65% of students worry about their parents not having enough money

Equifax is marking Talk Money Week by revealing new insight into how children feel about their parents’ money worries.[1] The new research shows that boys worry more than girls, with 25% saying they are always worried their parents might run out of money, compared to 13% of girls.

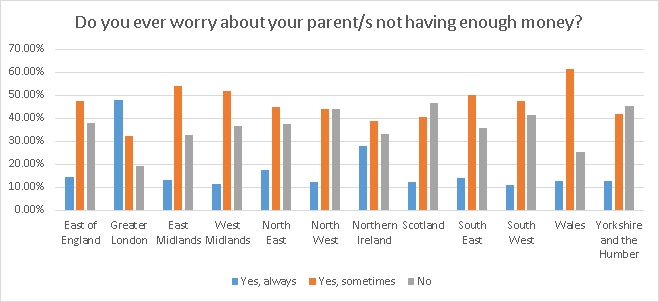

Across the UK, it appears that kids in Greater London worry the most about their parent’s finances, with 81% admitting that they worry either some or all of the time. Perhaps the reason for that, according to the Equifax research, is that 47% of parents living in Greater London always talk to their children about money problems, compared to just 4% in Wales and 7% in Yorkshire. Across the country, 47% of children in the UK said their parents never talk to them about money problems or their worries about family finances

Children in Scotland appear to be the most relaxed about their parents’ finances, with just over half (53%) saying they worry about the amount of money that their parents have.

Across all of the children surveyed, just over 40% said they do not talk to anyone about their parents’ financial worries – perhaps because just under 35% actually said they don’t worry at all about their parents’ finances. However, 16% say they talk to family members and 15% confide in their friends.

Children in Scotland are least likely to open up about their money concerns, with 57% choosing to keep quiet, followed by children in Wales (51%,) East Midlands (48%,) and the North West (48%.) Whilst children in Greater London express the most concern about financial problems, they are the most likely to share their worries with other people. 36% talk to other family members and 34% talk to their friends.

Lisa Hardstaff, credit information expert at Equifax said: “Our latest research shows that many children are aware of their parents’ money worries, but perhaps don’t feel that they have anyone they feel they can share their concerns with. Conversely, parents may feel the need to protect their children from their own financial concerns.

“Talk Money Week is a great time for parents to talk to youngsters and help them understand budgeting and how to manage their money. Concerns about finances are very normal, so it is crucial that youngsters learn how to express their worries and doubts and learn how adults manage financial pressures for when they are older and have to manage their own finances.

Russell Winnard, Head of Educator Facing Programme and Services at Young Enterprise adds, “It is vital that young people have the right influences at an early age. As well as budgeting skills and understanding basic finances, it’s also important that children know how to talk about money and face up to any difficulties they may be having before they become major issues. The latest Equifax survey shows that children know enough to know when parents are worried about money. The best way to help young people form the right attitude, is to help them understand finances and by showing them that it is okay to talk about money.”

Talk Money Week (formerly Financial Capability Week) is the annual celebration of the work thousands of organisations are doing to improve money management across the UK.

It is an annual event organised as part of the Financial Capability Strategy for the UK and aims to get more people talking about money. This year Talk Money Week runs from 12-18 November.

[1] Research conducted by Censuswide. 1003 8-16 year olds (501 8-13 year olds and 502 14-16 year olds.) 18.09.2018-21.09.2018

Responses