekers Allowance

- income-related Employment and Support Allowance (ESA)

- support under part VI of the Immigration and Asylum Act 1999

- the guarantee element of State Pension Credit

- Child Tax Credit (provided they are not entitled to Working Tax Credit and have an annual gross income of no more than £16,190, as assessed by Her Majesty’s Revenue and Customs (HMRC))

- Working Tax Credit run-on – paid for 4 weeks after someone stops qualifying for Working Tax Credit

- Universal Credit with net earnings not exceeding the equivalent of £7,400 pa

A student is only eligible to receive a free meal when they, or a responsible adult on their behalf, have made a successful application to the institution where they are enrolled.

Feedback from institutions has indicated that there is some confusion about Working Tax Credit and whether children from families in receipt of it are eligible for free meals. Working Tax Credit is not a qualifying benefit for free meals, and a parent/student in receipt of Working Tax Credit only are not entitled to a free meal. A parent or student must be in receipt of one of the qualifying benefits set out above to be eligible. Qualifying benefits include the Working Tax Credit run on which is paid for four weeks after you stop qualifying for Working Tax Credit.

The Department for Education has been working closely with the Department for Work & Pensions, other government departments and interested parties to establish new criteria for determining entitlements to free meals as the rollout of Universal Credit continues.

From 1 April 2018, any student who is in receipt of, or has parents who are in receipt of, Universal Credit must have a net earned annual income of no more than £7,400 in order to be eligible for free meals. This change will apply from the 2018 to 2019 academic year. Any further changes or clarifications about Universal Credit and free meals will be confirmed via an update to this guide.

Students must also satisfy the residency criteria set out in ESFA Funding regulation guidance for the 2018 to 2019 academic year.

Verification of student eligibility

Institutions are responsible for assessing applications for free meals. All students applying for a free meal for the first time in the 2018 to 2019 academic year must submit an application (either by the student, or by a responsible adult on their behalf) to the institution where they are enrolled. Some institutions may use a paper application form, others may use an on-line application form.

Institutions will be aware that the Department for Education provides an electronic Eligibility Checking System (ECS) that enables local authorities to check free school meal (FSM) eligibility on behalf of institutions. It is important that institutions and local authorities understand that the legal gateway (section 110 of the Education Act 2005) that enables the Department to obtain benefit information held by DWP and HRMC for checking eligibility is limited to FSM. Information from the ECS cannot currently be used to check entitlement for free meals for post-16 students.

As part of the application, institutions must ask the student (or their parent/guardian) to provide evidence of the award of the qualifying benefits. This might be an award notice or letter from the Department of Work and Pensions (DWP) or HMRC. Institutions may want to consider using a combined application form and process for free meals and the 16 to 19 Bursary Fund.

Universal Credit

For new applicants, institutions must verify the eligibility of students, or their parents, who are in receipt of Universal Credit, institutions will need to ask for a copy of their Universal Credit award notice which includes detail of their monthly earnings. Institutions will need to assess the information given to obtain an accurate proxy of the individual’s current earned annual income.

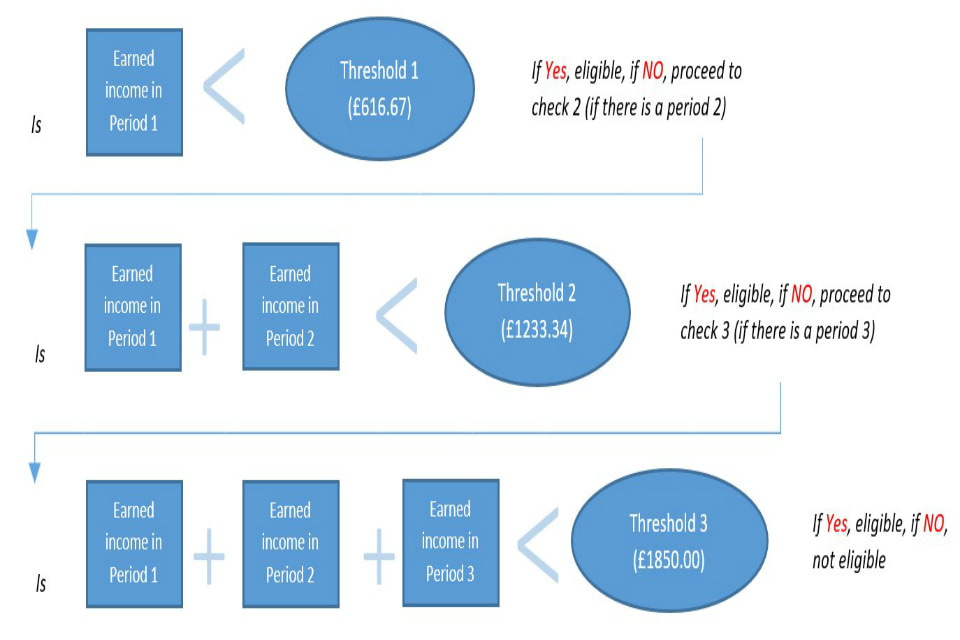

Institutions should check eligibility using the following three-step process:

