Rent now swallows up virtually all of the average maintenance loan as the student accommodation market reaches ‘crisis point’

- Bristol has the UK’s highest average annual rent at £9,200 per year outside of London

- Cost pressures for developers and an undersupply of beds are biggest drivers in rent increases

- New report from Unipol / HEPI includes policy recommendations, including revisions to maintenance support and new affordable room options

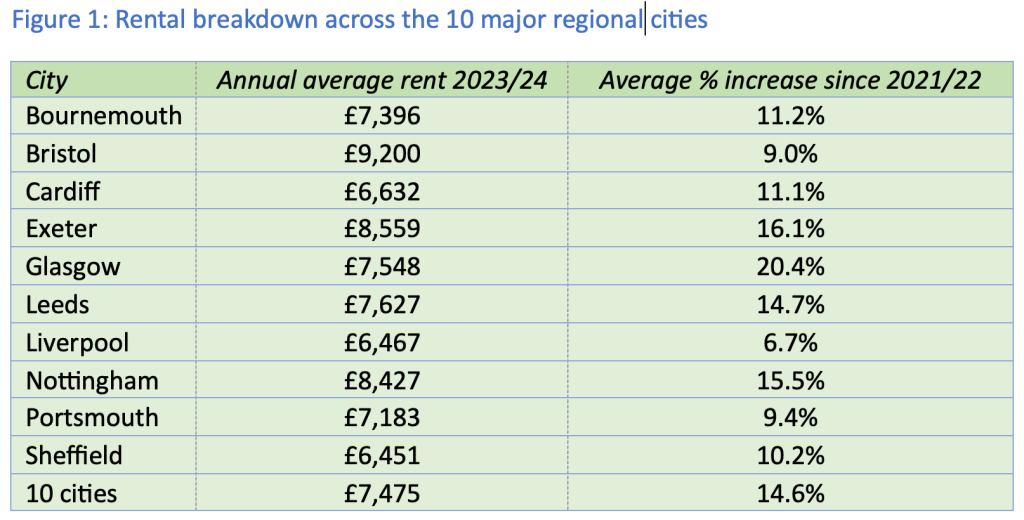

Rents for student accommodation have increased by an average of 14.6% over the past two academic years, according to a new report from Unipol and HEPI, meaning they now swallow up nearly all of the average maintenance loan.

Student accommodation costs across 10 cities in the UK: Cost pressures and their consequences in Purpose-Built Student Accommodation(HEPI Report 166) provides an authoritative picture of student living, conducted in response to the unprecedent rent rises and supply issues witnessed over the past two academic years. It includes data voluntarily submitted by both universities and the 10 largest providers of Purpose-Built Student Accommodation operating across ten major regional university cities who collectively manage more than 125,000 beds in those cities.

The cities covered are:

- Bristol

- Exeter

- Glasgow

- Leeds

- Liverpool

- Nottingham

- Bournemouth

- Cardiff

- Portsmouth

- Sheffield

As expensive capital cities, London and also Edinburgh are deliberately excluded from the analysis, to give a more balanced view of rents outside of these markets.

In 2021/22, average annual rents stood at £6,520, and increased to £7,475 in 2023/24 across the 10 key regional university cities. Across England, average annual rents now stand at £7,566 for the current academic year (2023/24).

The average maintenance loan received by English students this current academic year is officially expected to be £7,590, versus the average rent in England of £7,566, meaning rents swallow up virtually 100% of the average loan, leaving a mere £24 left over for other living essentials, equating to 50p a week.

The average rent also equates to more than three quarters (76%) of the maximum maintenance loan.

The regional rental landscape

The highest rents and increases are in the most undersupplied cities. The survey suggests Bristol has the UK’s highest average annual rent at £9,200 per year, with Exeter at £8,559 and Glasgow at £7,548.

Glasgow saw the highest rental growth at 20.4% over the past two years, followed by 16.1% in Exeter and 15.5% in Nottingham.