- step 1: the student or their parents provides a Universal Credit award statement from their most recent complete assessment period, showing that their earnings in that period do not exceed £616.67 (this is a twelfth of an equivalent annual income of £7,400). If their earnings do not exceed £616.67, they are eligible for free meals. If their earnings do exceed £616.67, the check must move on to the next step

- step 2: the student or their parents provides Universal Credit award statements from their 2 most recent complete assessment periods, showing that their earnings in that period do not exceed £1233.34 (this is a sixth of an equivalent annual income of £7,400). If their earnings do not exceed £1233.34, they are eligible for free meals. If their earnings do exceed £1233.34, the check must move on to the next step

- step 3: the student or their parents provides Universal Credit award statements from their three most recent complete assessment periods, showing that their earnings in that period do not exceed £1850.00 (this is a quarter of an equivalent annual income of £7,400). If their earnings do not exceed £1850.00, they are eligible for free meals. If their earnings do exceed £1850.00, the student is not eligible for free meals

A manual check will be required to determine eligibility for those students or their parents who are self-employed and in receipt of Universal Credit. Parents will need to provide evidence that:

- they are in receipt of Universal Credit by providing their Universal Credit award letter

- they are self-employed by providing a copy of their company registration or tax return form

- their monthly net earnings do not exceed the threshold as set out in steps 1, 2 and 3. Institutions should request that self-employed parents complete the self-declaration form and, once satisfied that they are eligible, provide the student with a free meal

Self employment declaration form

MS Word Document, 52.2KB

The diagram that follows also shows the assessment process:

Transitional protection arrangements

The introduction of new eligibility criteria under Universal Credit from 1 April 2018 will result in some households becoming eligible for free meals and others falling outside of the eligibility criteria. The Department for Education is introducing transitional protection arrangements to provide certainty for families and to ensure that they do not experience a sudden loss of free meals.

The protection arrangements are designed to be as straightforward as possible for institutions to implement. It will apply as follows:

- from 1 April 2018, all students already receiving free meals will continue to receive free meals whilst Universal Credit is rolled out. This will apply even if their household earnings rise above the new threshold during that time

- any student who becomes eligible for free meals after the threshold has been introduced will also continue to receive free meals during the Universal Credit rollout. This will apply even if they subsequently become ineligible during this period because their household earnings rise above the new threshold

Institutions do not need to carry out any further eligibility checks for these protected families during this period. They may wish to note the students as ‘protected’ in their free meals auditable records.

Institutions should seek to identify students who are eligible to receive free meals under the transitional protection by speaking to the student’s previous school or their local authority (in the case of FSM) or to their previous further education funded institution (in the case of free meals in further education). The information may also be available on the Common Transfer file where institutions have signed up to the Department’s for Education’s school-to-school system, although the Department recognises this may not be appropriate for all further education funded institutions. The Department is also exploring options for providing historical free school meals (FSM) information to help institutions identify students who are protected and should continue to receive a free meal.

Where institutions are unable to verify previous eligibility for free meals using the approaches above, institutions may wish to consider seeking evidence from the student/their parent, for example, by requesting a copy of previous entitlement letters etc.

A student who has not previously claimed free meals is only eligible to receive one when they, or a responsible adult on their behalf, have made a successful application to the institution where they are enrolled. Once Universal Credit is fully rolled out, any students receiving free meals who no longer meet the eligibility criteria at that point (because they are earning above the threshold) will continue to receive protection until they complete their 16 to 19 funded education. 19+ continuers and students aged 19 and over with EHCPs will continue to receive protection until the end of their current programme of study.

Student who apply after 1 April 2018 and who have household earnings above the threshold will not be eligible for free meals.

Allocations and payments

Where possible, ESFA has based 2018 to 2019 academic year free meals funding for further education institutions on their 2016 to 2017 full academic year data and their funded student number for the 2018 to 2019 academic year. ESFA has used the number of students assessed as eligible for, and in receipt of, free meals in the 2016 to 2017 academic year as a percentage of the total number of reported students aged 16 to 19 in that year. This establishes the number of students we might reasonably expect to be eligible for free meals support in the 2018 to 2019 academic year.

If 2016 to 2017 full academic year information is not available, ESFA will use alternative approaches to generate the allocation and explain the calculation to the institution. ESFA strongly advises institutions to make data returns for the number of students assessed as eligible for, and in receipt of, free meals on an ongoing basis.

ESFA apportions the number of fundable free meals students across the funding bands, using the same methodology as for mainstream allocations. Band 5, Band 4 and Band 1 FTEs are full-time students. Band 3 and Band 2 are part-time students. Two funding rates apply, one for full-time students and one for part-time students, equivalent to £2.41 per student per meal.

As in previous years, ESFA has made an adjustment for historic double funding between free meals and the 16 to 19 Bursary Fund. ESFA calculates each institution’s share (percentage) of the total number of students supported with free meals who informed the 2018 to 2019 free meals allocations. This percentage is used to calculate the amount to be subtracted from each institution’s discretionary bursary allocation.

Further information about the allocations methodology is set out in ESFA funding statements (issued to institutions in February to March 2018).

Payment of allocations

ESFA will pay free meals allocations to institutions in 2 parts: approximately two-thirds in August and one third in April. The first payment for eligible academies is September, reflecting that this is generally the date for first payments to academies.

If any institution given an allocation of free meals funding determines they do not have eligible students, they should contact ESFA to return their allocation.

Administrative contribution

Institutions are permitted to use up to 5% of their allocation for administrative costs.

Institutions that are in scope for both the 16 to 19 Bursary Fund and free meals in further education schemes are permitted to use up to 5% of the combined allocation for administration. Institutions must ensure they do not take a sum that is greater than 5% of the single allocation total.

Unspent free meals funding and carrying forward funds

ESFA permits institutions to carry unspent funds over to the next academic year.Institutions must ensure that any unspent funds they carry forward continue to be used to support students. Funds that are carried forward cannot be added to general institution funds.

Institutions given a single overall allocation in the previous academic year that included funding for both free meals and discretionary bursary can carry forward funds from both schemes. The funding can be used for either free meals or discretionary bursary payments in the new academic year (2018 to 2019).

Institutions must fully utilise any unspent funds for either discretionary bursary or free meals before using their new academic year allocation.

ESFA reminds institutions that discretionary bursary and/or free meals funding cannot be carried forward for more than one year. Institutions must contact ESFA to arrange to return any unspent funds they hold from any year prior to 2017 to 2018.

The provision of free meals to students

Institutions must make provision for free meals to eligible students (those who are in receipt of the qualifying benefits and who make a successful application for free meals) for each day the student attends their study programme, where this is appropriate.

For example, if a student attends for 5 days a week, 9am to 3pm, for part of their course, the institution should provide 5 free meals. If a student has 2 days a week when they only attend from 9am to 10am, then the institution does not have to provide meals on those days.

Institutions are responsible for encouraging and supporting students in making healthy food choices. Many caterers will be able to advise on suitable healthy options to offer students. Institutions should also offer hot food options where practical.

Institutions should provide a meal free of charge to eligible students, or fund the free meal via an electronic credit or voucher that can be redeemed on-site or off-site where institutions have arrangements with nearby food outlets. Electronic credits and vouchers must be worth a minimum value of £2.41.

If an institution determines it is necessary to enhance the £2.41 free meals funding rate, in other words, to provide a meal with a greater value, from the single funding allocation or other sources, they have discretion to do so.Institutions must consider the value for money and reasonableness of an enhancement to the £2.41 rate and must be able to justify this at audit, particularly if they choose to make a significant variation from this amount.

The cost of meals is sometimes included as part of the package of support for High Needs Students that is agreed with local authorities. In these instances, institutions should consider the issue of potential double funding for meals when assessing the need to support. This might be by deducting the appropriate amount of funding from the total costs of the package for those students who will be eligible for a free meal, enabling local authorities to use those funds elsewhere.

The majority of students will require a free meal at lunchtime to fit in with usual study/attendance patterns. However, institutions may exceptionally choose to make provision for a free meal at an alternative time, for example, a breakfast, depending on the study pattern of individual students.

Institutions must make free meals provision for students on days when they are off-site as part of their study programme, for instance attending a work placement or work experience. Wherever possible, institutions should provide the student with a voucher they can use at nearby food outlets or arrange with the work placement or work experience provider to provide a meal.

ESFA expects that a meal, voucher or credit will be provided to eligible students. However, this may not be practical in some situations and institutions are permitted to make cash payments to students in the following exceptional circumstances:

- students attending institutions that meet all of the following criteria:

- fewer than 50 students in total on roll

- no catering or kitchen facilities on site

- no suitable food outlets locally that will agree to take part in a credit or voucher scheme

- students who are off-site on work placement or work experience as part of their study programme whose host organisation is unable or unwilling to provide a meal and who have no access to a suitable food outlet that will accept a voucher. Examples include work placements in rural areas or on industrial sites

- institutions with more than 50 students in total on roll but which have sites away from their main campus that a) have no on-site catering facilities and b) are too far away for students to travel back to facilities on the main campus

If institutions identify particular and exceptional circumstances that fall outside these parameters, they have discretion to make cash payments if they believe that failing to do so will prevent an eligible student from being provided with a meal. Institutions must ensure they record any such decisions as part of their auditable records.