Other notable rises were seen in Leeds (14.7% rise to £7,627) and Bournemouth (11.2% rise to £7,396). Meanwhile, Liverpool, Cardiff and Sheffield are deemed the most affordable, with lower annual rents of £6,400-£6,600 and smaller annual increases. The reason for the more moderate increases are due to the healthier supply levels across these markets.

Victoria Tolmie-Loverseed, Assistant Chief Executive at Unipol, said:

Student housing has reached a crisis point in affordability, underpinned by these alarming figures. Rents are rising rapidly just as real-terms government support has stagnated. With rents consuming unhealthy levels of an average maintenance loan, students are being forced to take desperate measures – illegally doubling up in rooms, taking on increasing amounts of paid work or even avoiding university altogether due to costs.

Failing to address the student housing crisis risks undermining decades of progress in widening participation in higher education. We risk excluding those from poorer backgrounds, forcing middle-income students to take on unsustainable debts, and damaging the student experience for all.

What is driving rents?

The report asks 34 leading student accommodation providers (including universities and private operators) a series of questions, looking at key market drivers and the issues they face. Rising costs of energy, construction, staff and borrowing are the biggest drivers impacting both private and university providers.

High development costs along with barriers to gaining planning permission are hindering the ability of providers to build more and relieve supply pressures, with only 30,000 total new beds brought to the market in the past two years.

The new rooms that do get built come with a higher price tag, so that providers can recoup their development costs. The pipeline of new accommodation is being slowed by historically high interest rates which are driving up funding costs. Rent levels in existing buildings have also been increasing as a consequence of rising running costs.

The new Report warns the upcoming Renters (Reform) Bill could push more landlords to exit the student market for shared houses (known as house in multiple occupation or HMOs) – causing it to shrink further and ultimately putting university-owned and Purpose-Built Accommodation under more strain, exacerbating supply issues even further.

Martin Blakey, Chief Executive of Unipol, said:

The student maintenance system is broken. Students and parents need urgent and practical solutions to delivering affordable accommodation.

It is easy to pin the affordability issues on providers but they are under pressure to cover increasing build and running costs. Meanwhile, the planning system does not currently see the economic or political value in allowing more student accommodation schemes to be built, impacting the sector and students alike.

Nick Hillman, Director of HEPI, said:

The Accommodation Costs Survey has been tracking the real costs of student housing for decades. Compared to years gone by, we are now at a crisis point. Across most of the UK, the official levels of maintenance support simply do not cover anything like most students’ actual living costs.

In the short term, maintenance support should be increased at least in line with inflation. In the medium term, Ministers should rebase maintenance support using the evidence they’ve gathered as part of the Student Income and Expenditure Survey, which is due to be published soon.

For the longer term, we need measures to encourage the supply of new student housing, which is currently restricted by factors such as higher interest rates and confusion over new regulation.

Policy recommendations

The report sets out a number of policy recommendations for the Government, universities and providers to consider:

1. Major reform of the student maintenance system

The student maintenance system needs resetting if access to higher education is to be maintained evenly across both richer and poorer students. The maintenance loan should be redesignated as a ‘contribution to living costs’, and the importance of the parental contribution should be highlighted rather than just mentioned in passing. In future maintenance support needs to be based on how much it actually costs to be a student living independently and away from home, utilising data to make an informed approach.

2. Financial support and introduction of affordable room options

Private providers deliver more expensive room types largely because they need to cover growing build costs. A recent report from Cushman & Wakefield estimated that rent levels needed to be towards £170 a week for a room in a cluster flat, simply to cover the cost. Clearly more affordable options are needed, such as refurbishment of older accommodation or regulated double occupancy, but private providers are unlikely to take on the risk without support and partnerships with universities and broader sector.

Accommodation bursaries and hardship funds could also be used in markets where there is a lack of affordable options.

3. Facilitating more supply

Universities and private providers need to have an active dialogue with planners in local councils to understand their needs, and the value of building more student accommodation. Many planners realise the need for affordable student accommodation, but then look for improved space standards, higher-specification design and lower density – all of which increase cost.

Responses