Catering for students with special dietary requirements

Institutions are best placed to make decisions in the case of students who have special dietary requirements, taking into account local circumstances. Institutions are expected to make reasonable adjustments for students with these requirements.

The School Food Plan’s UIFSM toolkit was developed to help schools implement universal free school meals for infant pupils, but it contains advice on how to cater for pupils with special dietary requirements, which may be helpful to institutions.

Free meals and the 16 to 19 Bursary Fund

ESFA removed the ring fence between the free meals in further education allocation and the 16 to 19 Bursary Fund discretionary bursary allocation in the 2016 to 2017 academic year. This flexibility remains in place. Institutions must manage the single allocation appropriately to ensure all students eligible for a free meal receive one in line with this guide.

Prior to the introduction of additional funding for free meals, institutions had supported the cost of meals for students who needed them from discretionary bursaries. ESFA adjusts discretionary allocations to take account of this double funding for those institutions also in receipt of an allocation for free meals.

Institutions have discretion to manage the single allocation as they decide most appropriate to best provide support to eligible students for both schemes. Free meals in further education remains an entitlement and institutions must manage the single allocation appropriately to ensure that all students entitled to a free meal are provided with one.

If an institution determines it is necessary to enhance the £2.41 free meals funding rate and provide a meal with a greater value, whether from their single allocation or other sources, they have the discretion to do so. However, where institutions choose to do this, they must ensure that funding for discretionary bursaries continues to provide sufficient help to students facing the range of barriers to participation and should not enhance free meals funding to the detriment of other needs.

Institutions can give additional support to students eligible for a free meal from the 16 to 19 Bursary Fund, if the institution assesses they meet the criteria for bursary for vulnerable groups or the discretionary bursary.

Institutions should ensure they consider the provision of a free meal, or the funding provided to the student for the free meal, when they assess their overall need for support.

Raising awareness of free meals

Institutions are responsible for ensuring students are aware of the eligibility criteria for free meals. They should also encourage students who may meet the criteria to make an application for a free meal.

Institutions should clearly set out their free meal provision for students and parents. This might be by publishing a statement on their website, providing information at enrolment days, sending letters home to parents, etc. Template forms are available on gov.uk for institutions to use.

Students do better in their studies when they have access to proper, regular, nutritional meals. ESFA encourages institutions to support students to make healthy food choices by raising awareness of relevant information and guidance.

Individualised Learner Record (ILR)

Institutions must complete the free meal field in the ILR to provide information on the number of young people eligible for free meals. This is code FME2.

Institutions must ensure they only record students who are eligible and have taken up the free meal in the free meal field.

Students who receive funding for meals from the discretionary 16 to 19 Bursary Fund must not be recorded in the free meals field nor should students who receive Free School Meals (FSM) (for example, 4 to 15 year-olds). FSM students should be reported in the separate FSM field.

The ILR states that code FME2 should be used if the student is eligible for, and has taken up, free meals at any point during the academic year. If the student stops taking free meals FME2 should be retained and not removed until the start of the following academic year. Similarly, if a student becomes ineligible during the year, the transitional protections mean that FME2 should be retained until the student’s programme of study ends.

This code should be recorded for eligible students who are ESFA funded students aged 16 or over and under 19, 19 to 24 year-old students who are subject to an EHCP, ESF funded students aged between 16 and 18 and 19+ continuers.

Institutions that do not complete the ILR but instead complete the School Census should complete the 2 free school meals fields.

Audit and assurance

Free meals in further education is subject to normal assurance arrangements for 16 to 19 education and training.

Institutions must maintain accurate and up to date records that evidence which students receive free meals funding; confirm student eligibility for funding, including where transitional protections apply, and demonstrate appropriate use of funds, including the rationale for any enhancement to the £2.41 free meals rate.

Institutions are responsible for deciding what evidence they accept for free meals and how recent it is. However, they must ensure they can evidence that only students who meet the eligibility criteria for free meals in each academic year receive them. Where institutions have used their discretion to make cash payments that are outside the specified criteria set out in this document, they must ensure these are recorded.

Institutions should note that, following an audit, ESFA might recover funding where free meals payments are found to have been made to ineligible students.

Further information

The Children’s Food Trust has produced guidance for schools that may be helpful for free meals in further education. The Free School Meals Matter Toolkit, and A quick guide to free school meals are available on the Trust’s website.

Information about healthy eating, including recipes, is available at Change4Life and NHS.

Published 22 March 2018

Last updated 13 September 2018 + show all updates

- An update to give more clarification on the transitional protections put in place as a result of the roll out of Universal Credit.

- First published.

Responses